Upstox Originals

Tick-by-tick trading (TBT): Capture every market move

.png)

5 min read | Updated on September 27, 2024, 12:01 IST

SUMMARY

Tick-by-tick trading refers to a method where traders focus on the tiniest price movements (ticks), and make multiple trades to earn profits. This system requires advanced technology, low-latency data, and automated systems to execute trades quickly and effectively. Traders using this strategy monitor every price movement, trade volume, and order flow to capitalize on small price fluctuations. Read on to find out more.

Traders try to take advantage of smallest ticks to earn profits

A tick size refers to the minimum price movement of a stock or financial instrument in a market.

For example, if the tick size is ₹0.05, then the price of a stock can only move in increments of ₹0.05 that is from ₹100.00 to ₹100.05/₹100.10/₹100.15. Different asset classes, exchanges, and markets have varying tick sizes.

Tick trading, also known as tick-based trading (TBT), is a strategy where traders make money by taking advantage of the smallest price changes, called "ticks." These traders focus on very tiny price movements and make lots of quick trades throughout the day. The goal is to profit from these small price movements by making many trades in a short time.

How does a tick trading work?

Let’s take a very simplified example (without taxes, or transaction costs) to understand this better

| Scenario 1 | Scenario 2 | |

|---|---|---|

| Shares brought (#) | 50,00,000 | 2,50,00,000 |

| Share price (₹) | 100 | 100 |

| Total trade size | 50,00,00,000 | 2,50,00,00,000 |

| Tick size (₹) | 0.05 | 0.05 |

| Price increases by (₹) | 0.125 (2.5 ticks) | 0.125 (2.5 ticks) |

| Value of trade (₹) | 50,06,25,000 | 2,50,31,25,000 |

| Profit on trade (₹) | 6,25,000 | 31,25,000 |

To do this, traders use low-latency systems, meaning computer systems that react and make trades very quickly, in milliseconds or even microseconds. Continuous monitoring of market conditions through real-time tick data allows for adjustments in strategy.

Traders may modify their algorithms or manually intervene based on market changes. Advanced systems use machine learning or quantitative models to optimize trade timing and risk management.

Regulation of tick size in the stock market

In India, SEBI regulates the tick sizes, and has stipulated the following tick sizes:

- ₹1.00 for stocks with a market capitalization of more than ₹10,000 crores

- ₹0.50 for stocks with a market capitalization of ₹4,000 to ₹10,000 crores

- ₹0.05 for stocks with a market capitalization of less than ₹4,000 crores

From June 10th, 2024 NSE has implemented 1 paisa tick size for the stocks under the price of ₹250/share, it aims to improve price discovery in the market.

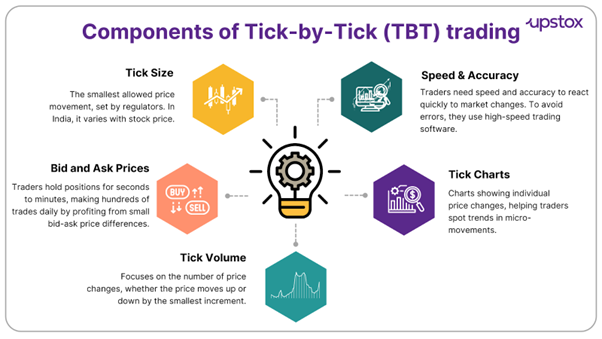

Components of tick trading

Who uses TBT data?

| User type | Who they are | How they use TBT data |

|---|---|---|

| High-Frequency Traders (HFTs) | These are professional trading firms that rely on algorithms to execute trades in milliseconds. | They operate at high speeds and use advanced technology for real-time market access. A small advantage in execution speed from TBT data can result in large profits due to the high trade volume due to low latency. |

| Day Traders and Scalpers | Scalpers focus on very small price changes and hold positions for just a few minutes or seconds. Day traders also execute multiple positions within the same day. Compared to scalpers, day traders can have larger time frames of 15 minutes, 1 hour and 4-hour, etc. | Both of them use TBT for better timing and precision in their trades |

| Arbitrageurs | Traders or firms who seek to profit from price discrepancies between different markets, exchanges, or assets. | They often execute trades simultaneously in multiple markets to exploit these inefficiencies. TBT data helps them track simultaneous price movements in multiple markets or assets. |

Tools and technology for TBT trading

To make effective decisions in the stock market, users need to process and utilize the TBT data provided by the regulators. To process the data, users need:

- Direct Market Access (DMA): To receive tick-by-tick data directly from exchanges.

- Low-Latency Servers and Networks: High-speed internet and data processing to ensure minimal delay.

- Advanced Trading Platforms: Software and proprietary systems to process and act on tick data in real time.

- Algorithmic Trading Systems: Automated systems that can execute trades based on predefined rules derived from tick data.

Impact of tick size on trader’s decision making

- Tick size can widen or narrow the bid-ask spread. A higher tick size widens the spread which results in reducing the liquidity, eventually increasing the cost of entering or exiting the stock.

- A larger tick size can reduce the number of potential trades available since prices move in larger increments, making scalping less viable. A smaller tick size provides more price levels to trade from, allowing HFT strategies to function more efficiently.

- With a large tick size, stop-loss orders can be less precise and traders may experience higher slippage when their orders are triggered at a less favorable price.

- A smaller tick size enhances price discovery by allowing more granular price movements, while a larger tick can lead to sticky prices.

Conclusion

To stay competitive, traders need to understand tick size is important for improving short-term trading strategies, managing risks, and making better trades. A smaller tick size increases liquidity and trading opportunities, which is useful for high-frequency traders and scalpers. On the other hand, larger tick sizes can make it harder to buy and sell quickly by widening the price difference between buyers and sellers.

To benefit from tick-by-tick trading, traders should invest in tools that help in direct market access for real-time trade execution. It’s also important to stay updated on any regulatory changes, as these can create new trading opportunities and improve price accuracy.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story