Butterfly Spread: A Low Risk Options Trading Strategy

In the previous article, we covered the 4 common Vertical Spread Options trading strategies. In this article, we will get a basic understanding of a popular, but complex Options Spread Strategy: the Butterfly Spread.

Butterfly Spread

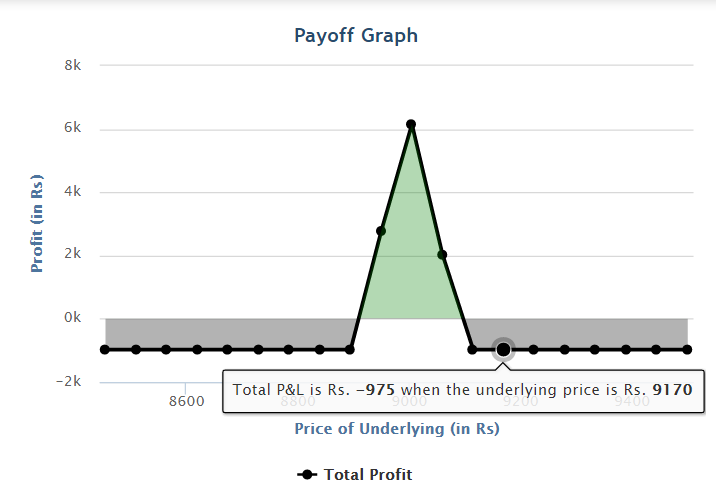

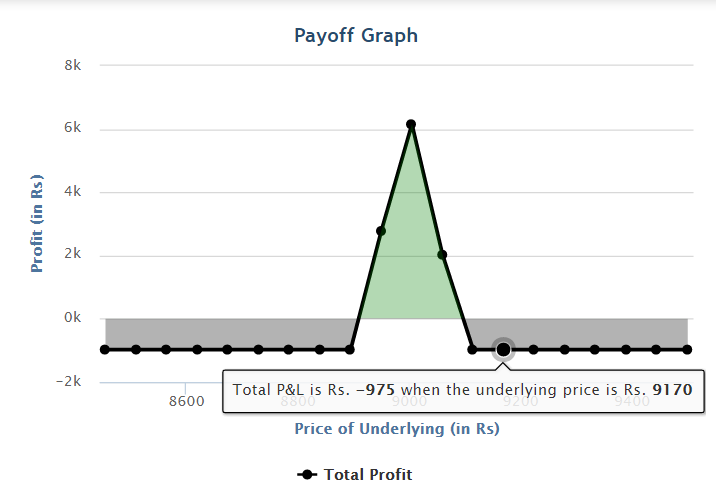

This strategy is called a Butterfly Spread due to how the Options Graph always looks like. Here it is, using the Upstox Options Strategy Builder.

[caption id="attachment_7145" align="alignnone" width="650"] Payoff Graph for Butterfly Spread[/caption]

Payoff Graph for Butterfly Spread[/caption]

Payoff Graph for Butterfly Spread[/caption]

Payoff Graph for Butterfly Spread[/caption]There are 4 types of Butterfly Spread strategies: Long Call Butterfly, Short Call Butterfly, Long Put Butterfly, and Short Put Butterfly.

Long Call Butterfly Spread

In a Long Call Butterfly, we expect the underlying to remain range-bound. You construct it by selling 2 at-the-money (ATM) Options, buying 1 in-the-money (ITM) Option, and buying another out-of the money (OTM) option. As a result, the underlying, expiry, and option type (call/put) are the same for all 4 options.

Let's take an example with Nifty. Suppose the Nifty is trading at 8960 on 10th March, 2017. We take the view that Nifty will expire around 9000 at expiry. Therefore, we execute the following.

