- home/

- stocks

Invest Right, Invest Now

Open a FREE* Demat and Trading account to invest in Stocks

By signing up you agree to our Terms and Conditions

Discover Stocks Easily

5000+ stocks, find ‘the one’ easily with our smartlists

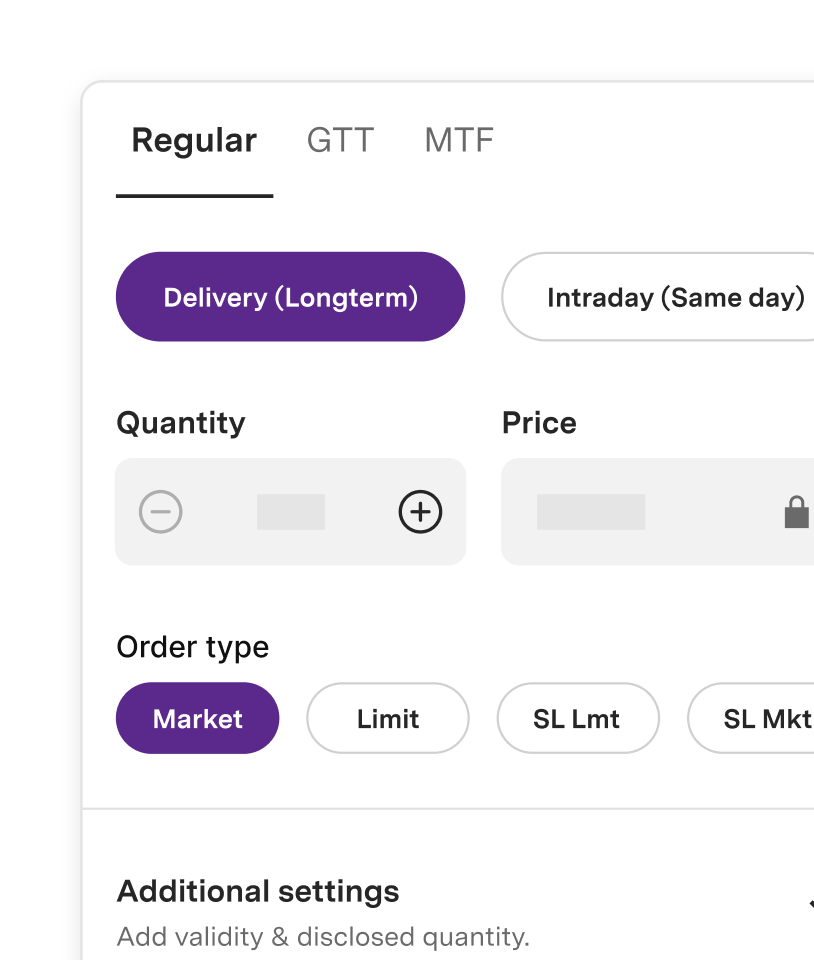

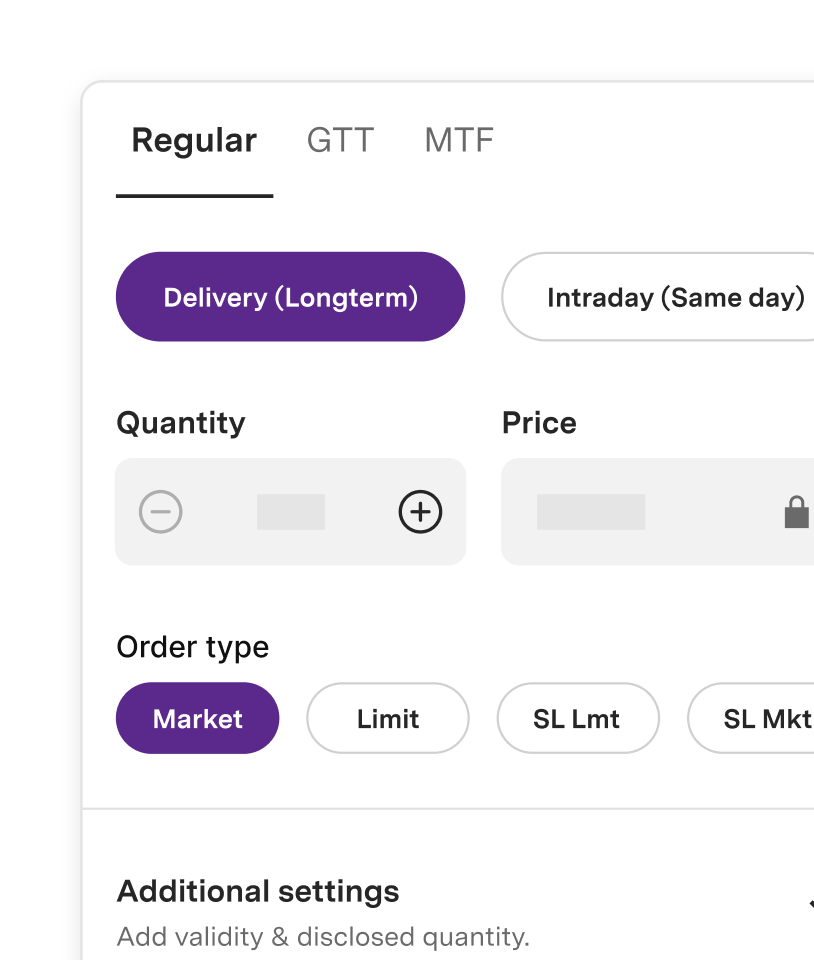

Place Quick Orders In A Few Clicks

One platform with many order types

Delivery

Intraday

Good till Triggered (GTT)

Margin Trading Facility (MTF)

