Stock Market Timings in India

Here's your comprehensive guide to the stock market timings in India. By knowing these timings and utilising the sessions, traders and market participants can navigate the stock market with confidence and optimise their investment strategies.

The stock market operates year-round from Monday to Friday, except on advance declared trading holidays. Weekends which include Saturdays and Sunday, are closed for trading.

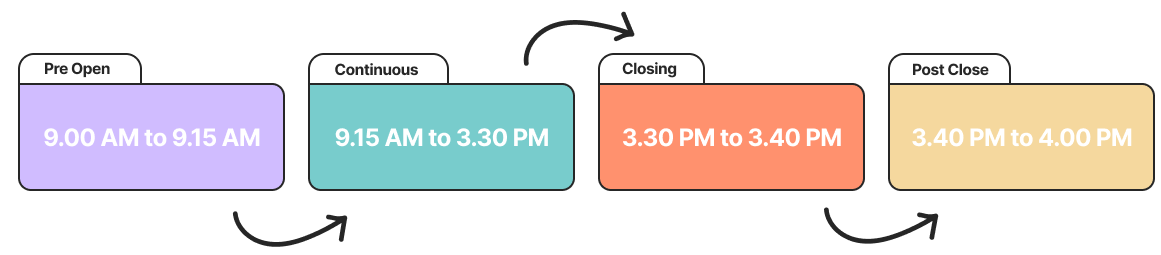

NSE and BSE Trading Schedule:

| Pre-Open Session | 9:00 AM To 9:15 AM |

1: Analysing overnight developments 2: Tuning into official announcements 3: Observing the global cues |

| Continuous Session | 9:15 AM To 3:30 PM |

|

| Closing Session | 3:30 PM To 3:40 PM |

1: The closing price of a security is calculated by using a weighted average of prices at securities trading from 3:00 PM to 3:30 PM on a stock exchange. |

| Post-Close Session | 3:40 PM To 4:00 PM |

|

*It's advised to be updated on the official announcements made by the stock exchanges to know about any changes to the schedule.

Commodity Trading Timings

Commodity trading is elemental to India's economy. Investors, traders and other market participants can trade in various commodities like gold, silver, crude oil, agricultural products, and more. Three primary commodity exchanges are currently operational in India:

- The Multi Commodity Exchange (MCX)

- The National Commodity and Derivatives Exchange (NCDEX)

- The Indian Commodity Exchange (ICEX)

The commodity market operates year-round from Monday to Friday, except on advance declared trading holidays.

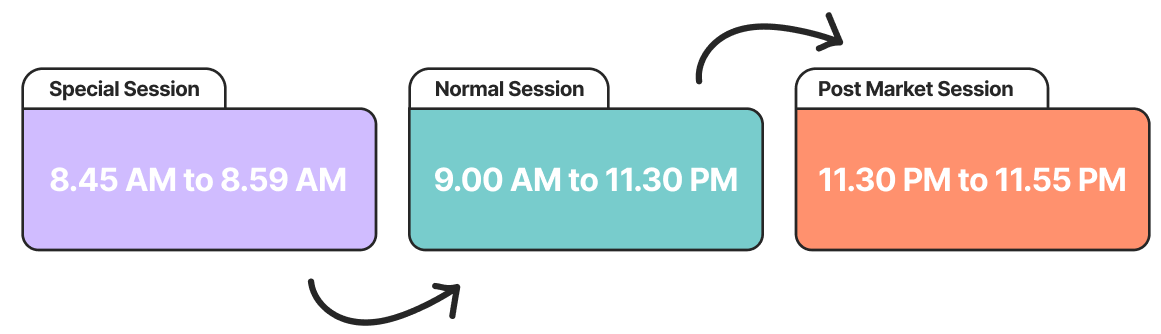

MCX Trading Schedule:

| Special Session | 8:45 AM To 8:59 AM |

|

| Continuous Session | 9:15 AM To 3:30 PM |

|

| Normal Session | 9:00 AM To 11:30 PM |

|

| Post Market Session | 11:30 PM To 11:55 PM |

|

| Extended Trading Hours | 11:30 PM To 11:55 PM |

|

*It's advised to be updated on the official announcements made by the stock exchanges to know about any changes to the schedule.

The MCX has revised its trading hours on Monday, 13th March 2023, and onwards. This is to keep under consideration the change in the US daylight saving time.

The revised trading hours for the MCX are:

| Particulars | Trade Start Time | Trade End Time | Client Code Modification Session |

|---|---|---|---|

| Non-Agri Commodities | 9:00 AM | 11:30 PM | 11:30 PM to 11:45 PM |

| Select Agri Commodities (Cotton, CPO & Kapas) | 9:00 AM | 9:00 PM | 9:00 PM to 9:15 PM |

| All Other Agri Commodities | 9:00 AM | 5:00 PM | 5:00 PM to 5:15 PM |

*It's advised to be updated on the official announcements made by the stock exchanges to know about any changes to the schedule.

Muhurat Trading

Muhurat trading in the year 2023 will take place on Sunday, 12th November 2023.

Muhurat trading occurs when the exchanges open for one hour, on the occasion of Diwali.

The pre-opening session for muhurat trading starts at 6:00 PM and lasts for 15 minutes. This is followed by a continuous trading session that starts at 6:15 PM and ends at 7:15 PM.

| Event | Time |

|---|---|

| Pre-open session | 6:00 PM – 6:08 PM IST |

| Muhurat Trading | 6:15 PM – 7:15 PM IST |

| Post-close session | 7:30 PM – 7:38 PM IST |

| Market close | 7:40 PM IST |

*Please note that the exact timings for Muhurat Trading are usually announced by the stock exchanges a few days before Diwali. The above timings are just an example and may differ from year to year.

Frequently Asked Questions (FAQs)

What are the stock market timings in India?

The regular trading hours for the NSE and BSE are from Monday to Friday, 9:15 AM to 3:30 PM, Indian Standard Time (IST).

Are the trading timings the same for the NSE and BSE?

Yes, the trading timings are the same for both stock exchanges.

Is trading open 24-hours in India?

No, there are specified times at which the stock exchanges operate in India, year-round.

Are the timings the same for equity, commodity, and currency markets?

No, the timings differ for each market segment.

Can I buy shares after 3:30 PM?

Yes, you can buy shares after 3:30 PM as the closing session, also known as the post-market session is open from 3:40 PM to 4:00 PM for the NSE and BSE. However, only market orders are permitted. Like pre-market orders, post-market orders are only permitted for the equity segment. The MCX follows its own trading schedules that operates after 3:30 PM.

Are there any extended trading hours?

Yes, there are extended trading hours for equity derivatives (futures and options). The extended trading session is known as the "After Market Order" session.

Are there any trading holidays?

Yes, there are trading holidays. The stock exchanges release an official list of trading holidays for each calendar year.

Can I trade on Saturdays and Sundays?

No, the Indian stock market is closed on Saturdays and Sundays.

Can anyone participate in Muhurat Trading?

Yes, anyone who has a trading account with a registered stockbroker can participate in Muhurat Trading.

Is Muhurat Trading different from regular trading?

No, Muhurat Trading is not different from regular trading. Its special feature is that it is conducted on a special day and for a shorter duration.

Is it necessary to participate in Muhurat Trading?

No, it is not necessary to participate in Muhurat Trading. It is a choice by the investor.

*Please note that the Indian Stock Market trading schedule may change from year to year and it is always recommended to check for the most up-to-date information from reliable sources before making any trading decisions or planning your investment activities. Always consult with a financial advisor for personalised investment advice.

Happy investing!