Upstox Originals

What does inclusion in JP Morgan's Emerging Bond Index mean for Indian debt markets?

.png)

4 min read | Updated on July 09, 2024, 18:34 IST

SUMMARY

India’s inclusion in the JPMorgan Emerging Market (EM) Bond has already brought in ~$10 billion in inflows into the debt markets and is expected to bring in a lot more. In this article, we understand this event better and take it a step ahead to see the spillover effects of this inclusion.

In September 2023, JP Morgan confirmed that Indian government bonds would be included in its Global Emerging Market Bond Index, starting June 28, 2024. From 1% initially, India’s weight in the index will rise to 10% by March 25 (the highest it can be).

Understanding Bond Market Index

Like all indices, a bond index is the collection of specific types of bonds. The JP Morgan Emerging Market Global Diversified Index was launched in 1999 and manages assets of ~$213 billion. It invests in emerging market debt instruments issued by sovereign and quasi-sovereign entities.

Why does this matter?

Any investor/portfolio manager who tracks the JPMorgan Index will now mandatorily need to include Indian bonds in their portfolio.

What does this mean for flows into the market?

This should bring in FII flows upwards of ~$21 billion (10% of AUM) into the Indian bond market. Since the announcement, experts believe inflows to the tune of ~$10 billion have already come into the Indian debt markets.

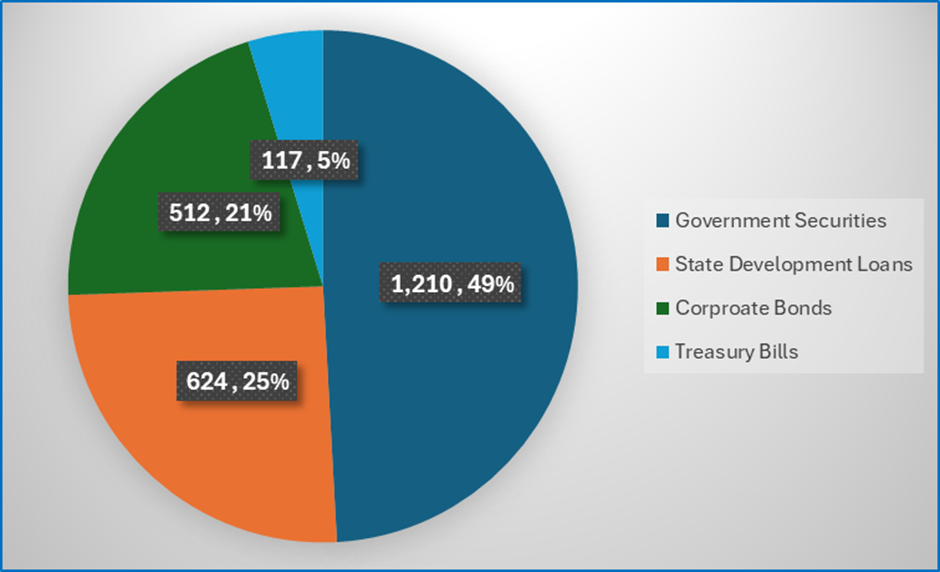

Size of the Indian bond market currently (in $ billion)*

Source: Bloomberg, Morgan Stanley; *rounded up approximate numbers

Don't FIIs already invest in Indian debt?

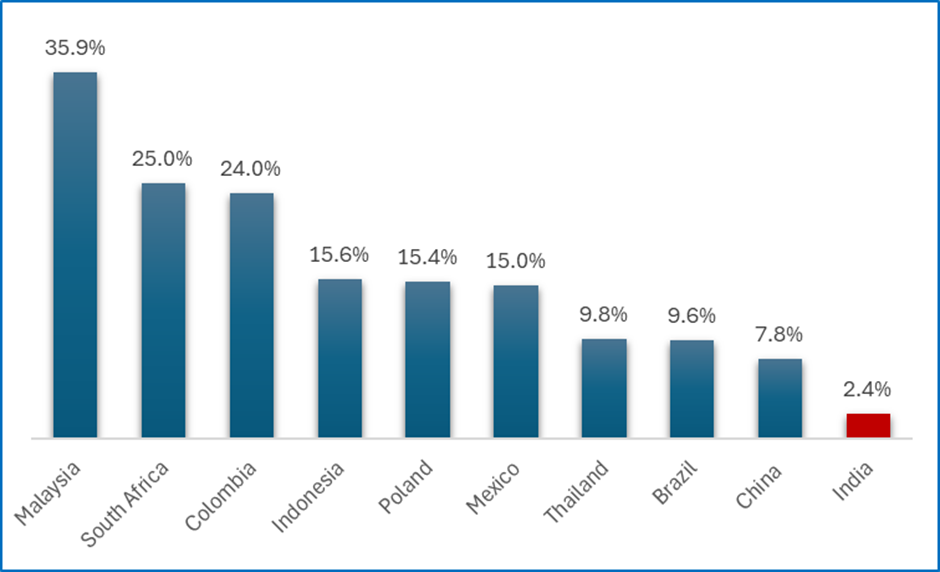

Yes, they do. That said, this index will bring more stable or passive money into the markets. Also, as shown in the chart below, India remains a significantly under-owned market. With this move, experts believe, Indian ownership could gradually rise to anywhere between 3.5-5%.

Foreign ownership of government bonds by country*

Source: Bloomberg, Morgan Stanley. *Data as of June 2024

Is there any direct implication on interest rates?

Theoretically speaking, higher demand should drive the interest rates down. That said, given the global scenario right now (heightened inflation, economic growth challenges, global skirmishes) as well as the gradual nature of the flows, a direct impact on interest rates is unlikely.

What are some other potential benefits of this?

We list below some key potential benefits of this move

- Lower cost of government borrowing: Currently, government bonds are majorly owned by banks, insurance companies, pension funds, and mutual funds. With increased flows and a new set of investors demand would increase and help keep interest rates, therefore borrowing costs under check

- Could lead to higher capital spend: If the cost of borrowing is under control, it would reduce the pressure of interest cost on the government. This could prompt spending on productive capital, which could benefit the overall economy.

- Could result in higher lending by banks: One of the major reasons for banks to hold government bonds, is RBI’s SLR norms. Simply put, banks are mandated to purchase government securities under the RBI’s Statutory Liquidity Ratio (SLR) norms. Increased ownership of these bonds could potentially act as a lever for RBI to lower the SLR requirements. This would effectively help banks lend more to other profitable ventures.

- Impact on stock markets: No direct impact is envisaged. That said, steady or even lower yields could help in corporate financing. Furthermore, higher flows, could help lower deficits, strengthen the currency, and could help bolster the overall economy.

- Impact on borrowing costs of organizations: With additional flows, overall borrowing costs for money flowing into the bonds markets, borrowing costs for the organizations are also expected to become more controlled

Finally, we would also like to mention that government bonds will also be included in the Bloomberg EM Local Currency Government Index. While good news for sure, this index is smaller than the JP Morgan index so the impact is expected to be lower.

Conclusion

India's inclusion in major global bond indexes is a huge step forward for the country and the markets. This can potentially open the door to huge foreign investments, potentially lowering borrowing costs, spurring capital flows, and leading to better fiscal management.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story