Upstox Originals

Pockets of opportunities when markets are at an all-time high

.png)

4 min read | Updated on July 09, 2024, 09:44 IST

SUMMARY

Nifty has rallied almost 25% over the past year and markets are at an all-time high. Confused about where to find companies with reasonable valuations and decent fundamentals? Here is a curated list of stocks.

Retail investors driving force behind current bull run; 160m demat accord as of June 2024; robust inflow into MFs

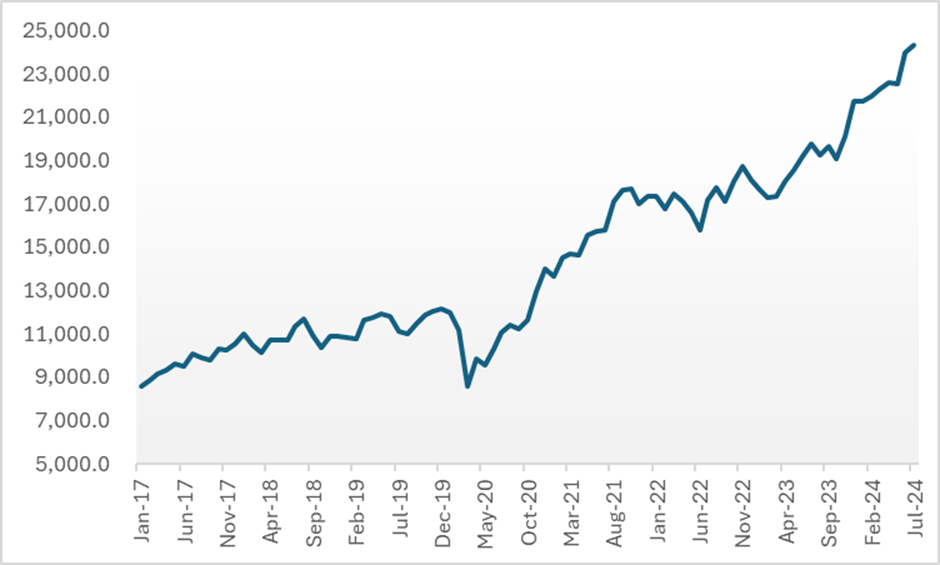

The Indian markets surged to an all-time high as seen in the chart below.

Nifty at all-time highs*

Source: Investing.com; *As of 5th July 2024

At such times, when share prices have rallied and valuations of most companies look stretched, investors are definitely going to be confused about where to find their next opportunity.

We have curated a list to get you started. From the top 500 stocks, we have filtered stocks that meet the following criteria:

- Underperformed Nifty in the last year

- Positive Free Cash Flow for the last 3 years

- Return on Equity (ROE) of more than 20%

Stock screener

| # | Name | Sector | ↓Market Cap (₹ Crore) | 1Y Return (%) | ROE (%)* | EBITDA Margin (%)* |

|---|---|---|---|---|---|---|

| 1 | Tata Consultancy Services | IT | 14,51,504.3 | 20.8 | 50.3 | 27.6 |

| 2 | HDFC Bank | Banks | 12,53,894.6 | -1.4 | 17.1 | 3.6 |

| 3 | Infosys | IT | 6,82,172.6 | 21.8 | 31.9 | 24.0 |

| 4 | ITC | FMCG | 5,41,399.9 | -8.8 | 28.3 | 37.4 |

| 5 | LTI Mindtree | IT | 1,60,570.8 | 3.3 | 25.0 | 17.6 |

| 6 | Abbott India | Pharmaceuticals | 59,122.9 | 19.7 | 31.6 | 24.9 |

| 7 | PI Industries | Chemicals | 57,468.7 | -1.7 | 18.5 | 26.3 |

| 8 | AU Small Finance Bank | Financials | 49,984.9 | -12.6 | 15.4 | 5.5 |

| 9 | Coforge | IT | 39,150.3 | 23.8 | 23.1 | 16.1 |

| 10 | Indraprastha Gas | Utility | 36,561.0 | 7.7 | 21.1 | 16.9 |

| 11 | CRISIL | Financials | 31,216.6 | 9.6 | 33.1 | 26.2 |

| 12 | CIE Automotive India | Auto | 23,222.7 | 15.3 | 20.3 | 15.1 |

| 13 | Kansai Nerolac Paints | Paints | 21,579.7 | -17.2 | 23.3 | 13.2 |

| 14 | Cyient | IT | 19,707.1 | 19.0 | 17.0 | 18.2 |

| 15 | IDFC | Financials | 19,407.8 | 6.1 | 41.4 | 68.4 |

| 16 | Fine Organic Industries | Chemicals | 16,380.7 | 10.5 | 49.4 | 24.6 |

| 17 | Indiamart Intermesh | Platform | 16,179.0 | -3.3 | 17.6 | 24.3 |

| 18 | Happiest Minds Technologies | IT | 12,346.4 | -17.1 | 21.4 | 20.7 |

| 19 | Cera Sanitaryware | Building Products | 11,906.5 | 19.2 | 18.8 | 15.7 |

| 20 | Happy Forgings | Auto Ancillary | 11,893.4 | 22.9 | 23.5 | 28.5 |

| 21 | Route Mobile | IT | 11,083.4 | 9.7 | 18.7 | 12.7 |

| 22 | Gujarat Narmada Valley Fertilizers & Chemicals | Fertilizer | 10,493.0 | 18.7 | 17.2 | 6.3 |

| 23 | Ujjivan Small Finance Bank | Banks | 8,665.6 | 10.7 | 26.1 | 9.1 |

| 24 | GMM Pfaudler | Capital Goods | 6,341.4 | -5.4 | 22.5 | 13.8 |

| 25 | Allcargo Logistics | Logistics | 6,335.0 | -7.9 | 18.9 | 4.7 |

Source: Screener.in, tickertape; *latest available financials. In the case of Banks, NBFCs - NIMs have been considered instead of EBITDA Margin

Why haven’t we included valuations?

The table above lists stocks across multiple sectors. As such, comparisons across sectors would be incorrect. Besides that, our goal was to list stocks that checked a few fundamental boxes.

Please note that even though these stocks have underperformed the Nifty in the past year – they could still be trading at steep valuations. As such, we would urge investors to consider all aspects. This list should serve as a good starting point.

Conclusion

Despite the current market levels, there are few pockets of opportunities that offer decent fundamentals and are available for reasonable valuations. Investors can use the above list to further analyse the companies as per their investing framework.

Next Story