NIFTY50 halts, volatility falls, oil heats up: Markets eye RBI policy

Upstox

2 min read • Updated: April 2, 2024, 5:55 PM

Summary

The volatility index (India VIX) has fallen 9% ahead of the weekly expiry of BANK NIFTY and NIFTY50 options contracts, traders are advised to remain wary of sharp spikes that may occur due to intraday volatility.

Markets took a breather and ended the range bound session flat amid profit booking in IT and banking stocks ahead of RBI's monetary policy decision on Friday. The NIFTY50 closed flat at 22,453, while the sensex slipped 0.1% to 73,903.

- Top gainer and loser in NIFTY50: Tata Consumers (+4%) and Hero Motocorp (-2.4%)

- The broader markets remained buoyant and extended the winning momentum. The NIFTY Midcap 100 and Smallcap 100 indices were both up over 1%.

- Top gainer in NIFTY Midcap 100: Aditya Birla Fashion and Retail (+12%)

- Top gainer in NIFTY Smallcap 100: Tanla Platforms (+10%)

On the daily chart, the NIFTY50 has once again formed a doji candlestick pattern, indicating ongoing indecision or a breather near the all-time high. Meanwhile, Brent Crude prices have climbed $88 a barrel for the first time since October, adding another layer of uncertainty ahead of the RBI’s policy decision on Friday.

While the volatility index (India VIX) has fallen 9% in the last two trading sessions ahead of the weekly expiry of BANK NIFTY and NIFTY50 options contracts, traders are advised to remain wary of sharp spikes that may occur due to intraday volatility.

Key highlights of the day:

☀️Shares of air conditioners and air coolers were in focus after IMD predicted a harsh summer for the April to June period. Shares of Voltas and Havells gained 3% and 2% respectively.

👕Aditya Birla Fashion and Retail (ABFRL) jumped 12% after announcing plans to separate its Madura Fashion business, aiming to create two focused entities.

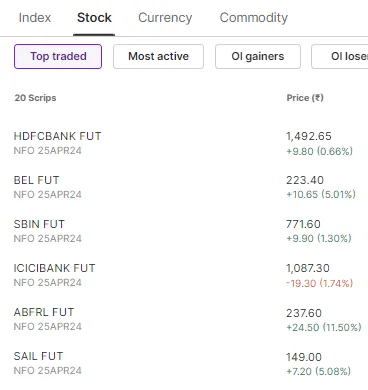

Top traded futures contracts

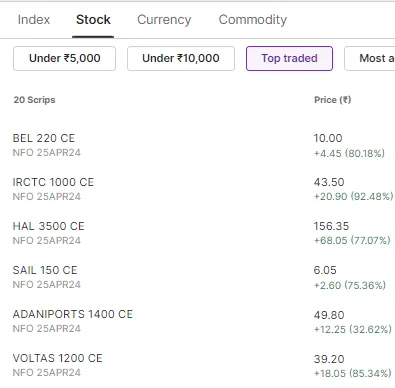

Top traded stock options contracts

4 trading insights from NIFTY 200🔍

📉Open = High (Bear power): ICICI Bank, Eicher Motors, Indus Towers, Eicher Motors and Cipla

📈Open = Low (Bull power): Syngene International, IGL, Bata India and HDFC Life

🏗️Fresh 52 week-high: Steel Authority of India (SAIL), Vedanta, Bharat Electronics, JSW Energy, Hindustan Aeronautics and Voltas

⚠️Fresh 52 week-low: N/A

And that's it for today's F&O recap! Get the full scoop on market trends and curated scans at https://pro.upstox.com/

See you tomorrow!