Upstox Originals

The risks of buy-and-hold: Why sticking with it might hurt your portfolio

.png)

4 min read | Updated on August 17, 2024, 10:29 IST

SUMMARY

Long-term investing is often equated with buy-and-hold. It can become dangerous if buy-and-hold becomes buy-and-forget. Why? In this article, we list three such case studies that have delivered meagre returns over long periods of time. These cases serve as a critical lesson for investors on the importance of diligent research, understanding market dynamics, and the risks of holding onto a stock without reassessing its growth potential.

Investors should regularly assess the validity of their investment thesis

The buy-and-hold strategy is a proven long-term strategy to earn steady returns. That said, there is an important caveat that a buy-and-hold strategy must not evolve into a buy-and-forget strategy.

That is, an investor should always take care to monitor their holdings and be informed about their developments continually even if the stock is a beloved, long-held one.

Why?

Let’s look at one of many such case studies: Intel Corporation

Intel's stock performance over the past 25 years reflects market reaction to negative events such as:

- Missed opportunities for a first-mover advantage in AI

- Manufacturing delays

- Increased competition

- Failure to capitalize on the mobile market

- Processor issues

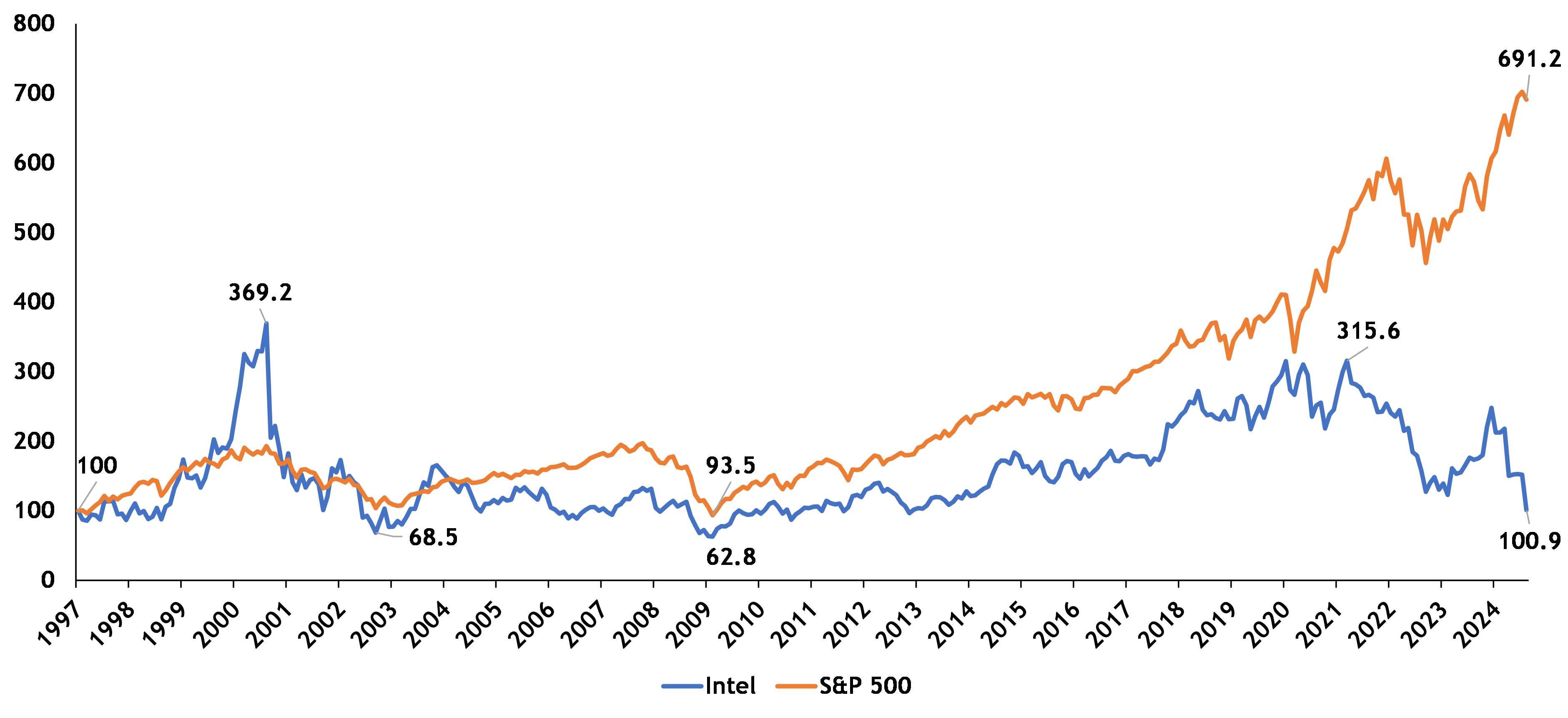

Intel’s indexed share price performance versus S&P 500*

Source: Investing.com, Cap IQ; *till August 2024

Source: Investing.com, Cap IQ; *till August 2024An investor with $100 invested in Intel at the start of 1997 would have made a measly 0.9% return in August 2024.

Conversely, if that same investor had considered S&P ETF as his choice of investment, their investment would have grown by almost 7x in the same period.

If you think this is just an outlier, here are a few more examples closer to home.

