What is compounding and how to benefit from it?

When it comes to investing, how much you invest is as important—if not more—as the duration for which you remain invested. The true power of compounding is only unleashed over a longer investment horizon. Let’s understand what is compounding and how to benefit from it:

What is compounding?

Compounding is the process where the earnings accrued from your principal amount are reinvested. In case of a debt instrument (bank fixed deposit or debt mutual fund), the earnings are the interest you earn, while in the case of equity investment, the earnings are technically the capital gains, dividends, bonus or stock split. As years go by, not only will your initial principal grow, but also the accumulated earnings. If investments are made in the right security, there comes a point in the investing journey where the accumulated earnings exceed the initial amount you have invested. That’s the power of compounding. No wonder compounding is called the 8th wonder of the world. It has helped legendary investors like Warren Buffett and Charlie Munger create enormous wealth.

Simple interest versus compound interest

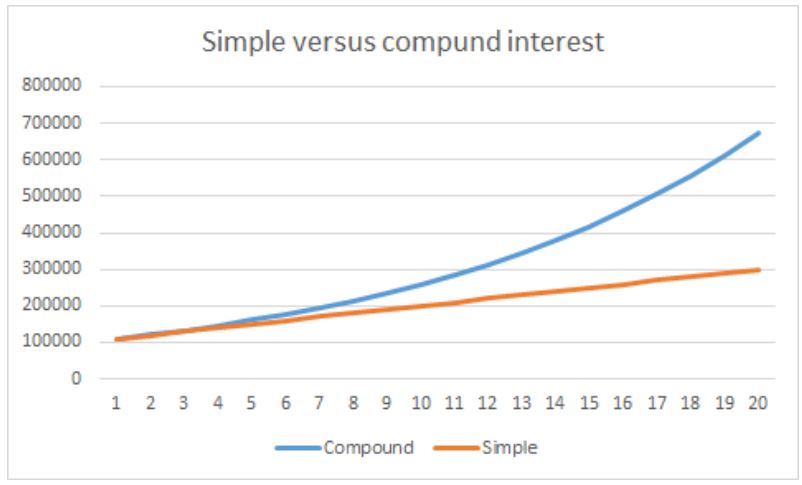

How compounding works can be best illustrated by understanding how simple interest and compound interest works. Assume you invested a principal amount of ₹100,000 at an interest rate of 10% per annum. Now let’s see how simple interest works: At the end of the first year, you will earn an interest of ₹10,000 on the principal you invested. Next year, and during your entire investment horizon, of say 20 years, you will earn the same amount of ₹10,000 per annum. This is because simple interest is levied only on the principal. Essentially, it means that you are not reinvesting the interest you earn every month. At the end of 20 years, your total investment will be worth ₹300,000.

Now let’s see how compound interest works. Let’s say the principal, interest rate and holding period remain the same, i.e. ₹100,000, 10 percent and 20 years, respectively. Here, at the end of the first year, you will earn exactly the same interest, which is ₹10,000. But this will be reinvested. Therefore, your principal would grow to ₹110,000. Next year you will earn interest on this amount, which will be slightly higher at ₹11,000. Similarly, next year and for the following years, the principal will keep on growing as interest keeps getting added. At the end of the 20-year period, your investment amount would have appreciated nearly 7 times to ₹672,750. For simple interest, the annualised returns (known as compounded annual growth rate or CAGR) are around 10%. But if the interest amount is compounded, the CAGR returns are more than 20%.

Benefits accrue in the long run

As it can be seen from the chart below, the returns for the initial few years may appear similar under both simple and compound interest. Only after the eighth or the ninth year, does the real benefit of compounding kick in. For the above cited example, the difference in returns is only about 10% during the first six years. At the end of 10 years it is 30 percent, while after 18 years it is more than double.

How does compounding work in the stock market?

The basic principle—long holding period and reinvesting gains—remains the same for stock market investments. However, there is a fundamental difference between debt and equity investing. Typically, for debt investment, you earn returns at a fixed rate. On the other hand, there is no fixed or guaranteed return on equity investment. An equity investor mainly gains from capital appreciation in the stock, which isn’t linear like debt investment. For equity, there are years when returns can be phenomenal and there are years when returns can also be negative. Besides, an equity investor earns from corporate action such as dividend payouts, bonus issues or stock splits. To get the benefit of compounding, an equity investor has to remain invested and not look to withdraw or redeem the capital gains. Also, if possible the dividends can be ploughed back into the stock. If you are taking the mutual fund route, this can be done by opting for ‘growth’ option instead of the ‘dividend’ option. Similarly, one can avoid selling extra shares obtained via a bonus issue or stock split. By doing so, you ensure that your investment corpus remains big, which if remains invested for a 10, 20

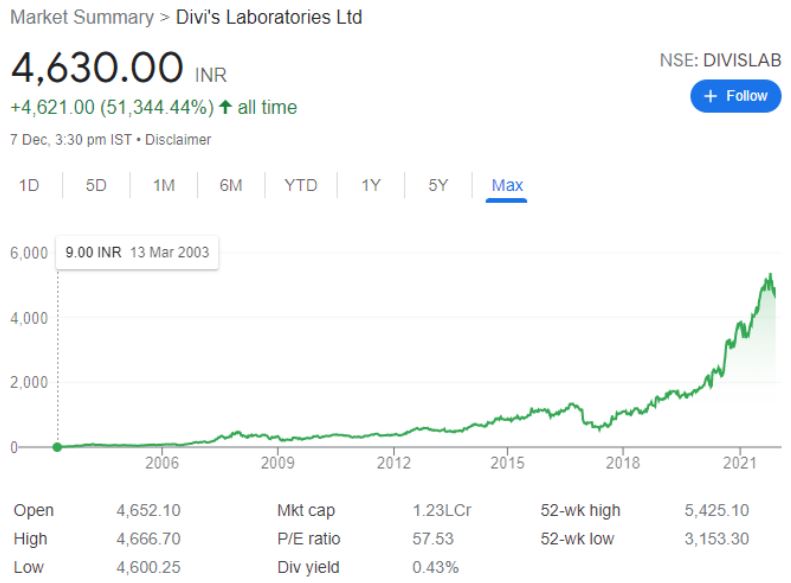

- or 30-year period can grow into something phenomenal. By doing a simple Google search for stock prices, you will get an idea how some stocks have compounded over a long period. For instance, if you key in the search words ‘Divi’s Lab share price’ you will get the following graph. Since March 2003, shares of Divi's Laboratories have soared over 500 times, translating into CAGR gains of nearly 40%.

This was just one example; one can compare long-term returns for any listed company using the same technique. Remember, not all stocks see the price multiply. You have to be lucky to select the right stock. One can also look to diversify their holdings to mitigate risk.

Secret of compounding

Start as early as possible. Save more, invest more, and for longer. At the end of it, watch your money compound.