Upstox Originals

ESG investing: Rise of sustainable finance

.png)

5 min read | Updated on July 13, 2024, 20:26 IST

SUMMARY

Want to earn inflation-beating returns with relatively safer equity investments? Enter ESG investing. Read on to find out various avenues to invest responsibly.

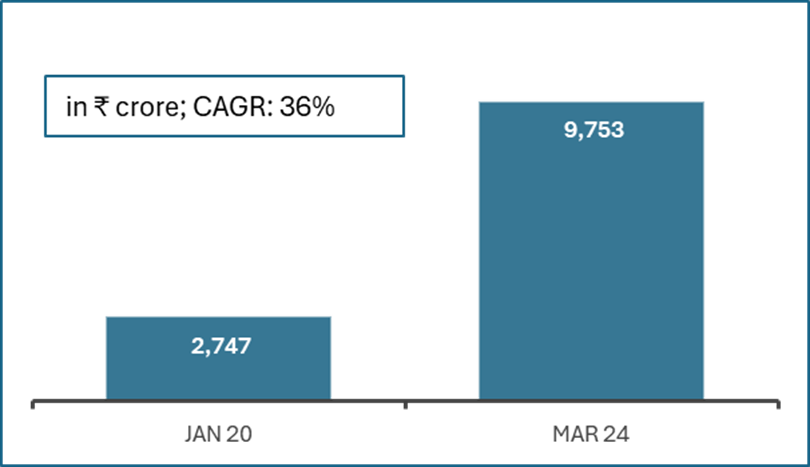

AUM of ESG funds has grown by a CAGR of 36% since 2020

ESG stands for Environmental, Social, and Governance. It represents a framework for companies to consider alongside financial performance. Assets of ESG-focused funds have seen a robust 36% CAGR since January 2020 to reach ₹9,753 crore by March 3, 2024. This growth is partially led by the SBI Magnum Equity ESG Fund, which holds ~₹5,500 crore in AUM.

Growth in ESG AUM in India

Source: IBEF

Besides this, a study by Avendus Capital forecasts that ESG could represent approximately 34% of the total domestic AUM by 2051 from less than 2% now.

Why are they becoming popular?

-

Regulatory push: SEBI has mandated that the top 1,000 listed companies disclose their ESG efforts, leading to better transparency and accountability.

-

Potential for competitive advantage: Companies prioritizing ESG are seen as less risky and better prepared for the long term, leading to more resilient business models.

-

Alignment with investor values: Investors increasingly prefer companies that align with their values.

How can investors participate?

- Individual Stock Picking: Look for companies that demonstrate strong environmental practices, positive social impact, and good corporate governance. Rating firms like MSCI and Morningstar assess companies' ESG efforts through unique frameworks.

List of select top-rated stocks

| Company Name | Sector | Stock Price 3-Year CAGR % | NIFTY 3-Year CAGR* % | Crisil rating** | Refinitiv rating** |

|---|---|---|---|---|---|

| Persistent Systems | IT | 44.8 | 7.3 | 74 | 77 |

| ICICI Bank | Bank | 21.7 | 14.8 | 68 | 77 |

| Zensar Technologies | IT | 20.8 | 7.3 | 69 | 67 |

| Eclerx Services | IT | 18.8 | 7.3 | 70 | 66 |

| HCL Technologies | IT | 18.8 | 7.3 | 72 | 78 |

| IDFC First Bank | Bank | 15.3 | 14.8 | 67 | 63 |

| Average | 23.4 | 9.8 | 70 | 71 |

Source: Crisil Esg, Refinitiv; *3-year CAGR for the Nifty Bank Index and the Nifty IT Index; **Lower the risk, the higher the ESG score on a scale of 100.

-

Mutual Funds: Invest in ESG-focused mutual funds offered by various fund houses. These funds curate portfolios prioritising companies with high ESG ratings, providing diversification and expert management—for example, SBI Magnum Equity ESG Fund.

-

Exchange-Traded Funds (ETFs): Consider ESG ETFs that track a basket of ESG-compliant stocks. These exchange-traded funds often exclude sectors like tobacco or weapons.

-

Index Funds: Invest in ESG index funds that track specific ESG indices, such as the Nifty 100 ESG Index or the S&P BSE 100 ESG Index.

Let's take a closer look at these funds

| Funds | Net AUM (₹ crore)* | 3 years CAGR return (%) | Scheme Benchmark (3Yr) % |

|---|---|---|---|

| SBI ESG Exclusionary Strategy Fund | 5,534.3 | 15.2 | 13.8 |

| Axis ESG Integration Strategy Fund | 1,338.1 | 12.3 | 13.8 |

| ICICI Prudential ESG Exclusionary Strategy Fund | 1,409.9 | 16.7 | 16.2 |

| Kotak ESG Exclusionary Strategy Fund | 988.8 | 16.3 | 16.2 |

| Aditya Birla Sun Life ESG Integration Strategy Fund | 666.4 | 13.7 | 16.2 |

| Invesco India ESG Integration Strategy Fund | 527.3 | 15.1 | 16.2 |

| Quant ESG Equity Fund | 266.1 | 31.4 | 15.4 |

| Mirae Asset Nifty 100 ESG Sector Leaders ETF | 105.6 | 12.5 | 13.3 |

| Quantum ESG Best In Class Strategy Fund –Direct Plan-Growth | 76.6 | 14.7 | 15.7 |

| Average | 1212.6 | 16.4 | 15.2 |

Source: Company website, *as per latest data available, **as on 3rd July 2024

Why consider participating?

Well, an investor can continue to earn inflation-beating returns from this investment avenue while simultaneously making a small difference. In response to this growing focus on ESG, SEBI has allowed mutual funds to introduce new categories under the ESG scheme, expanding investment options. These categories include exclusions, integration, best-in-class and positive screening, impact investing, and transition-related investments.

Key risks with ESG investing

- The lack of standardized reporting makes it challenging to accurately compare companies' ESG performance

- Companies may exaggerate or falsify their ESG credentials, undermining investor trust and the credibility of ESG investing as a whole

- ESG-focused investors may need to forgo investments in high-performing companies that don't meet standards. This will effectively lead to undervalued securities that are not ESG compliant and create a potential for high returns, attracting more investors.

Conclusion

Overall, ESG is gaining significant importance in India, driving businesses towards a more sustainable and equitable future. The stricter ESG framework in India empowers investors to make more informed decisions about the companies they invest in. By prioritizing sustainability and social responsibility, ESG investing can create long-term value for both investor portfolios and the environment and society as a whole.

Next Story