Popular Option Trading Strategies

[caption id="attachment_888" align="aligncenter" width="427"] Simple and Complex Options Strategies: Will you be Bearish or Bullish?[/caption]

Simple and Complex Options Strategies: Will you be Bearish or Bullish?[/caption]

Simple and Complex Options Strategies: Will you be Bearish or Bullish?[/caption]

Simple and Complex Options Strategies: Will you be Bearish or Bullish?[/caption]Definition of an Option

As studied earlier, an option is a contract between two parties (buyer & seller), where one party (the buyer) pays the premium to another party (seller) for the right to buy or sell an asset/ underlying at a predetermined future date at a specific price. Unlike trading other derivative products, options have a non-linear payoff (a limited risk with high-profit potential). One of the highest advantages of trading in options is that it can complement the said portfolios in many ways. (Here is the link to my earlier blog post on the non-linearity nature of options payoffs). Now, we will cover some popular options strategies.

Popular Options Strategies

This blog will cover a few popular options strategies. Trading in popular options strategies cannot get you rich quickly since most of them have limited profit potential but on the other hand, have a limited risk associated with it. The Return on Investment (ROI) in percentage (%) terms is much higher than in absolute value terms. Before forming a strategy in options, a trader must identify the goal that suits his portfolio or financial plan. Any option strategy is said to be successful only if it meets the financial plan of the trader.

Once the goal is decided then the strategy could be formed accordingly. It is very much essential for a trader to also have a viewpoint of a future date of the options traded when trading popular options strategies.

There are four important terms associated with options:

-

Strike Price (Predetermined Price)

-

Expiry Date (Future Date)

-

Break Even Point (Zero Level Profit / Loss)

-

Risk / Reward

Similarly, views can be mainly of four types:

-

Bearish

-

Bullish

-

Volatile

-

Range Bound/ Neutral

Each of them has a simple way strategy with a single option trading, and also complex strategies which compensate for the risk associated with the options. At the same time, one must be aware that lower the risk, the lesser the returns would be. Let's get right into some of the popular options strategies

Bearish View

This type of viewpoint is generally like when a trader is expecting a downside in the asset / underlying at a predetermined future date. This type of viewpoint an the strategy would give good returns if the movement is in favor; that is if the asset / underlying price move southwards. Some of the simple bearish view strategies in options are Long put, Short Call, Protective Call, Covered put, while the complex ones include Bear Call Spread and Bear Put Spread.

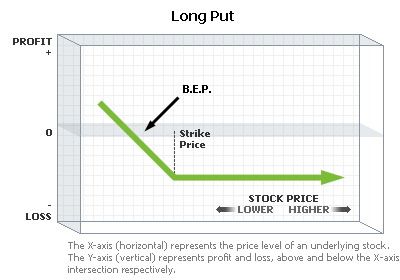

Long Put

A buyer of an option is bearish and has limited risk potential can take a long put strategy. He simply buys a put of a particular strike price of a particular expiry date. Any southward movement would be profitable whereas the risk is limited if the movement is northward. It is a perfect hedge to a long asset.

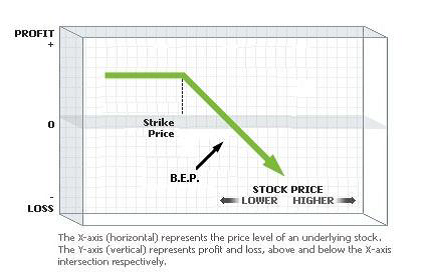

Short Call

A short call strategy works exactly opposite to a long put strategy. Here a trader shorts a call and receives the premium unlike paying in long put. But at the same time risk is very high in case of northward movement and profit limited in the case of southward movement of price.

Bear Call Spread

Sell ITM Call, Buy OTM Call

This strategy can be used when the trader is mildly bearish. It is a kind of complex strategy. A requires two Call options to be traded: One to buy and the other to short sell. The selection of the strike prices of the Call option a very crucial as it decides your risk/reward at a future date. It involves selling an In

- The Money (ITM) call option and hedge it by buying an of Out-Of-Month (OTM) Call Option. The trader receives the premium as the ITM option is sold and OTM option is bought the maximum reward would be the difference premium received. As the asset price moves downward both the call options expire worthless and the whole premium is received as the profit/ reward. On the other hand of the price moves northward, the loss would be maximum the difference between the strike prices less the net premium credit received.

