Upstox Originals

Why are PSU stocks seeing a turnaround in performance?

.png)

7 min read | Updated on July 04, 2024, 15:03 IST

SUMMARY

The Nifty PSE index has delivered a CAGR return of ~50% since 2021, after underperformance for several years. In this article, we track this journey and analyse reasons for this shift in performance that has made PSU stocks investor favourites.

Since 2021, PSU stocks have delivered robust returns, after almost 6-7 years of consistent underperformance

Public sector undertakings (PSU) or public sector enterprises (PSE) are companies in which the government owns 51% or more of the share capital, or are JV between multiple PSEs.

The three charts below summarise the robust turnaround witnessed in PSE performance over the past decade.

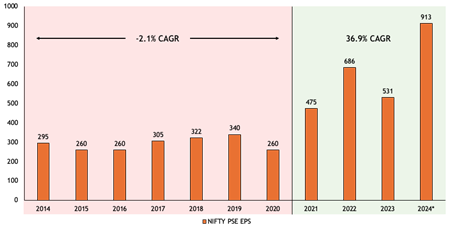

For more than the first half of the decade, PSE performance continued to disappoint investor expectations, delivering a flat to negative earnings CAGR, which has since then seen a remarkable turnaround.

Nifty PSE Index EPS (figures in ₹): 2014-2024

Source: Trendlyne Note: *EPS as on 10th June 2024

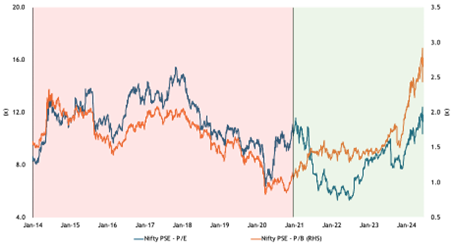

Improving performance has also bolstered investor confidence, which can be seen from the expanding valuations (supported by earnings) of these enterprises.

Nifty PSE Index valuation trend: 2014-2024

Source: NSE

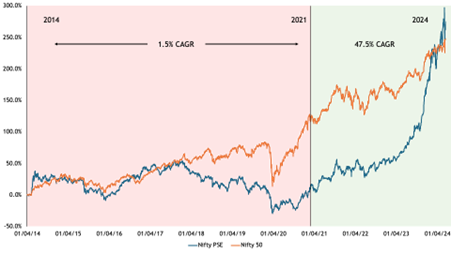

Improving earnings and expanding multiples have contributed to a robust market performance of these stocks. Since 2021, PSU stocks have delivered robust returns, after almost 6-7 years of consistent underperformance as seen in the chart below.

NIFTY PSE Index price performance versus the Nifty50: 2014-2024

Source: S&P CapIQ

Let’s take a look at what went wrong with PSUs and how that has changed since the pandemic.

What went wrong with PSUs in the past?

In this section, we list some of the key factors that contributed to this lacklustre performance between 2014-21:

-

Management churn: Between 2010 and 2020, PSUs underwent significant turnover in leadership. Notably, BSNL, ONGC, CONCOR, and PFC each experienced five changes in leadership, while COAL India saw six transitions. Additionally, BHEL, Air India, SAIL, and Oil India faced four leadership changes within the same period. These frequent changes in leadership had notable implications for the strategic direction and operational management of these PSU entities.

-

Delay in strategic divestment: For most of the period, the inability to divest companies like MTNL, BSNL, and Air India before competition reduced their value and continued to increase financial distress. For example, In 2017, Air India’s debt went from ₹5,000 crore to ₹50,000 crore in just 10 years, which played a part in reducing its value.

-

Lack of a clear strategy: Uncertainty over whether they would be revived or divested harmed their performance.

-

Financial strain from return of capital: Between FY16 and FY20, PSUs returned back close to ₹40,500 crore in form of share buybacks along with ₹2,04,000 crore in form of dividends during the period of FY15 and FY19. This hurt their ability to reinvest profits for their growth.

Taking note of this, measures were put in place to clean up balance sheets, improve governance standards, bring professional management and boost overall performance. Let’s look at how these measures helped:

Broad reasons why PSU stocks are the talk of the town

-

Strong financial performance: Many PSUs have reported strong financial results, with significant increases in revenue and profit. For example, RVNL & BEL reported significant increases in their financial metrics, driving investor confidence and stock prices higher. For example, BEL’s revenue and net profit went from ₹14,109 crore and ₹2,100 crore in FY21 to ₹20,268 crore and ₹3,985 crore in FY24 respectively (more than a 500bps increase in profit margin).

