Introduction to the Iron Condor

Introduction to the Iron Condor

What if you think that the markets or a particular stock will have minimal price movement over the coming days or weeks? You can enter into a short straddle or strangle. The short straddle allows a trader to collect more upfront premium than a strangle, but the trade-off is that with a short straddle, the underlying has to expire on the strike price in order to attain the max profit. A short straddle has a wider range to get the max profit from the trade. Of course, the risk associated with both of these strategies is that they are unhedged and have a risk of significant loss. The iron condor is a strategy that reduces the risk of loss. It is the counterpart to the short strangle strategy.

How do you construct an iron condor?

An iron condor is one of the more complicated option strategies that we will discuss. This is a four-leg strategy and consists of buying a call and put as well as selling a call and put. We will break this down into two parts to help you understand this better: the short strangle and the hedge.

As you have seen earlier, in a long strangle, a trader purchases a put option at a particular strike price – usually one that is below the current underlying price. The trader also purchases a call option at a strike price that is above the put option’s strike price. The strike chosen for the long call is typically above the current underlying price.

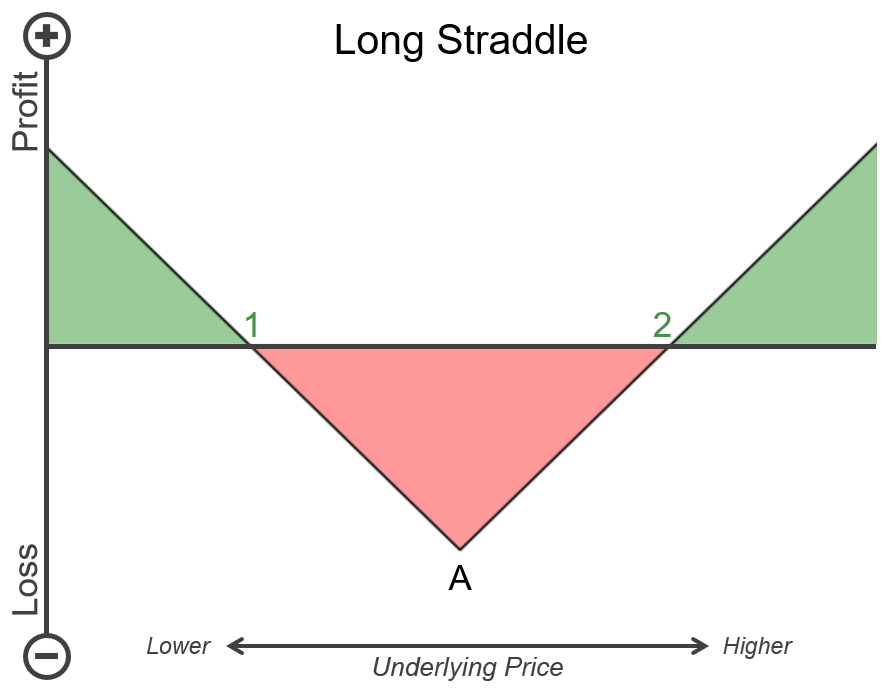

With an iron condor, you start with the opposite of a long strangle: a short strangle. Instead of buying a call and a put, you would sell a call and a put. In the illustrations below, you can see the payoff differences between the long strangle and short strangle are mirror images.

Illustration 1

|  |

|---|

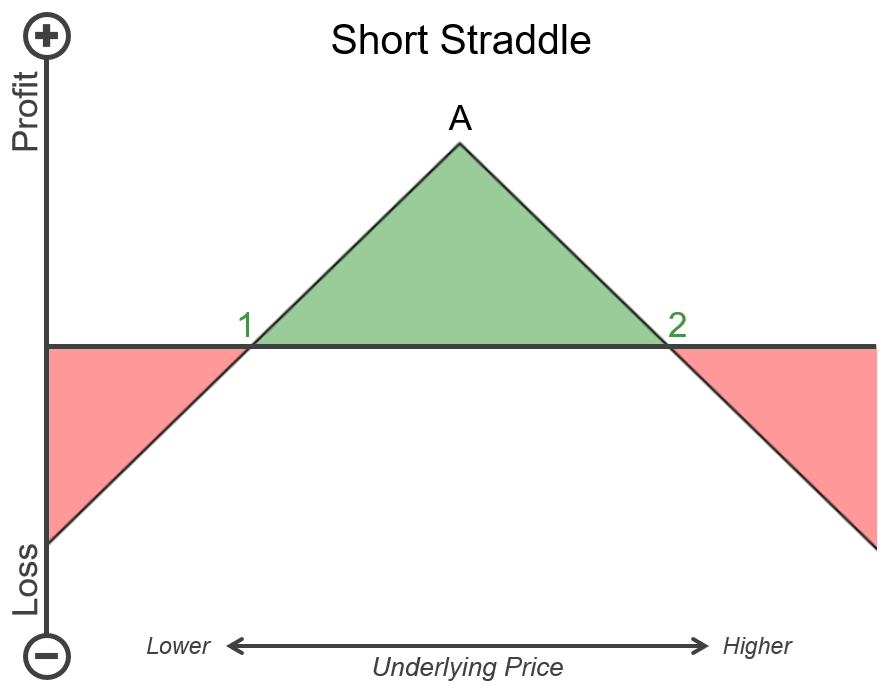

Let’s walk through how we would implement this. Using the data in illustration 2, we could short a strangle by selling the 98-strike put and the 102-strike call option. By doing this, the trader would receive 1.26 in premium from the short 98-strike put and 1.24 in premium from the short 102-strike call. The total premium received from this part of the trade is 2.50.

