Chapter 2

Long Call Option Strategy

To understand this strategy, let us go back to the analogy we used in the chapter on Call options.

We had assumed the following - You bought a flat costing ₹1 crore from the owner. To secure your interest in the property, you paid 5% of the cost as a ‘token.’ So, for a sum of ₹5 lakh, you purchased rights to a property worth ₹1 crore. This allowed you to buy it at a future date at the predetermined price of ₹1 crore.

In our example, the government had started work on a new metro line six months after you purchased the property, which upped its asking rate.

Now let’s assume instead that you knew about this beforehand and had bought the property expecting prices to go up. You plan to sell the property at a profit and exit your investment. That is exactly what you would be doing if you were to go long on a call option in the stock market.

Why would a trader use this strategy?

You buy or ‘go long’ on a Call Option if you believe two things:

1) The underlying stock or index will move upward, and

2) You expect this upward move to occur prior to the selected expiration date of the option.

The benefit of purchasing a call option instead of the underlying is that the cost to enter the position can be substantially lower. For example, if you were bullish on TCS that is currently trading at 3,402.00, the cost to buy 50 shares of this company would be 1,70,100.

However, an at-the-money option with 2 weeks until expiration could be trading at 51.80 for a total cost of 2,590 to purchase 50 options.

The drawback is that you are purchasing a contract rather than the actual asset. If you purchased the underlying, you would own that asset until you sell it. By purchasing the call option instead of the underlying, you could end up with something worthless at expiration if the underlying doesn’t move favourably.

How do you construct it?

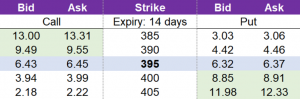

The table below is an example of an option chain with bid and offer prices for 5 strikes associated with calls and puts on one expiration date. If you were ready to place a trade for a long call option, you would look to the left side of the option chain for the call option section. Since you would be buying, you will likely pay closer to the ask price rather than the bid price. The ask price here is the ‘market price to buy’. You could select from any of the strikes listed. For example, if you wanted to buy the call option with the strike price of 405, this would cost you 2.22, which is the asking price for this option contract.

Illustration 1

What is maximum gain?

The maximum gain you can have with a long call option is theoretically unlimited. This is because the price of a stock or index can theoretically go to infinity. However, this is an unlikely scenario, and as a trader, you should more accurately assess your gain-to-loss ratio using historical data that matches the time period of the option.

For example, if you purchase an option with 10 days to expiration and plan to give the option up to the full 10 days to become profitable, you should refer to historical 10-day return distributions to understand what is a more realistic maximum gain.

Similarly, if you buy an option with 10 days until expiration but only plan to trade intraday, you could look at daily open-to-close returns or close-to-close return distributions to assess the realistic maximum gain.

What is the maximum loss?

The maximum loss is capped at the price you purchased the option for. In the option chain above, if you selected the at-the-money strike of 395, the premium or cost that you paid to buy the call option is 6.45. This cost is the maximum you can lose in this trade.

What is the break-even point?

The break-even point is the strike plus the cost to buy the call option. In the example table above, if you bought the 390-strike, it would cost you 9.55 (the ask price). The break-even price would be: 399.55 or (390 + 9.55).

For formula for the break-even price of a purchased call option is:

Key Formulae

Long Call Break-even Point = Strike Price + Call Option Cost

In our example, this would be an increase of 1.15% over the current price of 395. By comparison, if you bought the 400-strike, it would only cost you 3.99 which is 58% cheaper than the cost to buy the 395-strike. The break-even point for 400-strike would be 403.99 which would require the underlying to increase by 2.28% over its current price of 395.

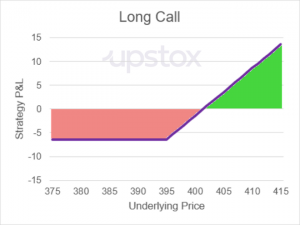

The illustration below shows the profit diagram of the purchasing the at-the-money call option. This would have a cost of 6.45 and a break-even price of 401.45 (395 + 6.45).