After-Market-Orders

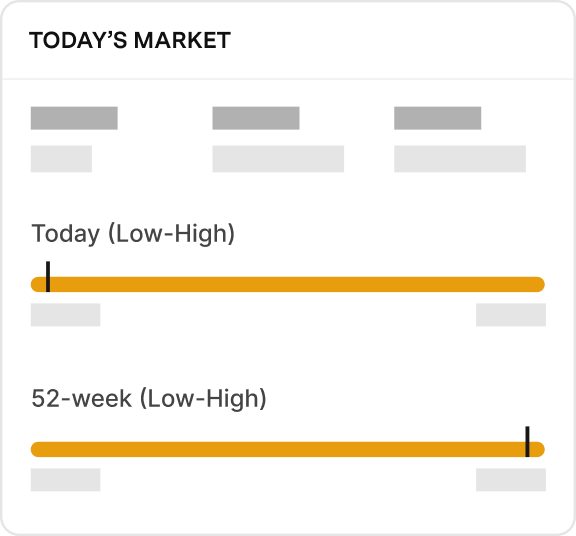

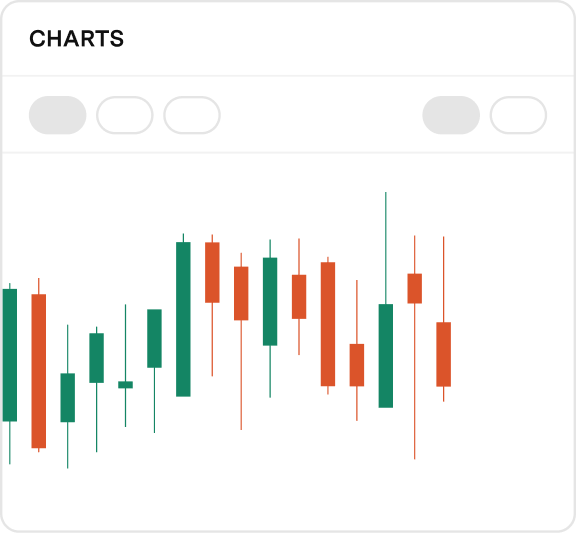

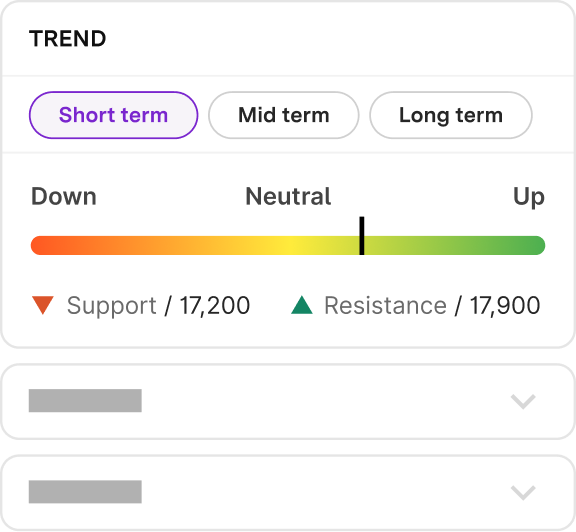

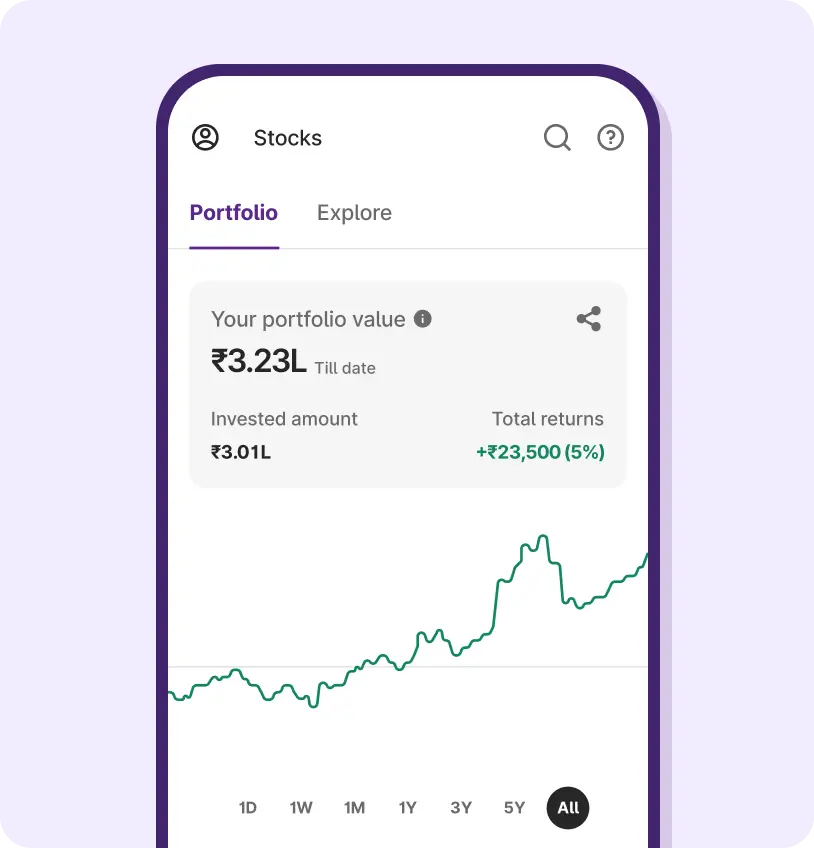

Analyse Trends Confidently