Looking at the short strangle payoff above, the ‘red’ sections on the left and right represent possibilities of significant loss for the trader if the underlying moves into these areas. The benefit of the iron condor is limiting the downside risk in these ‘red’ sections. This is done by purchasing a put at a strike lower than the sold put and also purchasing a call at a strike higher than the sold call.

To complete the iron condor, the trader could also purchase the 95-strike put and 105-strike call options. These long options would act as a hedge, thus capping the downside for the strategy. The 95-strike put costs 0.57, and the 105-strike call costs 0.56. The total cost of the long options is 1.13. The net premium received by the trader for executing this iron condor with 95-98-102-105 strikes is 1.37, which is 2.50 – 1.13.

Illustration 2

Source: Upstox

Source: UpstoxWhy would a trader use an iron condor?

A trader will enter into an iron condor option strategy if they believe that the underlying will not be volatile during the period prior to expiration. This strategy is essentially a hedged short strangle. We learned about short straddles earlier. The biggest drawback to that strategy was the potential for unlimited losses. With an iron condor, the strategy is constructed so that the maximum loss is fixed.

This trade works best when the underlying is more volatile prior to entering the trade and then becomes less volatile during the life of the options. Also, the trader isn’t required to have a specific forecast of market direction, but the trade will be successful if the underlying security doesn’t move.

What is the max profit of an iron condor?

Key Formula:

- Iron Condor Max Profit = Initial Net Premium

The maximum profit occurs when the underlying closes in between the two shorted strike prices. This means that at expiry, none of the options have intrinsic value, and the trader retains all of the initial premium collected by executing the iron condor. In our example, you collected an initial net premium of 1.37 by executing the iron condor. This initial net premium is the max profit.

How much can you lose trading an iron condor?

Key Formula:

- Iron Condor Maximum Loss = Net Premium Received – Long Call Strike Price + Short Call Strike Price

or - Iron Condor Maximum Loss = Net Premium Received – Short Put Strike Price + Long Put Strike Price

The maximum loss for an iron condor is capped. In our example, the long call strike price was 105, and the short call strike price was 102. As the underlying price rises above 102, you start to lose until the underlying reaches the 105-strike price of the long call. Once the underlying is at or above 105, you cannot lose anymore. By entering into the iron condor, you receive an initial credit that offsets this potential loss. If the underlying were to rise to this level, this would be a loss of 3 (102 – 105) plus the net premium received of 1.37. Therefore, the max loss in our example is 1.63. While we looked at what happens if the underlying rises, the same approach works if the underlying would fall below the strike price of the long put. The math would still be the same because the spread between the strike prices for the puts is the same as the calls.

What is the breakeven point when entering an iron condor?

Key Formula:

- Iron Condor Upper Breakeven Point = Short Call Strike Price + Net Premium Received

- Iron Condor Lower Breakeven Point = Short Put Strike Price – Net Premium Received

An iron condor has two breakeven points: an upper and lower breakeven. Since an iron condor is a credit strategy where you receive a premium upfront for a short position, the breakeven point or price isn’t where the trade becomes profitable but the price where the trade no longer is profitable. If the underlying price rises above the upper breakeven point, the strategy will begin to suffer losses. Similarly, if the underlying price falls below the lower breakeven point, the strategy will no longer be profitable. As long as the underlying price is between the upper and lower breakeven points on expiry, the trader will be profitable.

One thing to keep in mind is that these breakeven point formulas are for expiration. Prior to expiry, each of these options will have time value (also known as extrinsic value). Because of this time value, the strategies will have slightly more favorable breakeven points. In the case of an iron condor, this means that the upper breakeven point will be higher prior to expiry, and the lower breakeven point will be lower, thus creating a wider range of profitability.

What is the profit formula for an iron condor?

Key Formula:

- Iron Condor Profit = Short Call Profit + Short Put Profit + Long Call Profit + Long Put Profit

- Short Call Profit = Premium Received – Max(0 Underlying Price – Strike Price)

- Short Put Profit = Premium Received – Max(0 Strike Price – Underlying Price)

- Long Call Profit = Max(0 Underlying Price – Strike Price) – Premium Cost

- Long Put Profit = Max(0 Strike Price – Underlying Price) – Premium Cost

The profit formula for an iron condor is the combination of the profit of the individual four legs of the strategy: long call, long put, short call, and short put. For each of these individual legs, you need to account for the payoff of the option as well as the premium credit for the short legs and cost of premium for the long legs.

