Introduction to Short Straddle

Introduction to the Short Straddle

This is one for the fence-sitters. You know those people who can’t make up their minds and find merit in both sides of an argument? That could happen in the markets too. There are times when traders feel a security could be ‘indecisive’ and not move or move very minimally in either direction - up or down. The Short Straddle option strategy is tailor-made for those occasions.

How do you construct a short straddle?

A Short Straddle consists of selling both a call and a put for the same strike price and expiration date. For example, if the underlying is trading at 100 and you believe that the stock won’t move much from this price in the near future, you could sell a straddle.

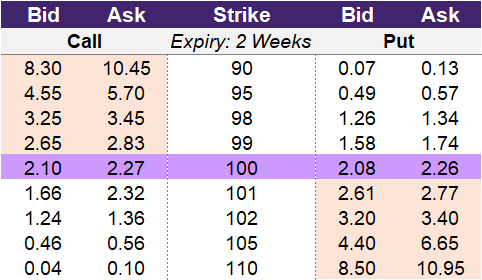

Let’s look at the data table in illustration 1. You could select any strike but as an example, you could sell a call on the 100-strike and collect a premium of 2.10, which is the bid price. You would also sell a put on the 100-strike, which would earn you a premium of 2.08. The total premium collected is 4.18.

Illustration 1

Source: Upstox

Source: UpstoxWhy would a trader use a short straddle?

A trader will enter into a Short Straddle if they believe that the underlying will not be volatile just before expiry. The trade works best when the underlying is more volatile prior to entering the trade and then becomes less volatile during the life of the options. The trader doesn’t have a specific forecast of bullish or bearish but will be successful if little movement in the security occurs.

What is the max profit of a short straddle?

Key Formula:

- Short Straddle Max Profit = Total Premium Received

The maximum profit occurs if the underlying closes exactly at the shorted strike price. If the underlying closes higher than the strike price on expiry, then only the put option will be worthless. Likewise, if the underlying closes lower than the strike price on expiry, then only the call option will be worthless. So the max profit is when both the short call and short put expire worthless, resulting in the trader keeping the entire premium initially collected.

In the prior example, we entered into a short straddle with a strike price of 100. The premium collected was 4.18; 2.10 from the short call option and 2.08 from the short put option. Therefore, the maximum profit is this collected premium of 4.18.

How much can you lose trading a short straddle?

Key Formula:

- Short Straddle Max Loss (if the stock rises) = Unlimited – Total Premium Received

or - Short Straddle Max Loss (if the stock falls) = Strike Price – Total Premium Received

With a short straddle, if the market moves significantly in either direction, you can potentially lose more than the premiums you collected. The maximum amount you can lose is theoretically unlimited. This would occur if the underlying price rises significantly. Alternatively, you can still lose a significant amount if the underlying falls. If the underlying falls to zero, then you will lose the value of the strike price less the premium received when you entered into the short straddle.

What is the breakeven point when entering a short straddle?

Key Formula:

- Short Straddle Upper Breakeven Point = Strike Price + Total Premium Received

- Short Straddle Lower Breakeven Point = Strike Price – Total Premium Received

The breakeven point for a short straddle is the strike price of the short options plus or minus the total premium received. Unlike with a long straddle or any other long strategy, the breakeven point is not the point where the strategy becomes profitable. Because this is a short position, the breakeven point is where we have lost the premium received due to market movements and our position turns negative. The breakeven point for a short straddle or any short strategy is where you are no longer profitable.

What is the profit formula for a short straddle?

Key Formula:

- Short Straddle Profit = Total Premium Received – Max(0 Underlying Price – Strike Price) – Max(0 Strike Price – Underlying Price)

The profit formula for a short straddle starts with the total premium received by entering into the strategy. The formula then subtracts the payoff of the call option and put option.