Sell 2 lots of 30-Mar-17-CE-9000 at Rs. 94.90

Buy 1 lot of 30-Mar-17-CE-8900 at Rs. 146.96

Buy 1 lot of 30-Mar-17-CE-9100 at 55.85

Buy 1 lot of 30-Mar-17-CE-8900 at Rs. 146.96

Buy 1 lot of 30-Mar-17-CE-9100 at 55.85

Therefore, we get the following:

Sell x 2 lots x 9000 Strike: Rs. 94.90 x 75 (Qty) x 2 (lots) = Rs. +14,235

Buy x 1 lot x 8900 Strike: Rs. 146.95 x 75 (Qty) x 1 (lot) = Rs. -11,021.25

Buy x 1 lot x 9100 Strike: Rs. 55.85 x 75 (Qty) x 1 (lot) = Rs. -4,188.75

Sell x 2 lots x 9000 Strike: Rs. 94.90 x 75 (Qty) x 2 (lots) = Rs. +14,235

Buy x 1 lot x 8900 Strike: Rs. 146.95 x 75 (Qty) x 1 (lot) = Rs. -11,021.25

Buy x 1 lot x 9100 Strike: Rs. 55.85 x 75 (Qty) x 1 (lot) = Rs. -4,188.75

Net Debit: Rs. -975.

Consequently, Rs. 975 is the maximum you can lose on this trade.

On expiration day, we assume Nifty expires at 9000. As a result, the two ATM options expire worthless. The 9100 OTM Call Option also expires worthless. Finally, the 8900 ITM Call Option expires at 9000 and loses (9000-8900)

- 146.95 = -46.95 points.

The profit is, therefore:

Sell x 2 lots x 9000 Strike: Rs. 94.90 x 75 (Qty) x 2 (lots) = Rs. +14,235

Buy x 1 lot x 8900 Strike: Rs. 46.95 x 75 (Qty) x 1 (lot) = Rs. -3521.25

Buy x 1 lot x 9100 Strike: Rs. 55.85 x 75 (Qty) x 1 (lot) = Rs. -4,188.75

Sell x 2 lots x 9000 Strike: Rs. 94.90 x 75 (Qty) x 2 (lots) = Rs. +14,235

Buy x 1 lot x 8900 Strike: Rs. 46.95 x 75 (Qty) x 1 (lot) = Rs. -3521.25

Buy x 1 lot x 9100 Strike: Rs. 55.85 x 75 (Qty) x 1 (lot) = Rs. -4,188.75

Net Profit: Rs. 6525

Low Risk, High ROI

This also happens to be the maximum you can earn from this trade. Not bad, right? Let's calculate your return on investment (ROI).

