Upstox Originals

From click to door, quick commerce is changing retail forever

.png)

6 min read | Updated on September 04, 2024, 17:46 IST

SUMMARY

A decade back who would have imagined that a single “store” would sell you everything from groceries to stationery to even medicine? And that it would be delivered to you in less than 15 mins. Today, it is part of our reality. Quick commerce has made life much more convenient. And on a lighter note, it has made people more lazy. This industry is projected to grow at a CAGR of 45.4% from ~$2 bn in 2022 to ~$40 bn in 2030. Let's dive deeper into this transformation.

Quick commerce has transformed the shopping experience

India's quick commerce market has experienced exponential growth, with the Gross Merchandise Value (GMV) increasing from $0.04 bn in FY19 to $2.3 bn in FY23, representing a CAGR of 175.4%. But, what is it that’s driving it?

| Reasons | Impact |

|---|---|

| High adoption | 60% of millennials prefer quick commerce, making it a must-have service. |

| Purchase patterns | Tailored experiences based on customer preferences drive repeat business. |

| Profitability | Average Order Value (AOV) increased by 14% YoY to ₹480 in 2023, boosting profitability. |

Source: News article

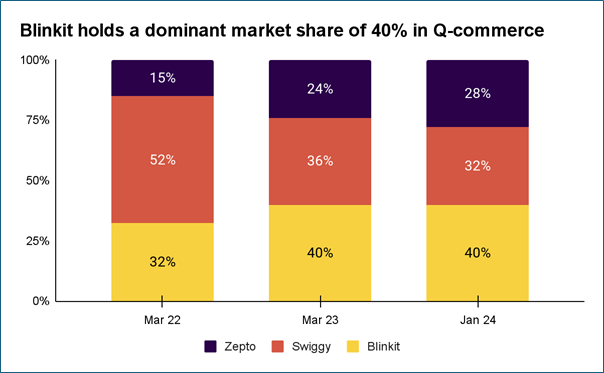

The big players: who’s leading the pack?

If you live in a city, chances are you've ordered from one of those quick delivery apps like Blinkit, Zepto, or Swiggy Instamart at least once. They're like your last-minute lifesavers!

Source: Statista, data as of March 2024

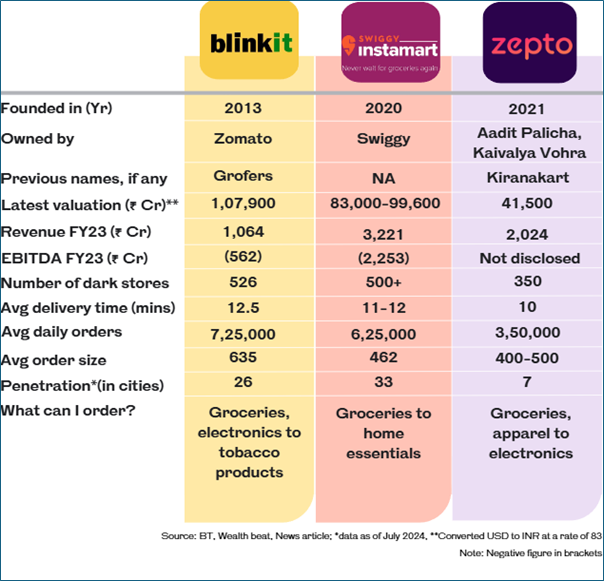

Head-to-Head: comparing the giants

Let’s take a closer look at how these players stack up against each other:

A little bit more about these players

Blinkit

Formerly known as Grofers, Blinkit rebranded in 2021 to emphasize its 10-minute delivery promise. Partnering with Zomato has supercharged its operations, particularly in technology and supply chain management.

The result? Some market experts now value Blinkit more than Zomato itself!

One interesting thing about Blinkit is its dynamic pricing. They use AI to adjust prices based on what's happening in real-time, like demand and what their competitors are charging.

Zepto

Zepto has made waves by setting up dark stores in busy areas and using the latest technology. They've even partnered with Yulu to use electric vehicles for deliveries, which is great for the environment.

They have a loyalty program, started on February 24, that rewards customers with free deliveries, and they use AI to predict demand and make sure they always have what you need in stock.

Instamart

Swiggy is leveraging its massive food delivery user base to integrate Instamart into its ecosystem. With perks like the 'Swiggy One' membership and partnerships with brands like Hamleys, Instamart offers more than just groceries like fitness products and electronics —it’s all about convenience and variety.

