Market News

NIFTY50 forms doji candle after subdued start, FMCG stocks shine

.png)

3 min read | Updated on July 08, 2024, 19:56 IST

SUMMARY

The NIFTY50 index traded within a range of nearly 100 points and consolidated at higher levels,forming an indecision candle. Meanwhile, the volatility index spiked over 7% to 13.6, signalling potential volatile sessions ahead.

NIFTY50 forms doji candle after subdued start, FMCG stocks shine

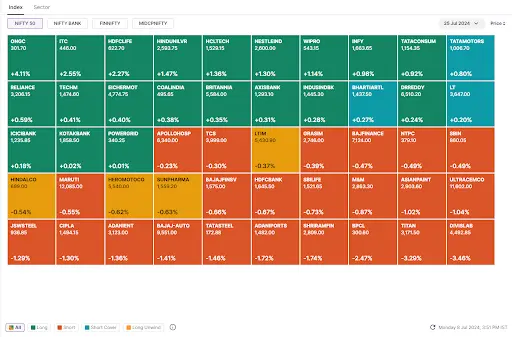

Markets started the week on a subdued note and traded in a narrow range throughout the day. In the absence of major triggers, both the NIFTY50 and SENSEX ended the session flat at 24,320 and 79,960 respectively.

Sector-wise, both FMCG (+1.6%) and Oil & Gas (+0.8%) indices extended the winning momentum and advanced the most. On the flip side, PSU Banks (-1.6%) and Metals (-0.9%) were the top losers.

The NIFTY50 index formed a doji candle on the daily chart, reflecting investor indecision and a pause at record high levels. The doji, a neutral candlestick pattern, shows the index opening and closing at nearly same levels, reflecting uncertainity.

Currently, the NIFTY50 index is consolidating between 24,000 and 24,400 zones. Within this range, the index may remain volatile. A break beyond this zone on a closing basis will provide further directional clues. Until then, the index is likely to osciallte within this range.

-

The broader markets extended their three-day winning streak to end the day lower. The NIFTY Midcap 100 index was down 0.3% and the Smallcap 100 index was down 0.1%.

-

Top gainer and loser in NIFTY Midcap 100: Paytm (+8.3%) and AU Small Finance Bank (-4.1%)

-

Top gainer and loser in NIFTY Smallcap 100: Great Eastern Shipping Company (+6.8%) and J&K Bank (-5.0%)

Key highlights of the day

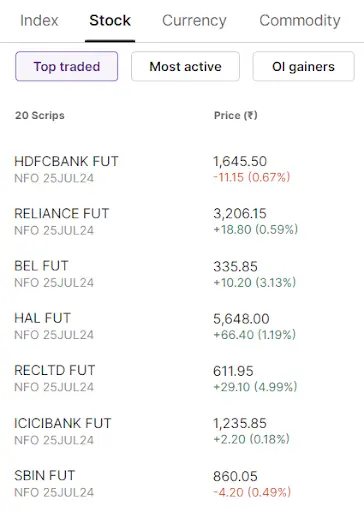

Top traded futures contracts

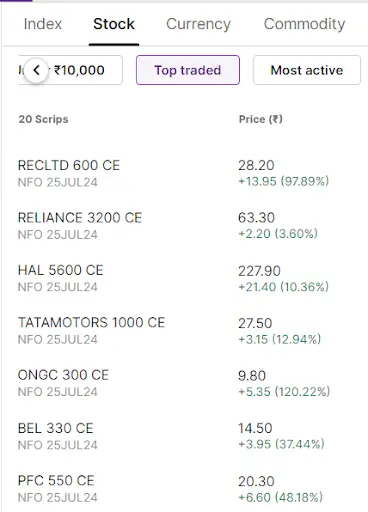

Top traded options contracts

4 trading insights from NIFTY 200🔍

📉Open=High(Bear power): Bank of Baroda, Oberoi Realty, Titan, Shriram Finance and JSW Steel

📈Open=Low(Bull power): Rail Vikas Nigam, One 97 Communications (Paytm), IRFC, Dabur and United Spirits

🏗️Fresh 52 week-high: Rail Vikas Nigam, IRFC, REC, Oil and Natural Gas Corporation and Bharat Heavy Electricals

⚠️Fresh 52 week-low: N/A

See you tomorrow!

Next Story