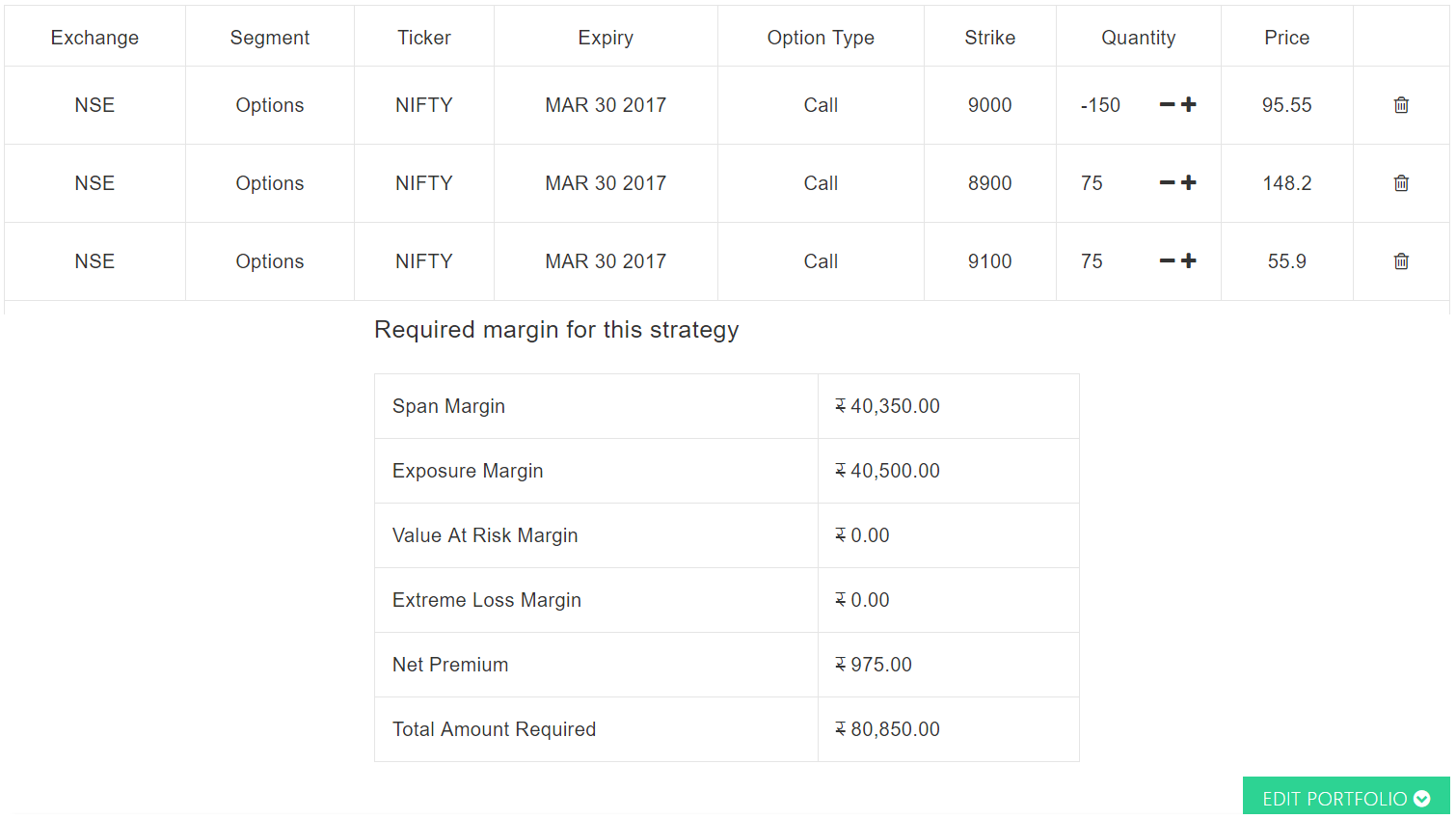

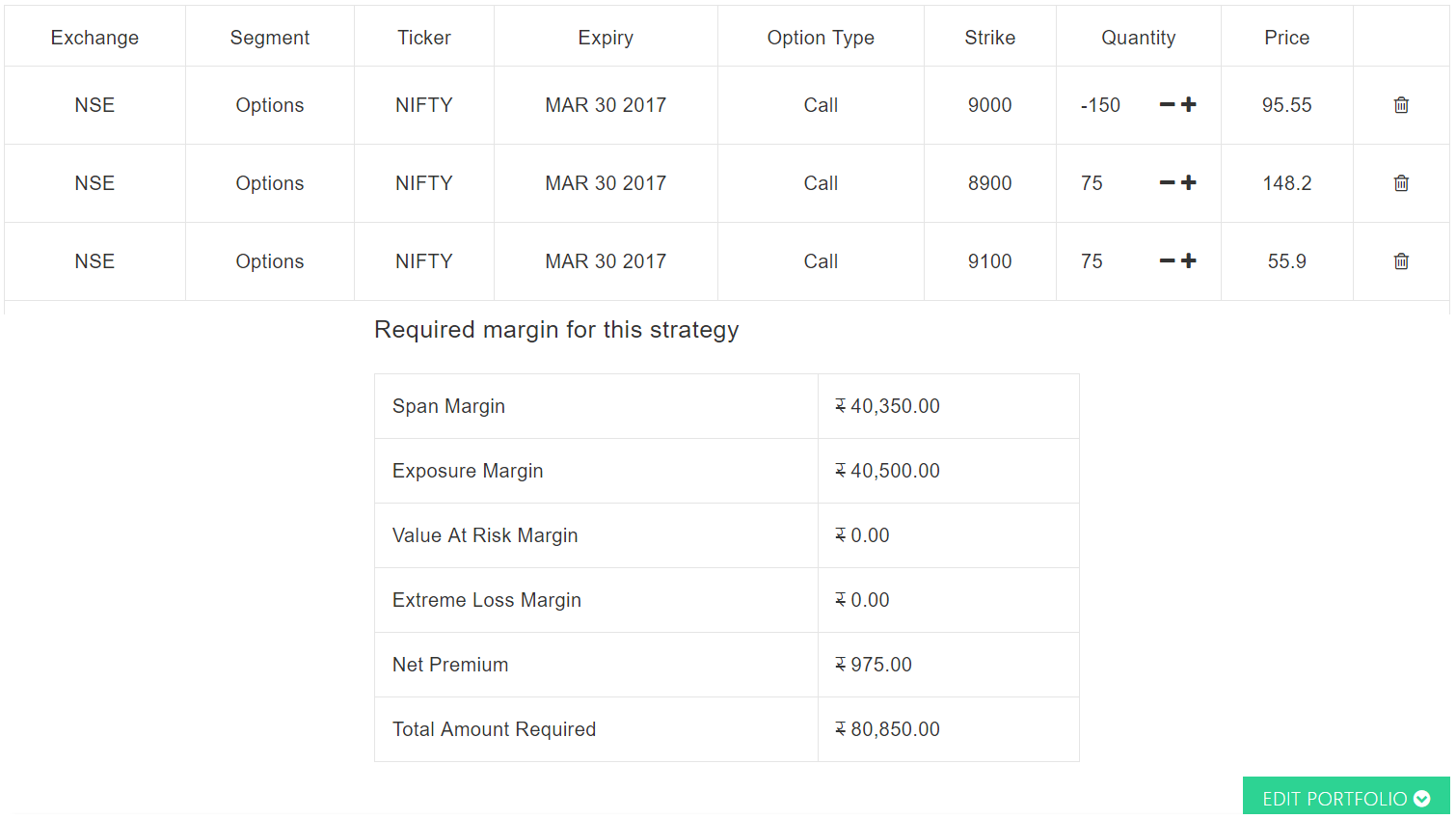

The total amount you will need to put up, in blocked margin, can be easily calculated using the Upstox SPAN Margin Calculator tool:

The total amount you will need to put up, in blocked margin, can be easily calculated using the Upstox SPAN Margin Calculator tool:

[caption id="attachment_7147" align="alignnone" width="1510"] Total Margin Required[/caption]

Total Margin Required[/caption]

Total Margin Required[/caption]

Total Margin Required[/caption]The total margin required is 80,850. As a result, your return on investment is 6,525/80,850 = 8.1%

It's important to note that the biggest benefit to this trade is not just the high ROI on it (a 8.1% return on a trade lasting 20 days equates to a 304% annualized ROI), but the very low risk. Your maximum loss is capped at just Rs. 975. That is the advantage of this type of advanced options strategy.

Short Call Butterfly Spread

This is structured the same way as a Long Call Butterfly, except the trade directions are reversed. Using the same example, you would execute the following:

