Chapter 7

How Options can give you an edge in trade?

We have established that Options are the fastest way to reach your trading goals. We also saw how options enable you to trade in any market situation, with low capital and have the potential to generate high returns on that capital; assuming, of course, you are able to control the associated risks. This chapter will give you a taste of how traders use options strategies in the real world to get an ‘edge’ in trading.

A Word of Caution:

Options are more complicated financial instruments than, say, stocks, bonds, ETFs, mutual funds, or physical assets like gold. So before you trade in Options, ensure that you get your basics in place.

The Options ‘Edge’

Despite their complications, options allow traders to do the following:

- Speculate – Traders may be working with a forecasted outcome of an index or stock. By using options, traders can speculate on this forecasted outcome and can do so with lower upfront costs as compared to stocks or futures.

- Hedge equities – Like insurance policies, options can be used to protect against market volatility. Put options can be paired with investments in an index or individual stock to provide a hedge, such that losses are limited to a certain amount.

- Earn yield – When investors buy certain stocks, dividends may be paid during the holding period. In addition to earning a return on price appreciation, the investor will earn an additional yield due to the dividend. Similarly, traders can sell call options on stocks that they own to earn option-based yield.

Speculation is the most common use case for options and we will spend most of our time focusing on this. The reason is that in order to be successful at speculation, traders need to have a well-rounded understanding of the ins and outs of options strategies.

In addition, the other two use cases of hedging and earning yield are limited to a few option strategies. Essentially, the mechanics to implement strategies for hedging and earning yield are a subset of the strategies needed for speculation. By having a detailed grasp of speculation, you will also gain a solid understanding of hedging and earning yield.

Using Options for ‘Speculation’

So, how do you make money through speculation using options? Let’s walk through an example.

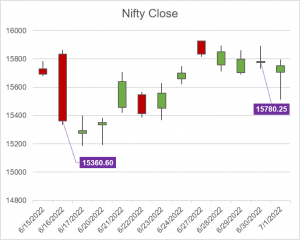

- On 16 June 2022, the Nifty 50 was trading at 15,360 near the end of the trading day. In this situation, perhaps you are bullish on the Nifty and think it will close substantially higher over the next two weeks.

- Since you are bullish, you will purchase a call option. Also, because your time horizon for this prediction is two weeks, you find an expiration date of 30 June 2022 which aligns with this.

- There are many strike prices available on this expiration date for the Nifty 50. The strike prices range from 13,000 all the way to 17,000+, in increments of either 50 or 100.

- To make things simpler, you want to buy the strike that is closest to the current price of the Nifty. This strike price is 15,350, just below the current price of 15,360. The chart below shows the Nifty prices at that point in time.

- When you look to purchase this call option with a 15,350 strike for a 30 June 2022 expiry, you decide to pay the market asking price of ₹285.35. (For reference, this is real historical data).

Let’s pause here and review what we have learnt. We know that a call option gives the holder the right but not the obligation to buy the underlying stock at a predefined price at a certain date. So, if on expiration, the Nifty closes at 15,200, then this option will be worthless. This is because the now-expired call option that you own allows you to purchase the Nifty at 15,350. You, and every other holder of this option, would never do this because you can get a more attractive price by purchasing it directly from the market at 15,200.

However, had the Nifty closed at 15,450, as an owner of a call option with a strike price of 15,350, you would certainly exercise your right as an option holder. Instead of having to buy the Nifty at the market price of 15,450, you can purchase the Nifty for 15,350. In this situation, your call option at expiration would be worth ₹100: the difference between the market price of 15,450 and your strike price of 15,350.

When the market price is above the strike price for call options, your call option is said to have ‘intrinsic value’.

So, what did happen in this situation – did the Nifty close above or below the strike price of 15,350? On 30 June 2022, the Nifty closed at 15,780.25. See the chart below to get an idea of what happened during the two-week period.

On expiration, the intrinsic value of your call option would have been:

₹430.25 = 15,780.25 - 15,350

(Intrinsic value = current price - strike price)

To calculate your profit on this trade, you need to subtract the cost to enter into the trade. Your profit therefore, is:

₹144.90 = ₹430.25 - ₹285.35

(Profit = intrinsic value - cost of call option).

Illustration 1

One last concept we will introduce in this chapter is ‘break-even point’ or ‘break-even price’ often described as BEP. This is the price that the underlying stock or index needs to rise to (for long calls) or fall to (for long puts) in order to start turning a profit on the trade.

The formula varies for different option strategies, but generally speaking, it is as follows:

BEP for a call option = Strike price + cost of the option

As you will see in subsequent chapters, put options work in reverse to call options. Again, the general rule to calculate for break-even points for put options is as follows:

BEP for put options = the strike price - minus the cost to purchase the put option.

We will discuss the specific break-even points in the chapters on bullish option strategies, bearish option strategies, neutral option strategies, volatile option strategies, and equity-option combination strategies.

To Conclude:

- Options are complicated financial instruments.

- Options have the potential to generate high returns, provided you can control the risks.

- Options are used to speculate - to trade basis a forecasted outcome and benefit from it.

- Options are paired with an index or individual stock to limit losses from volatility.

- Options are purchased to earn option-based yield.

Hope the above example gave you a sense of how traders use options strategies in the real world. But before we move on, do take the quiz below to see if Options is right for you.

Test your OQ (Options Quotient)

Take your first step towards financial independence with the right training.