5000+ stocks, find ‘the one’ easily with our smartlists

New to Buying Stocks?

You can do everything from a single frame

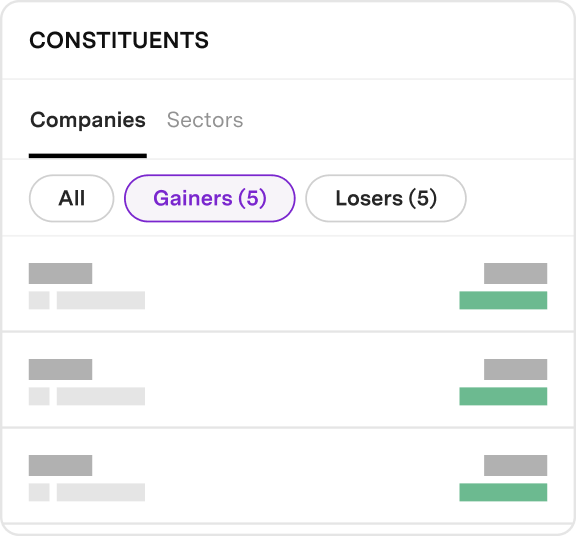

Discover stocks easily

With curated stock lists such as UpTrend, Best for Beginners, Everyday Brands, etc.