Buy 2 lots of 30-Mar-17-CE-9000 at Rs. 94.90

Sell 1 lot of 30-Mar-17-CE-8900 at Rs. 146.96

Sell 1 lot of 30-Mar-17-CE-9100 at 55.85

Sell 1 lot of 30-Mar-17-CE-8900 at Rs. 146.96

Sell 1 lot of 30-Mar-17-CE-9100 at 55.85

Long Put Butterfly Spread

This is structured the same way as a Long Call Butterfly, except that you execute your trades on Puts instead of Calls. Using the same example, you would execute the following:

Sell 2 lots of 30-Mar-17-PE-9000 at Rs. 138.90

Buy 1 lot of 30-Mar-17-PE-8900 at Rs. 93.50

Buy 1 lot of 30-Mar-17-PE-9100 at 198.95

Buy 1 lot of 30-Mar-17-PE-8900 at Rs. 93.50

Buy 1 lot of 30-Mar-17-PE-9100 at 198.95

Short Put Butterfly Spread

This is structured the same way as a Long Put Butterfly, except the trade directions are reversed. Using the same example, you would execute the following:

Buy 2 lots of 30-Mar-17-PE-9000 at Rs. 138.90

Sell 1 lot of 30-Mar-17-PE-8900 at Rs. 93.50

Sell 1 lot of 30-Mar-17-PE-9100 at 198.95

Sell 1 lot of 30-Mar-17-PE-8900 at Rs. 93.50

Sell 1 lot of 30-Mar-17-PE-9100 at 198.95

In the next article, we will cover the Iron Candor and Straddle strategies. Stay tuned!