Profit: Premium received of Sold Call

- Premium paid on Long Call

Loss: Difference in Strike prices

- Net premium received

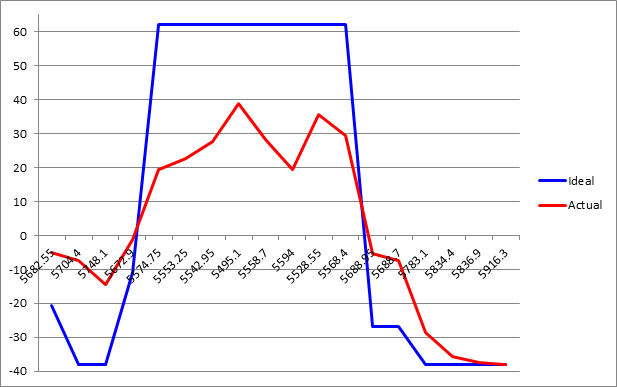

Example: On 29th Mar 2013, Mr. XYZ is bearish on Nifty and adopts a ** Bear Call Spread strategy**. He sells an ITM 5700 Call and buys OTM call of 5800 of April 25th expiry.

| The Pay-Off Schedule | | | | | | | |

| --

| --

- | --

- | --

- | --

- | --

- | --

- | --

- | --

- |

| Date | Nifty Spot | 5700CE Sold @ Rs 90 | | 5800CE Buy @ Rs 43 | | PAYOFF | |

| | | Price | Profit / Loss | Price | Profit / Loss | Actual | Ideal |

| 28-Mar-13 | 5682.55 | 94.35 | -4.35 | 49.95 | 6.95 | 2.6 | 47 |

| 01-Apr-13 | 5704.4 | 93.1 | -3.1 | 45.9 | 2.9 | -0.2 | 42.6 |

| 02-Apr-13 | 5748.1 | 113.5 | -23.5 | 57.5 | 14.5 | -9 | -1.1 |

| 03-Apr-13 | 5672.9 | 69.05 | 20.95 | 31.15 | -11.85 | 9.1 | 47 |

| 04-Apr-13 | 5574.75 | 36.3 | 53.7 | 15.45 | -27.55 | 26.15 | 47 |

| 05-Apr-13 | 5553.25 | 29 | 61 | 11.75 | -31.25 | 29.75 | 47 |

| 08-Apr-13 | 5542.95 | 24.65 | 65.35 | 9.6 | -33.4 | 31.95 | 47 |

| 09-Apr-13 | 5495.1 | 14.1 | 75.9 | 5.35 | -37.65 | 38.25 | 47 |

| 10-Apr-13 | 5558.7 | 22.85 | 67.15 | 8 | -35 | 32.15 | 47 |

| 11-Apr-13 | 5594 | 29.45 | 60.55 | 10.6 | -32.4 | 28.15 | 47 |

| 12-Apr-13 | 5528.55 | 14.05 | 75.95 | 4.8 | -38.2 | 37.75 | 47 |

| 15-Apr-13 | 5568.4 | 16 | 74 | 5.05 | -37.95 | 36.05 | 47 |

| 16-Apr-13 | 5688.95 | 51.8 | 38.2 | 17.25 | -25.75 | 12.45 | 47 |

| 17-Apr-13 | 5688.7 | 43.55 | 46.45 | 12.5 | -30.5 | 15.95 | 47 |

| 18-Apr-13 | 5783.1 | 96.65 | -6.65 | 32.05 | -10.95 | -17.6 | -36.1 |

| 22-Apr-13 | 5834.4 | 135.25 | -45.25 | 51.75 | 8.75 | -36.5 | -53 |

| 23-Apr-13 | 5836.9 | 140 | -50 | 49.05 | 6.05 | -43.95 | -53 |

| 25-Apr-13 | 5916.3 | 216.3 | -126.3 | 116.3 | 73.3 | -53 | -53 |

Maximum Profit = 90 – 43 = Rs. 47

Maximum Loss = 5800 – 5700 – (90 – 43) = Rs. 53

Bear Put Spread: Buy ITM Put, Sell OTM Put

This is an option strategy which is applied when trader has a mildly bearish view of the market. It is applied by short selling an ITM put option and buying an OTM put option. The trader would be only profitable of the price movement is downward. The net profit is maximum the difference of the net premium received as ITM put in short sold and hedged by OTM put option.