SpiceJet Ltd

Once an investor darling, SpiceJet’s fortunes have seen a significant reversal. Some of the reasons attributed to this are:

- Faulty top management hiring

- Repeated technical glitches

- Multiple flight delays/cancellations

- Delay in vendor payments

- Financial duress as a result of these factors, which further escalated troubles and kept hurting performance

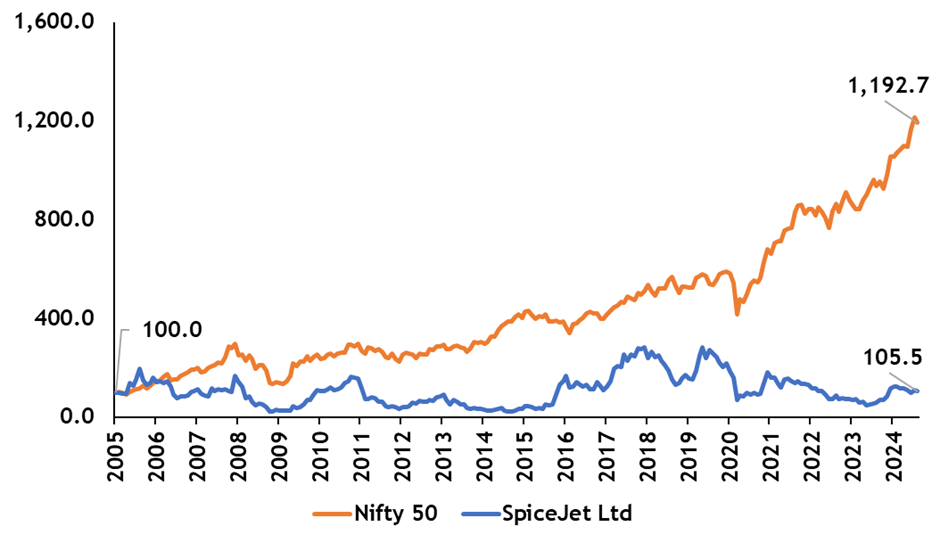

The result: While the Nifty 50 returned more than 1000%, the stock has returned only 5%, in absolute terms.

SpiceJet’s indexed share price performance versus Nifty 50*

Source: Investing.com; * till August 2024

Source: Investing.com; * till August 2024MTNL Ltd

Multiple reasons have weighed down on MTNl’s performance. Key among them were red tape and bureaucracy. For instance:

-

Restrictions were placed on the company’s ability to offer its GARUDA services

-

At the time of the 2008 spectrum sale, it was not allowed to participate

-

There are multiple examples of delay in appointment of core management team. For instance, for a period of nearly 2 years - from Jan'10 to Dec'11 - it functioned without a full-time Chairman

These eventually weighed on its performance, overall employee and team morale, customer perception, and service, which has led to this poor price performance.

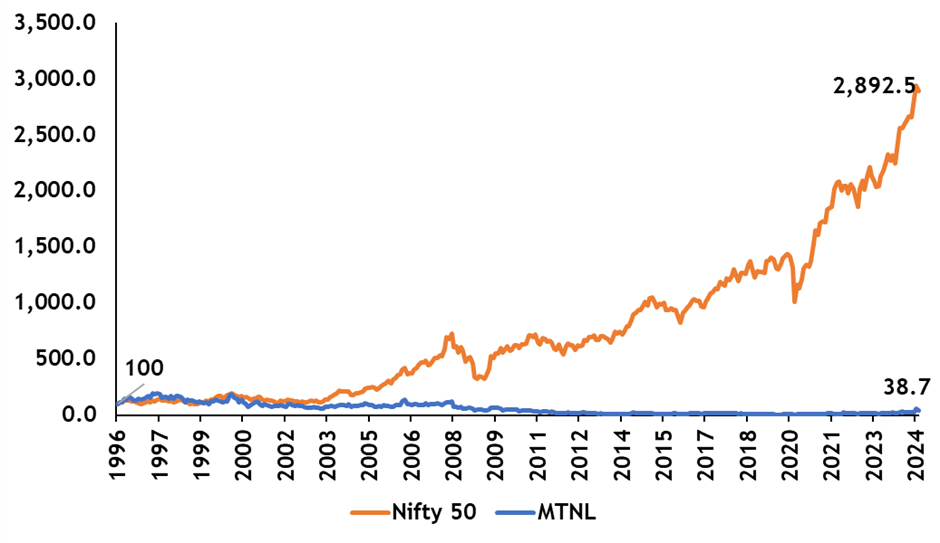

The result: While the NIfty 50 has returned more than 2500%, the stock has returned a negative 61%, in absolute terms.

MTNL’s indexed share price performance versus Nifty 50*

Source: Investing.com; * till August 2024

Takeaways for investors:

-

Active inactivity: Investors should master what is referred to as active inactivity. What it means is - actively monitoring the performance of your investments, especially long-term holds. An investor should go through annual/quarterly filings, investor presentations, conference calls, and others to ensure that business operations align with their original investment thesis. This is the active part of the equation. The inactive part - don't be trigger-happy to buy or sell stocks, simply because of price changes. Assess the validity of your investment thesis before making any trading decision.

-

Consider competitor moves: A long-term investor should always think about the threats a company’s competitors can bring to the table and be aware of the steps they are taking.

-

Be open to new, conflicting information: In an individual’s investor journey, they might have to change their original thesis about a company in light of the new information. This might also mean accepting negative information about the company such as wrong decisions the company management has taken, misallocation of capital, overlooking industry dynamics, etc.

-

Allocate to different sectors, diversify: Sometimes it is not an individual company or its competitor, but a sector as a whole that is going through a downturn, in such cases it would make better sense, returns-wise, to invest in other, higher returning sectors with better fundamentals.

-

Sometimes, you should sell: A key but often overlooked aspect of long-term investing is knowing when to sell. It's essential to maintain a disciplined approach, regularly reviewing the company's progress and updating your investment thesis. If the company's developments start to deviate from your original expectations, it might be time to reduce your holdings or even exit the position entirely. This proactive strategy can significantly benefit investors in the long run.

Next Story