Additionally, they've got this technology to get the latest features and updates without having to download anything new.

Dark Stores: The secret sauce

What exactly are dark stores? These small warehouses, strategically placed in urban centers, are the backbone of quick commerce. Stocking between 6,000 to 10,000 SKUs (Stock Keeping Units), these stores serve customers within a 2 km radius, with inventory refreshed 2-3 times daily. And it doesn’t stop there—the inventory is set to expand to 10,000 to 12,000 SKUs soon.

So, you're probably wondering how these quick delivery apps make money, right?

Well, they charge a small delivery fee and also make money from selling products. Plus, they often partner with other brands for promotions and deals.

| Blinkit | Instamart | Zepto | |

|---|---|---|---|

| Business model | Marketplace | Dark store | Dark store |

| Revenue streams | Marketplace commissions, delivery fees, advertising, partnerships | Commission, delivery fees, advertising, partnerships | Commission, advertising, partnerships |

| Marketplace Commission charged* | 11-13% | 15-25% | Not available |

| Key USP | Ultra-fast delivery, wide product range, user-friendly app | Ultra-fast delivery, convenience, diverse offerings | Ultra-fast delivery, tech-driven operations |

Source: Startup Talky, The Strategy Store, IIDE; *Fee charged by online marketplaces to sellers for using their platform to list and sell products

Big names in E-Commerce dive in

The quick commerce game is heating up! Big players like Flipkart and BigBasket are now offering super-fast delivery services, just like the smaller startups. Flipkart's new service, Flipkart Minutes, delivers stuff in just 10-15 minutes, and BigBasket is also focusing on super-fast deliveries. It's like a race to see who can get your stuff to you the fastest. Amazon is also planning to get in on the action next year, with plans to get into the buzzing space of Q-commerce.

It's going to be interesting to see how this competition affects prices, the quality of service, and what products these companies offer. We might end up with even more convenience and choice when it comes to online shopping.

Swiggy eyes IPO

According to a recent report, Swiggy, the popular food delivery app, is valued at $11.5 bn.

The company has been doing really well, with soaring revenue—it recorded ₹ 7,474 cr in H1FY24. While its rival, Zomato, has also seen a big increase in value to $21.5 bn, Swiggy is still holding its own.

Challenges: Not all smooth sailing

-

Dark stores: These stores, typically carrying 6,000 to 10,000 SKUs, face the challenge of maintaining profitability due to low gross margins and high delivery costs.

-

Cost structure: Logistics, especially delivering things to your doorstep is expensive. Companies like Dunzo have even lost a lot of money trying to keep costs down, they spent ₹9 to earn ₹1 in FY23, leading to a net loss of ₹1,801 crore. They need to find ways to make deliveries more efficient.

-

City focus: Quick commerce is still largely an urban phenomenon, with demand concentrated in the top 25-30 cities. Smaller cities may struggle to support the economics of fresh grocery deliveries.

-

Sale of large appliances: Delivering big stuff like refrigerators and TVs is tricky. Electronics, which account for 40-50% of sales on major e-commerce platforms, represent a significant opportunity if quick commerce can overcome the challenges of reverse logistics.

-

Financial struggles: It's tough for grocery delivery apps to make a profit. They have a lot of expenses, like paying employees, paying vendors, and offering discounts to customers. Recently, Dunzo had to let go of 75% of its employees to meet its financial obligations. Unlike regular online shopping, quick commerce doesn't always get a boost from having lots of orders or selling expensive items. This is because they need to deliver things right away. Instead, each of their little warehouses (dark stores) has to make money on its own, and they need to focus on selling things that make them the most profit.

The future of grocery delivery apps in India looks bright!

Will quick commerce be a big deal in India? It looks like it's on its way to being a major player. With our busy cities and hectic lifestyles, people appreciate the idea of getting stuff delivered super fast. It all comes down to a few things: getting more people to order, selling stuff that makes them a profit, delivering orders quickly and efficiently, and giving customers reasons to buy more.

We can expect to see a lot more competition These apps are also going to start spreading to smaller cities and towns. As more people get smartphones and the internet, they'll want to try out this convenient service. Investors and businesses are excited, but it's up to these quick commerce companies to keep the momentum going and become a regular part of how people shop in India.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story