This strategy is more or less the sum to the bear call spread, whereas a Call option would be used as compared to a Put Option being used in this strategy. Similar to the Bear call spread, the selection of the strike prices is important. Of the same expiry as it would be a deciding factor for the Reward/lossless the net premium paid, and the risk would be the net premium paid.

Profit: Difference in Strike prices + Net premium received

Loss Premium paid on Long Put

- Premium received of Sold Put

Example: On 29th Mar 2013, Mr. ABC is bearish on Nifty and adopts a BEAR PUT Spread strategy. He buys an ITM 5700 PUT and sells OTM 5600 Put of April 25th expiry.

Maximum Profit: 5700 – 5600 – (100

- 62) = Rs 62

Maximum Loss = 100 – 62 = Rs 38

| The Pay-Off Schedule | | | | | | | |

| --

| --

- | --

- | --

- | --

- | --

- | --

- | --

- | --

- |

| Date | Nifty Spot | 5700PE BUY @ Rs 100 | | 5600PE SOLD @ Rs 62 | | PAYOFF | |

| | | Price | Profit / Loss | Price | Profit / Loss | Actual | Ideal |

| 28-Mar-13 | 5682.55 | 83.95 | -16.05 | 51 | 11 | -5.05 | -20.55 |

| 01-Apr-13 | 5704.4 | 69.25 | -30.75 | 38.65 | 23.35 | -7.4 | -38 |

| 02-Apr-13 | 5748.1 | 50.75 | -49.25 | 27.15 | 34.85 | -14.4 | -38 |

| 03-Apr-13 | 5672.9 | 83.35 | -16.65 | 46.65 | 15.35 | -1.3 | -10.9 |

| 04-Apr-13 | 5574.75 | 141.15 | 41.15 | 83.8 | -21.8 | 19.35 | 62 |

| 05-Apr-13 | 5553.25 | 151.6 | 51.6 | 90.85 | -28.85 | 22.75 | 62 |

| 08-Apr-13 | 5542.95 | 162.5 | 62.5 | 96.9 | -34.9 | 27.6 | 62 |

| 09-Apr-13 | 5495.1 | 211.4 | 111.4 | 134.45 | -72.45 | 38.95 | 62 |

| 10-Apr-13 | 5558.7 | 156.9 | 56.9 | 90.6 | -28.6 | 28.3 | 62 |

| 11-Apr-13 | 5594 | 133.25 | 33.25 | 75.75 | -13.75 | 19.5 | 62 |

| 12-Apr-13 | 5528.55 | 176.5 | 76.5 | 102.75 | -40.75 | 35.75 | 62 |

| 15-Apr-13 | 5568.4 | 145.75 | 45.75 | 78.25 | -16.25 | 29.5 | 62 |

| 16-Apr-13 | 5688.95 | 57.2 | -42.8 | 24.4 | 37.6 | -5.2 | -26.95 |

| 17-Apr-13 | 5688.7 | 52.05 | -47.95 | 21.3 | 40.7 | -7.25 | -26.7 |

| 18-Apr-13 | 5783.1 | 15.05 | -84.95 | 5.7 | 56.3 | -28.65 | -38 |

| 22-Apr-13 | 5834.4 | 3.75 | -96.25 | 1.45 | 60.55 | -35.7 | -38 |

| 23-Apr-13 | 5836.9 | 1.2 | -98.8 | 0.7 | 61.3 | -37.5 | -38 |

| 25-Apr-13 | 5916.3 | 0 | -100 | 0 | 62 | -38 | -38 |