Illustration 2

How do you calculate the profit of a long call?

The formula for the payoff of a long call is the maximum of 0 or the difference between the underlying price and the strike price. The reason we need to calculate the maximum between two values is because a long call cannot have a value less than zero when it comes to the payoff of the option.

Meanwhile, the profit formula for a long call is the long call’s payoff minus the cost to purchase the option. The two formulae are given below.

Key Formulae

- Long Call Payoff = Max(0, Underlying Price – Strike Price)

- Long Call Profit = Max(0, Underlying Price – Strike Price) – Option’s Cost

Call Option Scenarios using Historical Data

To conclude this chapter, we will walk through a few examples using real market data to understand the opportunities and risks of long call options.

Scenario 1 – Underlying is above the break-even price at expiration

The Situation:

- The trader is bullish on the Nifty which is trading at 16,630.45.

- The trader buys a 2-week until expiration call option with a strike price of 16,650.

- This call option costs 311.10.

- The break-even price for the call option is when the Nifty is at 16,961.10 (16,650 + 311.10).

What happens:

- The Nifty trends upward throughout the first week and by the end of the week, the trade is profitable as the Nifty hits 16,975.

- Throughout the second week, the Nifty continues to trend upward.

- The trader holds the option until expiration when the Nifty closes at 17,222.75.

Trade Results:

- The call option is in-the-money and has an intrinsic value of 575.75 at expiration. This is calculated as the Nifty price of 17,222.75 minus the strike price of 16,650.

- This trade is profitable with a net gain of 261.65. This is the intrinsic value minus less the cost of 311.10 to buy the call option.

- This trade is successful with a return of 82.4% as the underlying closed above the break-even price.

Scenario 2 – Underlying is above the strike but below the break-even price at expiration

The Situation:

- The trader is bullish on the Nifty which is trading at 17,167.

- The trader selects a 2-week expiration call option with a strike price of 17,200.

- This call option costs 237.80.

- The break-even is when the Nifty is at 17,437.80 (17,200 + 237.80).

What happens:

- For the first week, the Nifty trades flat.

- In the second week, the Nifty trades to 17,470 and further on to 17,511 with three days until expiration.

- The trader decides to hold until expiration because the Nifty was moving favourably and the trade was profitable.

- Unfortunately, the Nifty pulls back over the next three days and the option expires.

- The Nifty closes at 17,324.90 on expiration which is above the strike price of 17200.

The Trade Results:

- The call option is in-the-money and has an intrinsic value of 124.90 at expiration (17,324.90 – 17,200).

- This trade results in a loss of 112.90 (124.90 - 237.80 i.e.,; intrinsic value minus less the cost to buy the option).

- This trade is unprofitable because while the underlying moved above the strike, it didn't reach the break-even point.

Scenario 3 – Underlying is above the strike at expiration

The Situation:

- The trader is bullish on the Nifty which is trading at 16,478.

- The trader buys a 1-week expiration call option with a strike price of 16,500

- This call option costs 137.85

- The break-even is when the Nifty is at 16,637.85 (16,500 + 137.85)

What happens:

- The day after purchasing the call option, the Nifty moves downward by 1.7% to 16,202. With this move, the delta for the strike moved from 50 to 25.

- This means that the strike purchased initially had a 50% likelihood of moneyness but, in a stroke of bad luck, that likelihood was cut in half.

- The trader decides to hold, and the next day, the Nifty moves downward more by another 2.6% to 15,774.

- At this point, the strike is deep out-of-the-money and the delta is less than 0.01. The option is worth only 6.15.

- The trader holds until expiration as the Nifty closes at 15,630.60.

The Trade Results:

- The call option is deep out-of-the-money and has no intrinsic value at expiration.

- This trade results in a loss of the original premium paid of 137.85.

Scenario 4 – The trade is profitable shortly after entry

The Situation:

- The trader is bullish on the Nifty which is trading at 17,167.

