Market News

Market highlights | NIFTY50 breaks above 50 DMA, eyes 25,200 for further upside

.png)

2 min read | Updated on October 14, 2024, 23:44 IST

SUMMARY

According to options data, there was a significant build-up of put options at the 25,000 strike for the NIFTY50 index, indicating strong support around this level. Conversely, call open interest was highest at the 25,500 strike, suggesting that the index may face resistance at this level.

Stock list

NIFTY50 breaks above 50 DMA, eyes 25,200 for further upside

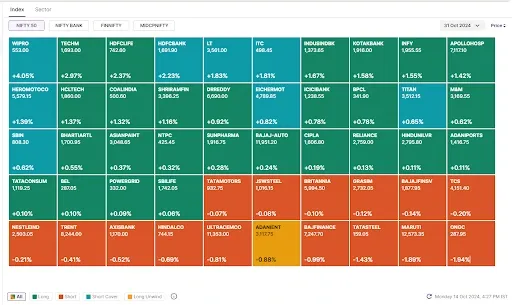

NIFTY50 index saw a strong upward movement on Monday, advancing 0.6%. After trading in a narrow range with a weak bias over the past few sessions, the index started the week on a positive note and formed a bullish candle on the daily chart.

Broad based buying was seen across sectors with Real-Estate (+1.6%) and IT (+1.2%) indices advancing the most. Metals (-0.2%) and Oil & Gas (-0.1%) were the only laggards.

The technical structure of the index remains range–bound as the index formed a bullish candle on the daily chart. The index is near the 25,200 resistance level, and a sustained move above this could trigger further gains toward 25,500–25,600. Immediate support is seen at 24,900.

-

Top gainer and loser in NIFTY50: Wipro (+4.2%) and ONGC (-2.0%)

-

Top gainer and loser in NIFTY Midcap 100: BSE (+7.1%) and Tata Chemicals (-7.1%)

-

Top gainer and loser in NIFTY Smallcap 100: CDSL (+7.1%) and IEX (-4.3%)

Key highlights of the day

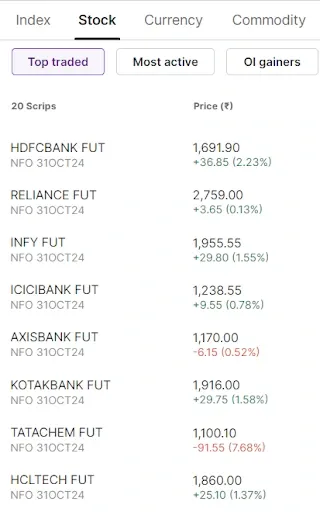

Top traded futures contracts

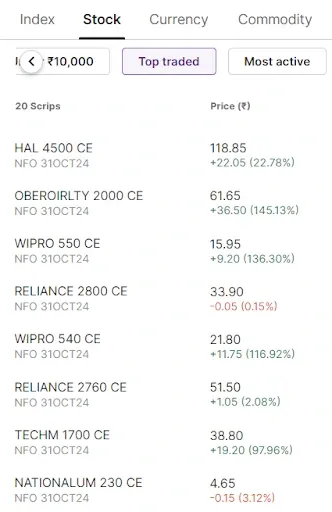

Top traded options contracts

4 trading insights from NIFTY 200🔍

📉Open=High (Bear power): Colgate Palmolive, Indraprastha Gas, Bajaj Holdings, Irb Infrastructure and Vodafone Idea

📈Open=Low (Bull power): Mphasis, Torrent Power, Tech Mahindra, Delhivery and IPCA Laboratories

🏗️Fresh 52 week-high: BSE, Oberoi Realty, Tech Mahindra, Persistent Systems and IPCA Laboratories

⚠️Fresh 52-week-low: N/A

See you tomorrow!

Next Story