SJS Enterprises IPO: Here’s what you need to know

Bengaluru-based decorative aesthetics solutions provider S.J.S. Enterprises’ IPO opens for subscription on 1 November 2021. Here's what you need to know about the IPO.

Issue Highlights

-

IPO Size: ₹800 crore

-

Fresh issue: NA

-

Offer for sale: ₹800 crore

-

Price band: ₹531– ₹542 per share

-

Lot size: 27 Shares

-

Minimum investment: ₹14,634

IPO Timeline

-

Start Date: November 1, 2021

-

End Date: November 3, 2021

-

Tentative allotment date: November 10, 2021

-

Tentative refund credit: November 11, 2021

-

Tentative credit of shares to demat: November 12, 2021

-

Expected Listing date: November 15, 2021

Registrar Information

-

Registrar Name: Link Intime India Private Limited

-

Concerned Person Name: Shanti Gopalkrishnan

-

Email: sjs.ipo@linkintime.co.in

-

Contact Number: +91 22 49186200

Key highlights

-

SJS Enterprises is one of the leading players in the Indian decorative aesthetics industry in terms of revenue

-

It designs, develops and manufactures a diverse range of products for customers, especially, in the automotive and consumer appliance sectors

-

Its product offerings include decals and body graphics, 2D and 3D appliques and dials, printed and painted injection moulded plastic parts, etc.

-

The company also offers a variety of accessories for the two-wheelers and passenger vehicles aftermarket

-

It has supplied over 11.5 crore parts to around 170 customers across 20 countries

-

It has a diverse customer base including Suzuki, M&M, Ashok Leyland, Bajaj Auto, Whirlpool, Samsung among others.

Reasons for going public

- Offer liquidity to the selling shareholders

Company Fundamentals

Before investing in an IPO, one should understand the company fundamentals.

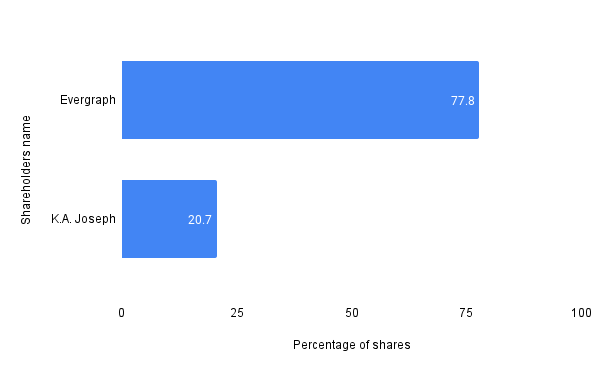

Top shareholders of the company are:

Company Financials

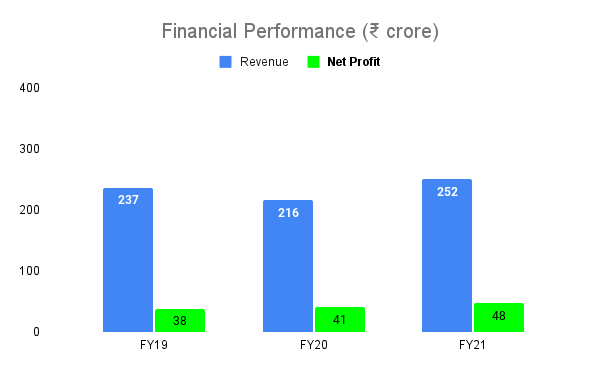

Here’s a look at the company’s financial performance:

Company Overview

S.J.S. Enterprises designs, develops and manufactures decorative aesthetic products. The design-to-delivery aesthetics solutions provider offers a diverse portfolio of products for a wide range of customers, especially in the automotive and consumer appliance industries. The company supplied over 115 million parts to around 170 customers in approximately 90 cities across 20 countries in FY21.

Competitive strengths

-

One of the leading decorative aesthetics suppliers with a wide range of products

-

Supported by established supply chain and delivery mechanism

-

Capable of product innovation, design, and development

-

Strong track record of financial performance

-

Well-established customer relationship

Opportunities

-

Leverage market leadership to enhance focus on premium products

-

Enhance product styling, customisation, design and development capabilities

-

Build, innovate, and develop new products

-

Intend to focus on expanding penetration in the two-wheeler automotive segment in Asia

-

Take steps towards the integration of subsidiary’s business

-

Business expansion through strategic inorganic growth opportunities

-

Increase geographical footprint and exports

Threats

-

Any loss of key customers and contracts to the competition

-

Fluctuations in the performance of the automotive and consumer appliance industries

Risks

-

Failure to source raw materials at competitive prices

-

High dependency on automotive sector which makes up 70% of revenues

-

Inability to accurately manage inventory

-

Counterparties may delay or fail to make payments or perform contractual obligations