Market News

Trade Setup for Oct 15: NIFTY50 reclaims 50 DMA, all eyes on 25,250 for sustained momentum

.png)

5 min read | Updated on October 15, 2024, 07:29 IST

SUMMARY

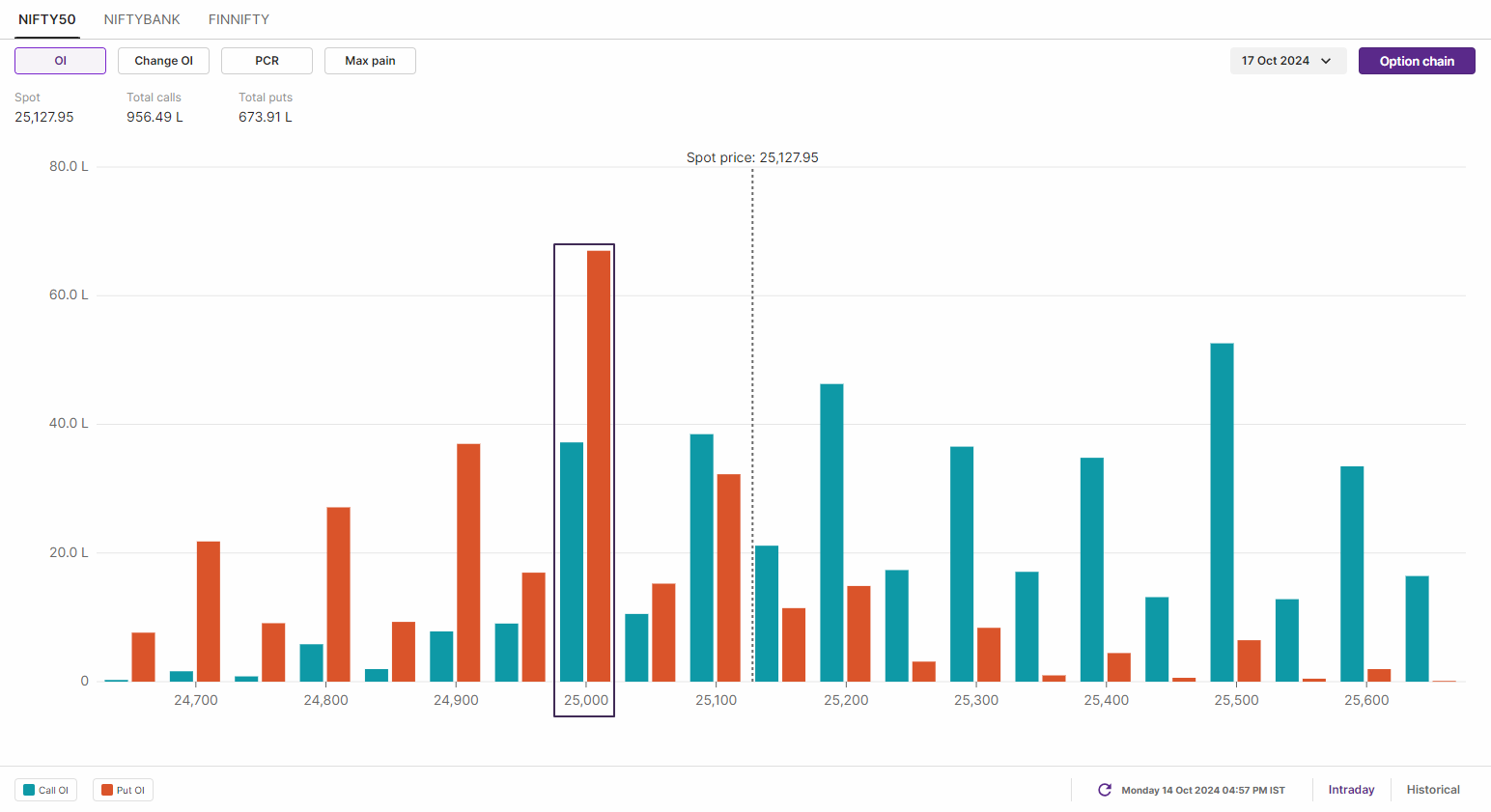

The NIFTY50 index saw a significant build-up of put options at 25,000 strike, indicating emergence fresh put writers around this level. The index has immediate support around 24,900 zone, while resistance remains around 25,250.