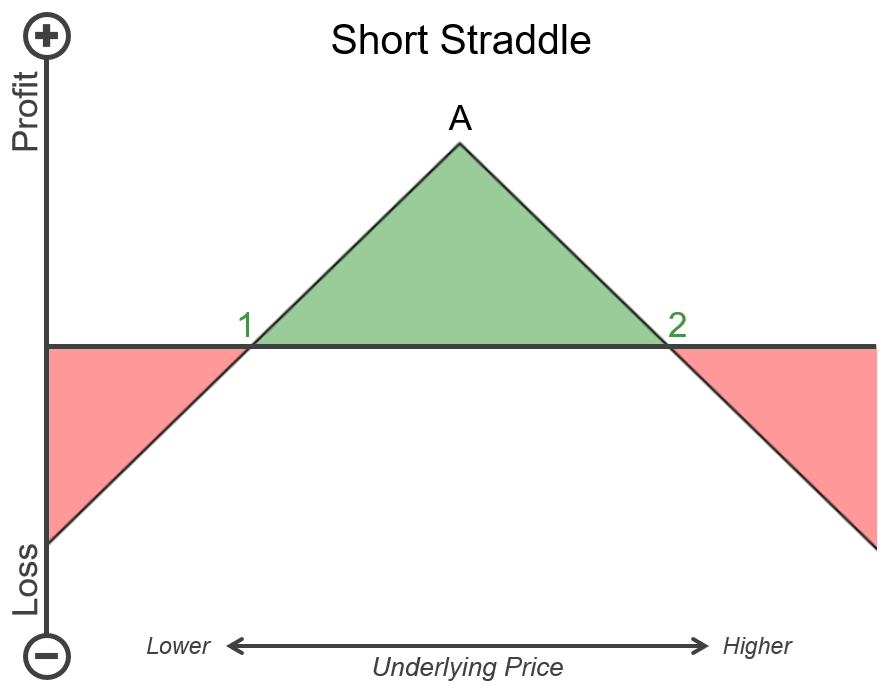

What is the payoff diagram for a short straddle?

Below is an example P&L diagram for a short straddle. The vertical axis is the profit and loss, where the higher up represents more profit and further down is a higher loss. The horizontal axis represents the underlying price. Further to the right is a higher underlying price, and further to the left is a lower underlying price. Areas that are shaded green are when the short straddle will have a positive payoff, and areas shaded red are when the short straddle will have a negative payoff.

Point A on the chart is the strike price selected for the short straddle. Point 1 is the lower breakeven point and is associated with the short put option. If the underlying price is below this price at expiry, the strategy will not be profitable. Point 2 is the upper breakeven point and is associated with the short call option. If the underlying price is higher than point 2 on expiry, then the trade will not be profitable. However, if the underlying price is between points 1 and 2 on expiry, then the strategy will be profitable. When this happens, the trader will retain some or all of the premium initially collected when entering into the short straddle. If the underlying price happens to be at point A on expiry, then the trader will keep the entire premium initially collected. This is the max gain of the trade.

Illustration 2

Source: Upstox

Source: UpstoxWhat is the point of max profit for a short straddle?

Key Formula:

- Price of Underlying = Strike Price

If the underlying closes at exactly the strike price on expiry, then the trader will retain the entire premium collected from selling the straddle. This is because both the short call and short put will be worthless on expiry. When shorting straddles or with any short option strategy, you are collecting an upfront premium. The best-case scenario is always when the options expire worthless, allowing you to keep all of the original premium.

What is the point of max loss for a short straddle?

Key Formula:

- Price of Underlying = ∞

or - Price of Underlying = 0

The maximum loss of a short straddle is theoretically unlimited. With a long call option, the gain is theoretically unlimited because the underlying stock can go up in price infinitely. By shorting a call option, the trader is exposing themselves to a theoretically limitless loss.

A short straddle also consists of a short put option. On the opposite side of this trade, the long put’s gain is capped at the value of the strike price because the lowest price that the underlying can fall to is zero. For example, if a stock is currently priced at 100 and a trader shorts a put option at a strike price of 100, and if the stock falls to 0, the trader has the obligation to sell this stock at a price of 100, even though it is only worth 0. The loss would be 100, which is the value of the strike price.

Summary

- Use if you believe the underlying will not be volatile just before expiry.

- This works best if volatility decreases during the life of the options.

- The trader does not have a bullish or bearish outlook and benefits if little movement occurs in the security.

- Construct a Short Straddle by selling both a call and a put for the same strike price and expiration date.

- Maximum profit occurs if the underlying closes exactly at the shorted strike price.

- A short straddle has two breakeven points.

- The trader's position turns negative at the breakeven point.

- The maximum loss of a short straddle is theoretically unlimited.

Is this chapter helpful?

- Home/

- Introduction to Short Straddle