F&O strategy: How to trade in Kotak Mahindra Bank ahead of its Q4 results?

Upstox

3 min read • Updated: May 3, 2024, 5:37 PM

Summary

Kotak Mahindra Bank has been consolidating between the 400-point range (2,000-1,600) since November 2020. The banking major is currently trading below its key daily moving averages, both 50 and 200 and slipped over 14% in the last one week.

The private sector lender will announce its earnings on 4 May and the impact of the results will be reflected in the stock on 6 May. For the fourth quarter, Kotak Mahindra Bank's net interest income is expected to grow 10% YoY to ₹6,600 crore. However, street estimates are for net profit to decline nearly 5% YoY to nearly ₹3,200 crore.

Moreover, the bank was recently in news after the RBI imposed restrictions preventing the bank from onboarding new customers through online and mobile banking and barred from issuing new credit cards. Furthermore, the bank’s recently appointed Joint MD resigned from his post.

Technical view

Kotak Mahindra Bank has been consolidating between the 400-point range (2,000-1,600) since November 2020. The bank has delivered a negative return (-1%) so far since FY2021-22, while the BANK NIFTY index has gained over 39%.

The banking major is currently trading below its key daily moving averages, both 50 and 200 and slipped over 14% in the last one week. However, the index has formed a hammer candlestick pattern on the daily chart on 2 May —which is considered as a bullish reversal pattern. The confirmation of the hammer happens if the next candle's close is higher than the hammer.

Options overview

Open interest for the 30 May expiry shows highest call options OI at 1700 and 1600 strikes which will act as immediate resistance. On the flip side, the put options base is at 1600 and 1500 strikes.

Based on the open interest data of Kotak Mahindra Bank and at-the-money (ATM.)) straddle prices as of 2 May, the options traders are expecting a move (up or down) of ±5.5% from the closing price of ₹1,575.

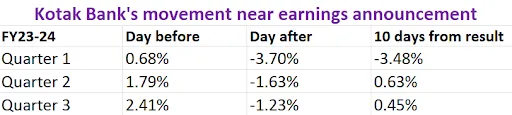

Let's take a look at how Kotak Bank's share price has performed over the last three quarters around its earnings announcements.

How to plan a trade with options?

Considering the movement of ±5.5% implied by the options market, traders can plan a long or short volatility trade through Long or Short Straddles based on their view on volatility and price action.

In simple terms, in a Long Straddle, a trader buys an ATM call and put option of the same strike and expiry of Kotak Mahindra Bank in expectation of a move of more than ±5.5% on either side. Conversely, in a Short Straddle a trader will sell an ATM call and put of the same strike and same expiry if he or she expects a move less than ±5.5%.

Interested to know more about straddles? Check out our UpLearn education content. If you want to see more historical earnings price data like in the table above for this stock, sign-up for our community, let us know, and we will share it!

Disclaimer

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for educational purposes. We do not recommend any particular stock, securities and strategies for trading. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.