Chapter 4

How to mark the mood of the market?

😀, 😢, 😡 Emojis - love them or hate them, they are popularly accepted shorthand to describe or express emotions and moods. But, did you know, the market has its moods too. Gauging the mood of the market is essential when you are planning a trading strategy. How do you do that? By using a combination of ratios and indicators. In this chapter, we will look at one such commonly used indicator - the Put Call Ratio or PCR.

What is the Put Call Ratio or PCR?

‘Buy low -> sell high -> repeat’ is probably one of the most popular trading phrases.Luckily, markets being cyclical - they move from the phases of extreme pessimism to irrational exuberance, then back to extreme pessimism and so on- you can get away with repeating the above contrarian strategy in the following manner:

Extreme pessimism -> You buy

Irrational exuberance -> You sell

So, if you are among those who often hedge your bets using this strategy, it is time you must learn what the put call ratio (PCR) is. This is because the PCR can help indicate that the markets have reached pessimism or exuberance zones and are about to reverse.

Note of Caution

No one ratio or indicator can definitively indicate the market’s top or bottom. Thus, most successful traders use confirmation from multiple sources to form their views before making a trading decision.

How is PCR calculated?

It is a simple ratio found by dividing the total open interest of put options by the total open interest of call options.

Put call ratio = (Total Put OI / Total Call OI)

The PCR will, generally, fluctuate over and under 1. Instead of OI, one could alternatively use the volume or value of all the option contracts (Calculation details are shared toward the end of this chapter). But before we go there, let’s see how to interpret and use PCR.

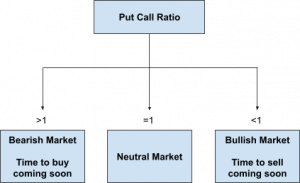

How to interpret PCR?

PCR can be above 1, below 1 or 1. Here is how you interpret each scenario:

- As the PCR rises above 1, it suggests that more puts are being bought compared to the calls. The mood of the majority of the traders is bearish. This makes the market oversold or simply - low. Now, since the mood of the majority is bearish, there could be only a few more traders who can take the market further down. Eventually, the bears will reverse their position (i.e. buy) and take the market up.

What you can do now- Buy low! - If the PCR falls below 1, it indicates that more calls are being bought compared to puts. The market sentiment is bullish. As the ratio keeps falling, the bullish sentiment grows stronger. At a point, the majority of the traders are bullish, making the market overbought. Eventually, the bulls will book profits (i.e. sell) and take the market down. What you can do - Sell high!

- When PCR is 1, the bulls and bears are even. It indicates that trading activity is normal.

Illustration 1: Put Call ratio

How much PCR is too much?

At what figures does the PCR give buy or sell signals? There is no definitive answer to this. However, you can backtest by plotting historical daily PCR. See what the extreme values are. You may not get the exact point where markets will peak or bottom this time, but can use the past extreme values as an indicator of the zone around which markets could reverse.

How to calculate PCR? (in detail)

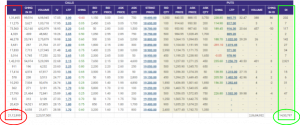

To calculate Nifty50’s PCR, find the total number OI of all the calls and puts from the Nifty50 option chain.

Illustration 2: Nifty50 option chain for 25-Aug-2022 expiry

Source: NSE. as on 19 August 2022

As shown in the image above:

Total Put OI = 14,50,797

Total Call OI = 21,12,999

PCR = (Total Put OI / Total Call OI) = (14,50,797/ 21,12,999)

PCR= 0.7

This indicates an underlying bull trend. In fact, between July 1, 2022 till August 19, 2022 (when this snapshot was taken), the Nifty had risen 12.5%.

To Conclude:

- PCR indicates the mood of the market. It does not indicate the exact point of market reversal.

- PCR is the ratio of total open interest of put options to the total open interest of call options. PCR can be above 1, below 1 or 1.

- PCR above 1 indicates a bearish mood and an opportunity to Buy Low.

- PCR below 1 indicates a bullish trend and an opportunity to Sell High.

- PCR of 1 indicates a neutral market.

- Do not consider PCR in isolation. Use it with other indicators.

So this was a round-up on PCR. We will see you in the next chapter.

Test your OQ (Options Quotient)

Take your first step towards financial independence with the right training.