Stock list

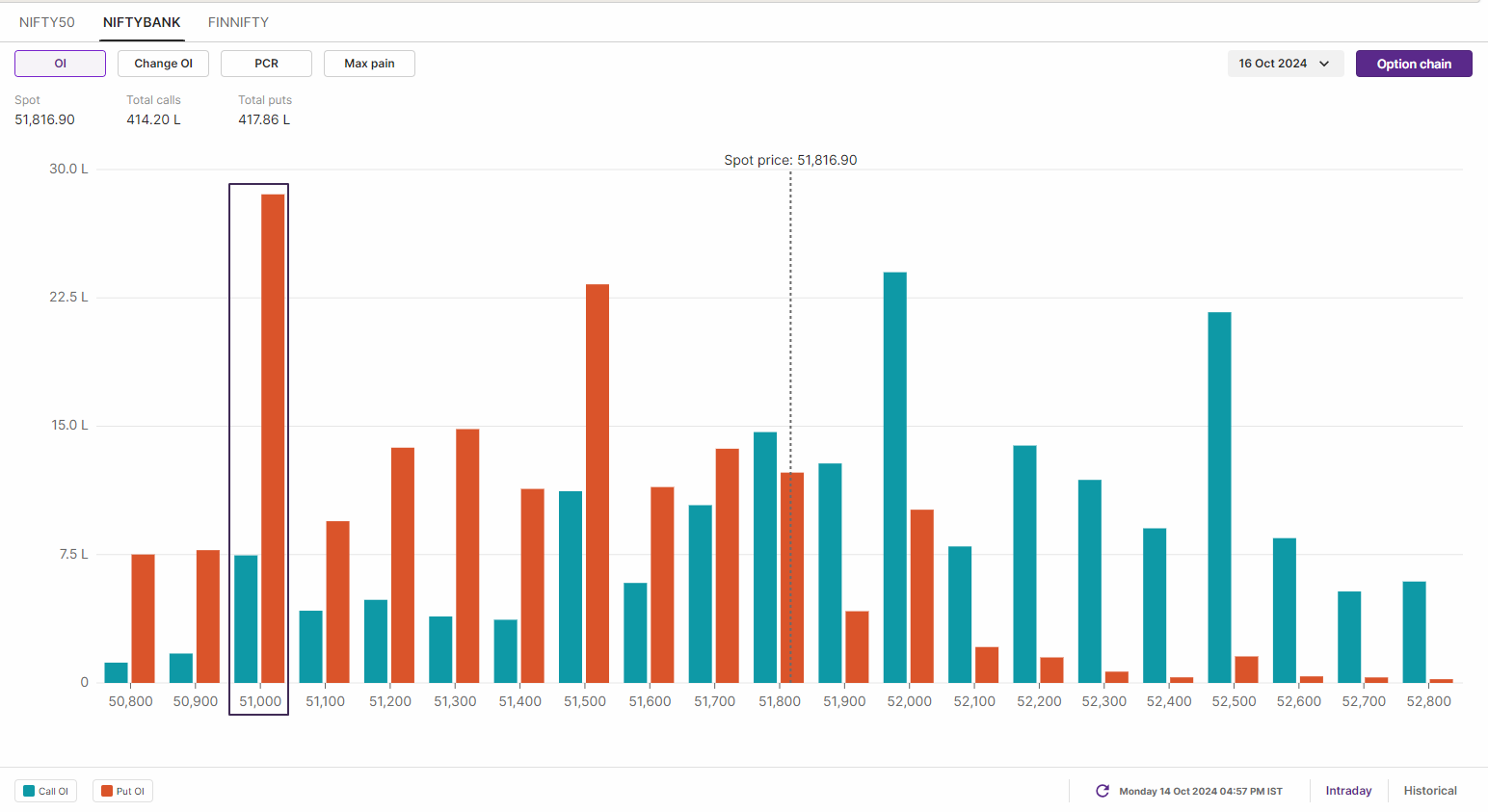

Open interest data for the October 16 expiry shows significant put writing at the 51,000 and 51,500 strikes, suggesting strong support for Bank NIFTY around these levels.

Asian markets update

The GIFT NIFTY is trading flat, pointing to a subdued start for the NIFTY50 today. Meanwhile, the other Asian indices are trading in the mixed territory. Japan’s Nikkei 225 is up 1%, while Hong Kong’ Hang Seng index is down 0.3%

U.S. market update

- Dow Jones: 43,065 (▲0.4%)

- S&P 500: 5,859 (▲0.7%)

- Nasdaq Composite: 18,502 (▲0.8%)

U.S. indices extended their winning streak for the second day in a row, with the Dow Jones and S&P 500 closing at fresh record highs. Technology stocks led the gains with chip giant Nvidia up almost 3%.

Third quarter earnings will be in focus today as Bank of America, Goldman Sachs and Citigroup report their results. Results from JP Morgan Chase and Wells Fargo kicked off the earnings season on a positive note, signalling the signs of a recovery in profits.

NIFTY50

- October Futures: 25,117 (▲0.7%)

- Open Interest: 5,39,790 (▼2.3%)

The NIFTY50 index moved out of three day consolidation and reclaimed its 50-day moving average, led by positive global cues and buying momentum in IT and private banks.

The index has formed a bullish candle on the daily chart, making a second attempt to close above the 7 October high. As shown in the chart below, the index is currently consolidating within the range of 7 October candle, broadly forming inside candles. If the index closes above 25,150 on the daily chart, it can make an attempt to retest its 20-day moving average. The immediate support for the index is around 24,900.

The open interest build-up for the 17 October expiry has seen significant additions of put options at the 25,000 and 25,100 levels. This suggests that the 25,000-24,900 area will act as immediate support. Conversely, the 25,000 call option saw significant unwinding, resulting in a sharp rally. The base of the call options shifted to the 25,500 and 25,200 strikes, indicating that the index may face resistance around these levels.

