Options Exercising

What does exercising an option mean?

When you buy a call option, you get the right to buy the underlying security. Similarly, when you buy a put option, you get the right to sell the underlying security. The process of activating that ‘right’ is called ‘exercising’ the options.

In the Indian stock market, two key things to note about exercising are:

- You can exercise options only on the expiry, not before that. (aka. European style options).

- Index options (e.g., Nifty50 options) are cash-settled, whereas in the case of stock options, the actual shares are transferred.

How does it work?

If one were to imagine a conversation between a call buyer and seller, it would be as follows:

- Call buyer: Hey, I am exercising my Reliance Industries’ call option; give me the shares.

- Call seller: Sure, pay me the strike price.

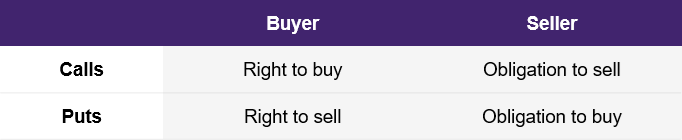

Transaction-wise, the call buyer transfers the total contract value and receives the delivery of shares in the Demat account. The call seller receives the money and is obliged to give the delivery of the shares. The reverse would be true for put options.

Table 1: Rights and obligations matrix

Source: Upstox

Source: UpstoxWhat happens on expiry day?

The options contracts—index or stock—which are open (i.e., not closed or rolled over) at expiry are automatically exercised.

- In the case of index options, which are cash-settled, you will receive the credit or debit in your trading account.

- In the case of stock options, a physical settlement takes place where cash and shares are exchanged.

How are positions settled?

All out-of-the-money and at-the-money option contracts expire worthless on expiry day. Only in-the-money options are physically settled. This requires options traders, depending on their positions, to hold stocks in their account for delivery or provide additional margin to purchase the stocks. The table below describes how settlement takes place.

Table 2: Delivery matrix

Source: Upstox

Source: UpstoxSummary

- All options have an expiration date, and following this, they are no longer tradeable.

- Open options contracts are automatically exercised at expiry.

- The process of activating your right to buy or sell the underlying securities of options is called ‘exercising’ the options.

- Index options are settled in cash, while for stock options, the company’s shares are transferred.

Is this chapter helpful?

- Home/

- Options Exercising