Market News

NIFTY50 breaks out of consolidation, IT stocks lead rally

.png)

2 min read | Updated on July 12, 2024, 19:12 IST

SUMMARY

The NIFTY50 and BANK NIFTY are giving mixed signals on the weekly chart. The NIFTY50 extended its positive momentum on a weekly basis, while the BANK NIFTY ended the week in red, forming an indecisive candle on the weekly chart.

Stock list

NIFTY50 breaks out of consolidation, IT stocks lead rally

Markets ended seven days of consolidation to close in positive territory on Friday, led by strong gains in the IT index. The NIFTY IT index soared over 5% on the back of better-than-expected results from bellwether Tata Consultancy Services.

Besides IT (+4.5%), Oil & Gas (+0.5%) and FMCG (+0.3%) sectors also pushed the index higher. The real estate (-1.5%), PSU banks (-0.5%) and auto (-0.4%) sectors were the main losers.

Despite negative cues from global markets, the NIFTY50 broke above the consolidation zone of 24,100 and 24,450. The index negated the early signs of a doji candlestick pattern on the weekly chart and closed above the previous week's high. This indicates a bullish trend continuation with immediate support at the 24,200 level.

-

Top gainer and loser in NIFTY50: Tata Consultancy Services (+6.5%) and Asian Paints (-1.0%)

-

Broader markets ended the day in green and closed marginally higher. The NIFTY Midcap 100 index closed the day flat, while Smallcap 100 index rose 0.1%.

-

Top gainer and loser in NIFTY Midcap 100: KPIT Technologies (+8.7%) and Macrotech Developers (-5.5%)

-

Top gainer and loser in NIFTY Smallcap 100: Zensar Technologies (+6.9%) and NLC India (-3.5%)

Key highlights of the day

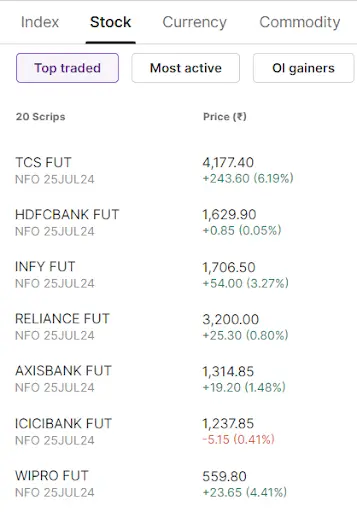

Top traded futures contracts

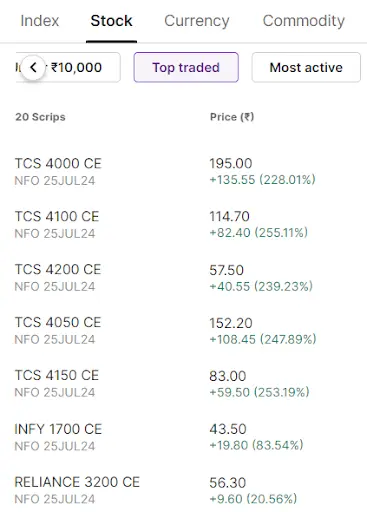

Top traded options contracts

4 trading insights from NIFTY 200🔍

📉Open=High (Bear power): Macrotech Developers (Lodha), Hindustan Petroleum, Punjab National Bank, DLF and Supreme Industries

📈Open=Low(Bull power): Shriram Finance, Axis Bank, Fsn E-Commerce Ventures (Nykaa) and Hindustan Unilever

🏗️Fresh 52 week-high: Oil India, KPIT Technologies, IRFC, Wipro and Persistent Systems

⚠️Fresh 52 week-low: N/A

See you on Monday!

About The Author

Next Story