BANK NIFTY

- October Futures: 51,386 (▲1.3%)

- Open Interest: 1,93,633 (▼7.1%)

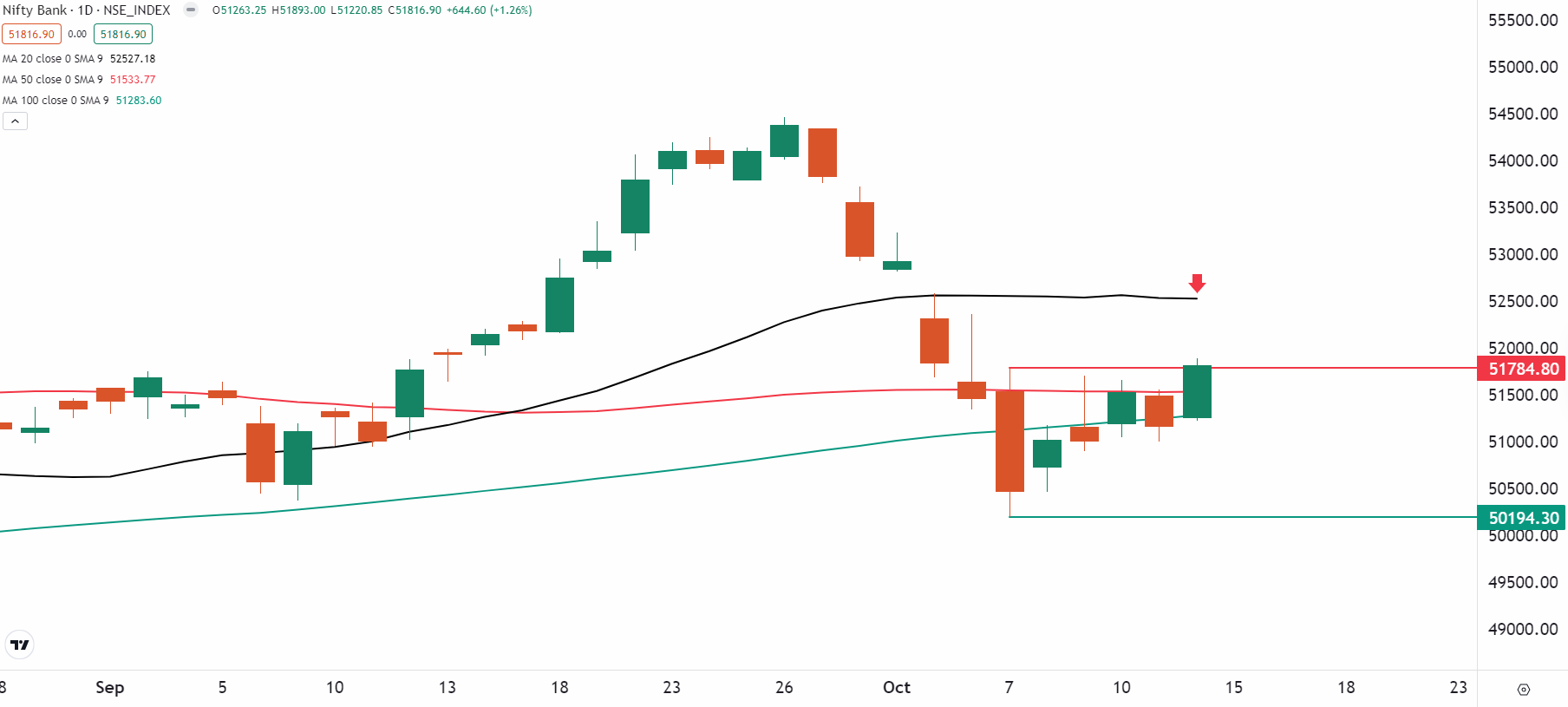

BANK NIFTY index outperformed versus the benchmark peers and closed the day with gains of over 1%, forming a bullish candle on the daily chart. The index also reclaimed the 50 and 100 day moving averages, signaling emergence of fresh buyers around 51,000 level.

In a sharp upmove in the first half of the session, the index zoomed past the immediate hurdle of 51,500 and closed above the 7 October high. As highlighted on the chart below, the index moved out of five day consolidation and may test its 20-day moving average (DMA) in the upcoming sessions. A close above the 20-day moving average (DMA) could shift the momentum in favour of buyers, signalling strength. However, a close below 51,000 could signal renewed weakness and further downward pressure.

Open interest data for the 16 October expiry shows significant put writing at the 51,000 and 51,500 strikes, suggesting strong support for the index around these levels. Meanwhile, the call option base has shifted to the 52,000 and 52,500 strikes after significant unwinding at the 51,500 strike, suggesting that these levels could act as immediate resistance for the index.

FII-DII activity

Stock scanner

Added under F&O ban: IEX, National Aluminium and Tata Chemicals

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

Next Story