- The trader buys a 2-week expiration call option with a strike price of 17,200.

- This call option costs 237.80.

- The break-even is when the Nifty is at 17,437.80 (17200 + 237.80).

What happens:

- The day after purchasing the call option, the Nifty moves downward by 1.37% to 17,402. With this move, the delta for the strike moved from 50 to 67. However, the option still isn't at the break-even price.

- Over the next several days, the Nifty trades down to 16,920 and then back up to 17,470.

- After a week, the Nifty trades up to 17,517.85 making the option 79.05 above break-even.

- However, due to the remaining time value, the option is trading for 369.85.

- The trader decides to close this trade early at 369.85 with 6 days still remaining until expiration.

The Trade Results:

- The trader sees that the 17,200 strike has a delta of 78 meaning that the option has a 78% chance of ending in the money.

- With 6 days until expiration, this call option has an intrinsic value of 316.85 due to the Nifty price of 17,516.85 and strike price of 17,200.

- Also because of the 6 days until expiration, there is a time value of 53.00 calculated as the difference in current option price of 369.85 and the intrinsic value of 316.85.

- This trade generates a profit of 132.05 resulting from the difference in the sell price of 369.85 and the initial cost of 237.80.

What is the impact of time decay on a long call option?

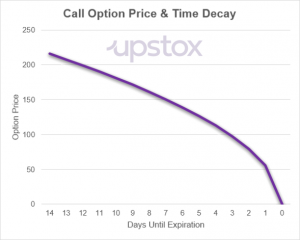

A purchased call option will lose time value every day until at expiration, the time value associated with the option will be zero. This loss in time value won’t be linear and will decay exponentially when an option is only a few days away from expiration. The chart below plots the change in option price over a 2-week period assuming that the underlying price or volatility doesn’t change.

Illustration 3

What is the impact of volatility on a long call option?

When you purchase a call option, you are also ‘long volatility’. As we’ve discussed before, the more volatility that an underlying stock or index has, the greater the likelihood that this security will move enough to be at a certain strike by expiration. Due to this, there is a positive relationship between implied volatility and the price of an option.

In the hypothetical situation where implied volatility goes up, but time and the underlying price stay the same, the price of the option will go up. The opposite is also true where a drop in implied volatility will result in a lower option price.

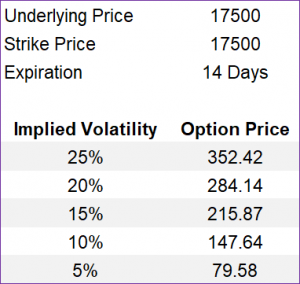

Illustration 4

As you can see in illustration 4 above, if we assume the underlying price and strike price of 17,500, the price of the call option will vary based on the level of implied volatility. At 15% implied volatility, the option price will be 215.87 but if volatility increases to 25%, the option price will increase to 352.42. The reverse is also true if implied volatility were to decrease.

To Conclude:

- Go long on a call option if you believe the price of the underlying will increase before expiry.

- The option becomes worthless if the underlying price doesn't increase.

- Calls are listed to the left of the option chain.

- You pay the 'ask price' to buy an option.

- Maximum gain on a long call option is theoretically unlimited.

- Maximum loss is capped at the ask price.

Key Formulae

- Break-even point = Strike price + Ask Price

- Long Call Payoff = Max(0, Underlying Price – Strike Price)

- Long Call Profit = Max(0, Underlying Price – Strike Price) – Option’s Cost

That concludes our chapter on Long Call Option strategies. Keep this quick checklist handy to help you cover all bases if you plan to execute a long call option strategy.

Before you buy that option,

- Use historical data (matching the time period of the option) to assess your gain-to-loss ratio

- Calculate the break-even price, profit and payoff

- Factor in time decay and volatility

See you in our next chapter where we will explore the Long Bull Call Spread options strategy.

Test your OQ (Options Quotient)

Take your first step towards financial independence with the right training.