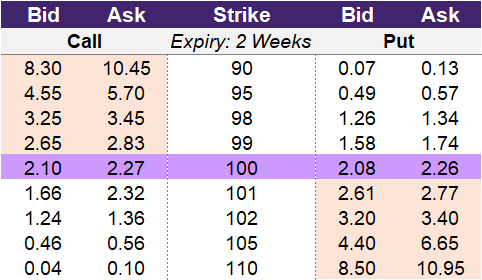

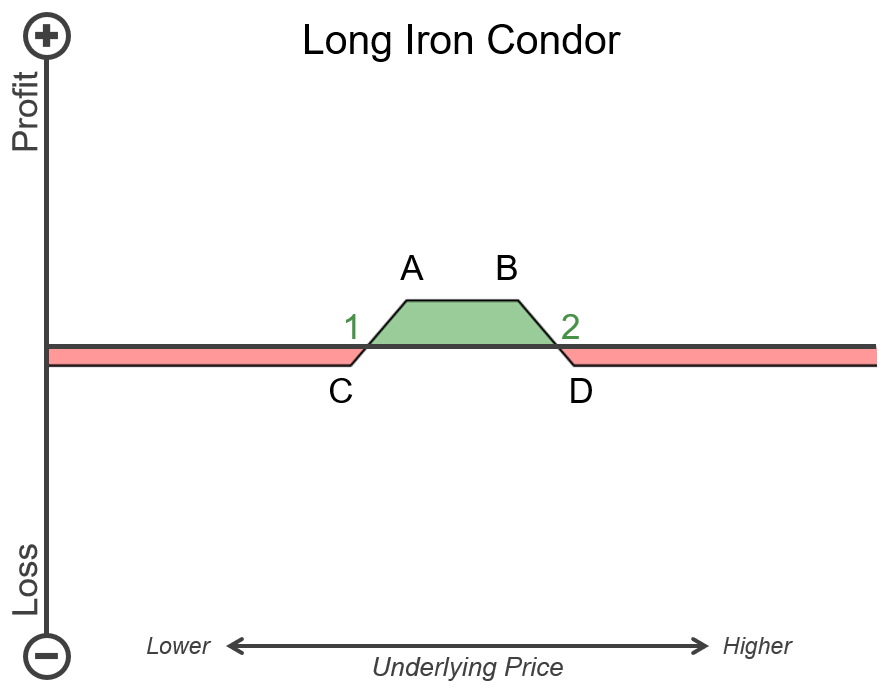

What is the payoff diagram for an iron condor?

Below is an example P&L diagram for a long iron condor. Points A and B on the diagram are strike prices of the respective short put (A) and short call (B) of the strategy. Point C is the strike price of the long put that hedges the short put position. Point D is the strike price of the long call that hedges the short call position. The vertical axis on this chart represents the potential profit and loss of this strategy. The horizontal axis is the underlying price that the option strategy is based on. Higher prices of the underlying price are to the right of the diagram, while lower prices are to the left side of the diagram. Areas of the payoff diagram that are shaded green are profitable regions, while those in red are losses. This strategy has two breakeven points. The lower breakeven point is shown as ‘1’, and the upper breakeven point is shown as ‘2’.

Illustration 3

Source: Upstox

Source: UpstoxWhat is the point of max profit for an iron condor?

Key Formula:

- Price of Underlying between short put strike and short call strike

The iron condor is a neutral option trading strategy. This means that the strategy will perform the best when the underlying’s price stays relatively flat prior to expiry. If the underlying is between the short put strike price and the short call strike price, then you will achieve the maximum profit.

What is the point of max loss for an iron condor?

Key Formula:

- Price of Underlying >= Upper Strike Price

or - Price of Underlying <= Lower Strike Price

The maximum loss of an iron condor is capped due to the purchased long call and put options that hedge against potential losses of the short call and put options. If the price of the underlying falls to the lower strike price of the purchased put option on expiry, the trade will have the maximum loss. Alternatively, if the price of the underlying rises to the higher strike price of the purchased call option on expiry, the maximum loss will also be reached.

Summary

- Use an iron condor when you believe the underlying will not be volatile before expiry.

- An iron condor trade is most successful if the underlying security doesn’t move.

- The iron condor is a four-leg strategy comprising a short strangle and a hedge. It consists of buying a call and put as well as selling a call and put.

- The put is purchased at a strike lower than the sold put, and the call is purchased at a strike higher than the sold call.

- The maximum profit occurs when the underlying closes in between the two shorted strike prices.

- An iron condor has two breakeven points.

- The iron condor does not turn profitable at the breakeven point; rather, it becomes unprofitable above and below the breakeven points.

- Maximum loss of an iron condor is capped because the purchased long call and put options act as a hedge against the potential loss of the short call and put options.

Is this chapter helpful?

- Home/

- Introduction to the Iron Condor