Upstox Originals

Worried about corrections? Here’s what could support the markets

.png)

3 min read | Updated on August 21, 2024, 16:44 IST

SUMMARY

Indian markets are trading near all-time highs, having weathered numerous short-term corrections. While domestic fundamentals remain encouraging, frothy valuations and global uncertainties raise concerns of potential corrections ahead. Our analysis suggests that five major factors could provide cushion during dips. Read on to find out more.

Exploring factors that could support markets during dips

Indian Markets are trading at an all-time high, and valuations are elevated. Besides that, recent global events continue to increase overall uncertainty.

That said, India’s overall macroeconomic scenario remains stable and broad market sentiment remains positive. Proof of the pudding is that, since COVID-19, every correction has been bought into and domestic markets have risen to new highs.

Encouragingly our analysis indicates that there are some cushions available that could support markets, in case of a decline.

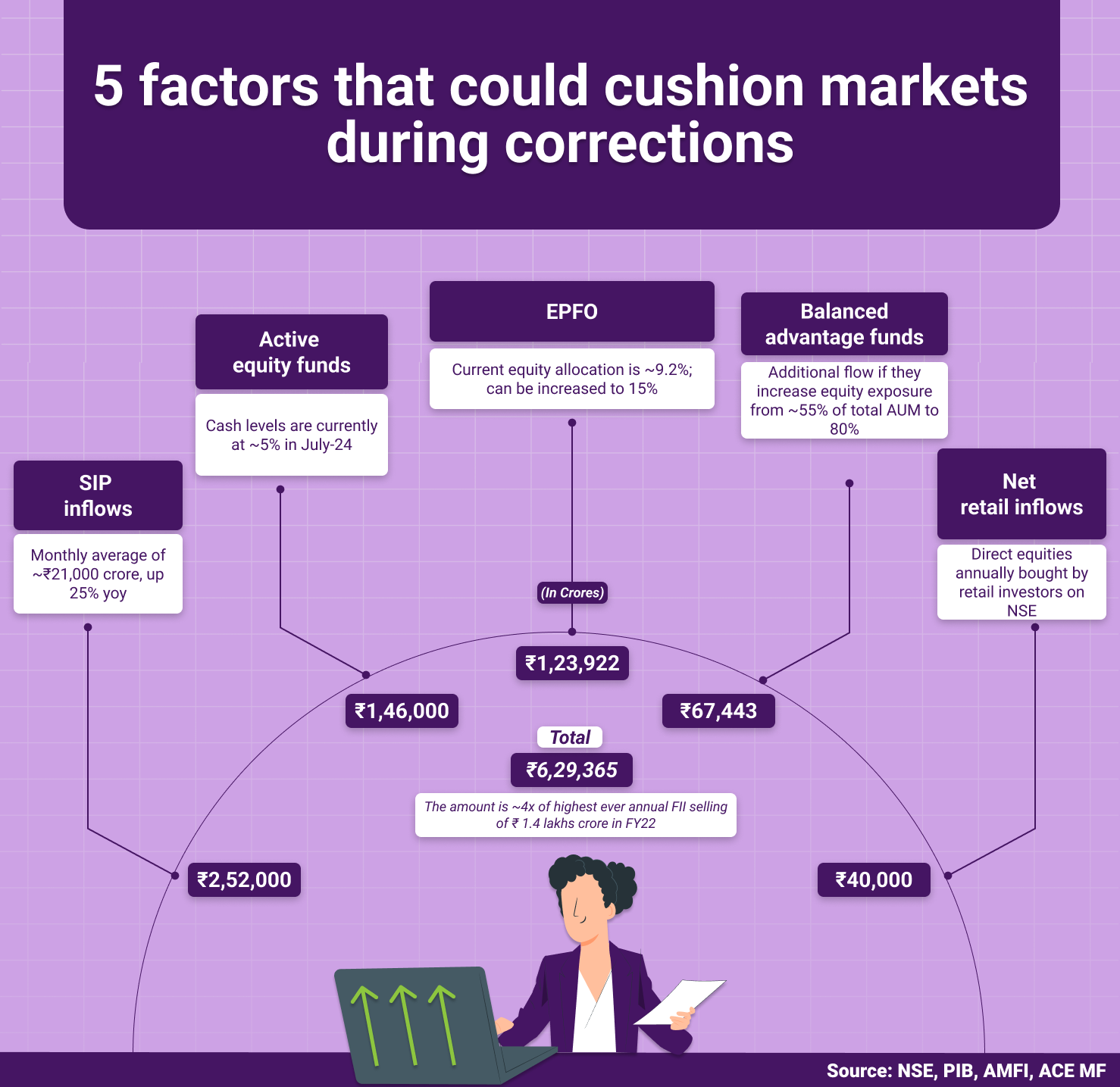

5 factors that could cushion markets during dips

We believe these five factors could play a role in providing some cushion to the markets in case of a market decline. These include:

We elaborate on each of these factors below

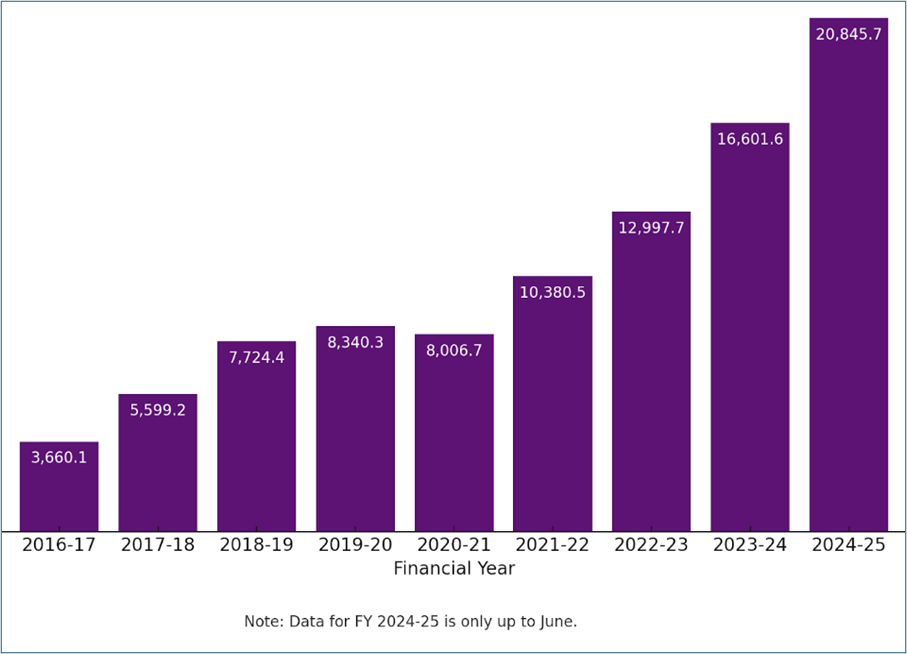

SIP inflows

SIPs bring in a steady average flow of ~₹21,000 crore every month. Since COVID-19, these consistent inflows can help stabilize the market, even during downturns, by providing a reliable source of financial support.

Average SIP monthly contributions have risen sharply

Source: AMFI

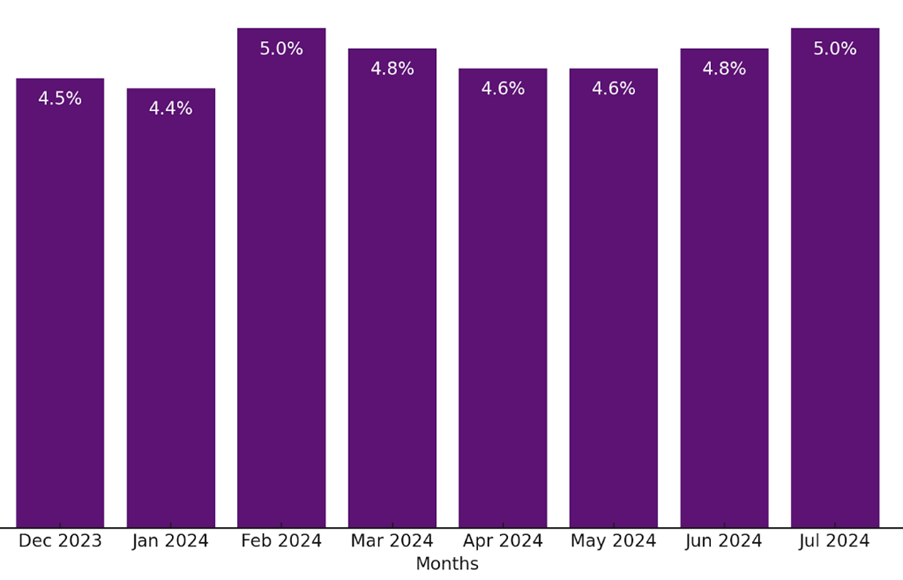

Active equity funds

Actively managed equity funds hold a cash worth ₹146,672 lakh crore, ~5.0% of actively managed equity AUM as of July 24, which they can deploy to support the market during declines.

Cash as % of active equity AUM

Source: ACEMF, Moneycontrol

Balanced advantage funds

Balanced advantage funds can adjust their equity allocation based on market conditions. Currently, they have a net equity allocation of about 55% of their total AUM of ~₹2.6 lakh crore. However, if corrections offer opportunities, they can increase it to 80%, bringing in additional inflows of ~₹67,443 crore.

Employees' Provident Fund Organization (EPFO)

The EPFO manages retirement funds of ₹21.3 lakh crore. EPFO has currently invested 9.2% of its AUM into equities. Regulations allow it to invest up to 15% of its AUM into equities. The increased equity allocation if done amounts to an inflow of ₹1.2 lakh crore. This boost provides additional support to the market, helping it withstand challenges.

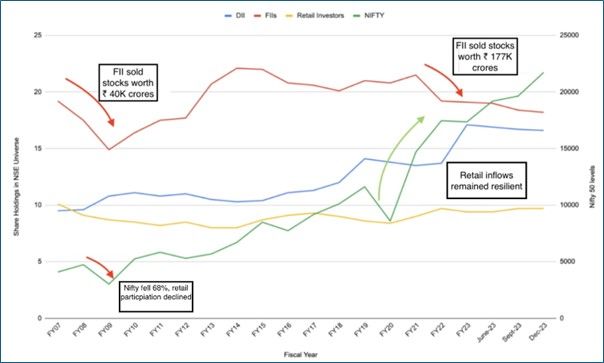

Retail net inflows into direct equities

Retail investors are investing in direct equities at unprecedented levels, with an estimated average yearly inflow of ~₹40,000 crore for FY23 and FY24 each. This demonstrates the significant impact of retail investors in supporting the market, acting as a financial force during challenging times which we discussed earlier in the article - Shifting trends: Growing confidence on retail investors in Indian Markets

Retail participation remained strong despite FII selling

Source: NSE, CDSL

Also, investors should note the above factors are the possibilities that could happen in case of market corrections and should be read with the overall risk associated with markets.

Conclusion

Market declines are a natural part of investing. The Indian market has shown resilience in the face of numerous challenges and has consistently rebounded from market shocks. The factors mentioned above could provide a cushion for the market in case of a correction, giving investors confidence in the long-term prospects of the Indian stock market.

Next Story