-

Improvement in PSU bank: A major part of the PSU recovery came from PSU banks. In 2015, RBI launched its Asset Quality Review (AQR), which has led to a sharp clean-up of bad loans. Besides this, bank amalgamation in 2020, robust recovery mechanisms, and banks’ decision to diversify their portfolios and mitigate risks along with regulations, have all bolstered asset quality. Read our detailed article here

-

Increased government spending: According to a Crisil report, government infrastructure spending will double to ₹143 lakh crore between fiscal years 2024-2030, compared to 2017-2023, with major focus on sectors such as defence, railway, renewable power, and highways. Read our detailed analysis of opportunities in defence and highways here and here.

-

Strategic collaborations and investments: Significant investments like Cochin Shipyard investing ₹2,800 crore in a new dry-dock and international ship-repair facility and collaborations like BEML & BEL partnering up to develop indigenous train control management systems.

-

Economic growth: The overall strength of the economy has also supported performance. As the economy improves, so does the performance of PSUs, especially key sectors such as banking, infrastructure, and defence.

-

Positive sentiment: The bullish sentiment in the stock market has helped PSU stocks rally, indices like BSE PSU and Nifty PSU Banks have seen significant gains, reflecting investor confidence in those sectors.

Finally, the table below lists the performance of some of the top-performing PSUs in the past decade. Similar to our analysis above, we have divided the table in two parts - showing the price performance in the time of poor performance and from 2021 onwards.

Investors should note that while the overall share price CAGR seems very impressive, most of the returns have come in the last few years.

Some of the top-performing PSU stocks in the last 10 years (2014-2024)

| Share price CAGR (%) | ||||

|---|---|---|---|---|

| Company | Sector | 2014-2021 | 2021-YTD | Overall |

| Mazagon Dock Shipbuilders | Shipbuilding | 40.0% | 155.4% | 85.3% |

| Rail Vikas Nigam (RVNL) | Railway Infrastructure | 22.5% | 136.1% | 79.9% |

| Indian Railway Finance Corporation (IRFC) | Railway Financing | -41.8% | 97.1% | 79.4% |

| Garden Reach Shipbuilders & Engineers | Shipbuilding | 28.9% | 100.7% | 60.6% |

| Indian Railway Catering & Tourism Corporation (IRCTC) | Railway | 38.2% | 42.7% | 48.4% |

| Fertilizers & Chemicals Travancore (FACT) | Fertilizer | 27.1% | 90.2% | 43.4% |

| Hindustan Aeronautics (HAL) | Defence | -2.9% | 114.3% | 42.8% |

| Bharat Dynamics | Defence | -4.7% | 106.6% | 39.1% |

| Ircon International (IRCON) | Infrastructure Engineering | 2.8% | 81.3% | 38% |

| Bharat Electronics (BEL) | Defence | 20.5% | 92.8% | 38.7% |

| Cochin Shipyard | Shipbuilding | -8.4% | 119.8% | 34.6% |

| Indian Telephone Industries (ITI) | Telecom | 32.7% | 37.8% | 34.2% |

| Bharat Earth Movers (BEML) | Defence | 24.3% | 56.3% | 33.1% |

| National Buildings Construction Corporation (NBCC) | Infrastructure | 24.3% | 47.8% | 31% |

| Hindustan Petroleum Corporation (HPCL) | Refineries | 19.9% | 30.4% | 22.9% |

| Satluj Jal Vidyut Nigam (SJVN) | Power | 2.7% | 72.3% | 20% |

| Rural Electrification Corporation (REC) | Power Financing | 2.4% | 73.6% | 20% |

| Power Finance Corporation (PFC) | Power Financing | 2.6% | 76.6% | 20.7% |

| Hindustan Zinc | Metal | 11.6% | 33.8% | 17.9% |

| Bharat Petroleum Corporation (BPCL) | Refineries | 16.6% | 12.3% | 15.3% |

Source: Cap IQ, Investing.com

Conclusion

PSUs play an important role in supporting the overall economy. Healthy PSU financials and performance are critical to overall economic growth. That said, investors should be on the lookout for any change in capital allocation policies, short-term decision making or increasing political interference which could impact performance.

Fundamentally, increasing valuations leave limited room for errors and need to be supported by strong underlying fundamentals.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story