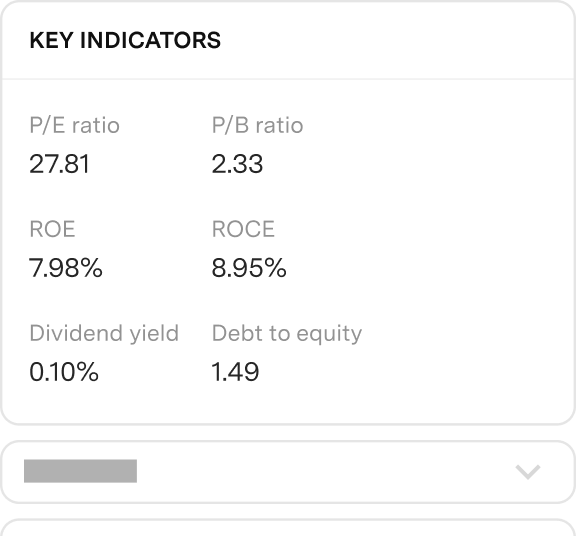

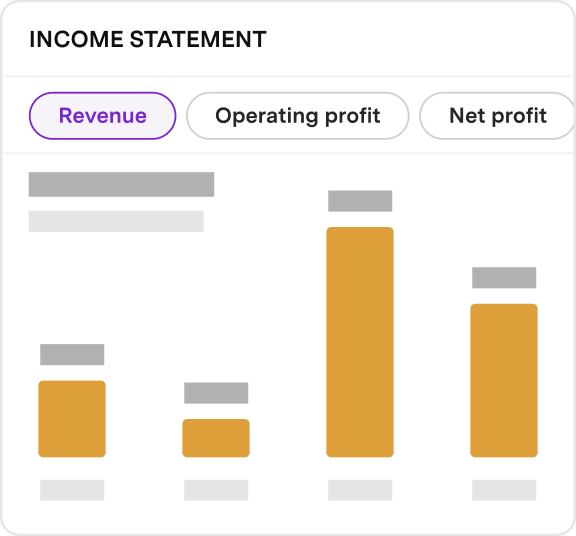

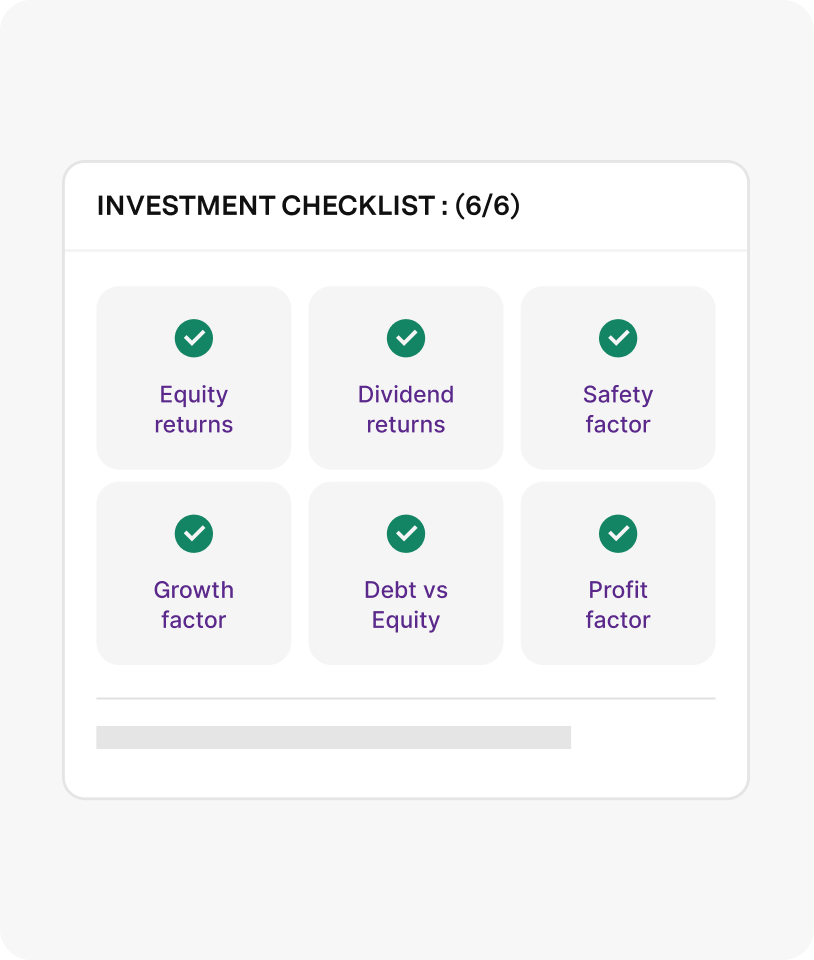

Invest in them confidently

With 6-point investment checklist and analyst ratings to buy, sell or hold a stock

Stock like you shop

Simplified buying and selling experience

Discover stocks easily

With curated stock lists such as UpTrend, Best for Beginners, Everyday Brands, etc.

Invest in them confidently

With 6-point investment checklist and analyst ratings to buy, sell or hold a stock

Stock like you shop

Simplified buying and selling experience

Getting started with your investing journey?

From beginner to advanced, we cover all levels of learning