F&O strategy: How to trade in Titan ahead of its Q4 results?

Upstox

3 min read • Updated: May 3, 2024, 1:43 PM

Summary

The Titan hit a new all-time high on 30 January 2024 and has since traded sideways, consolidating between 3,500 and 3,900. Before the earnings announcement, Titan trades between 50 and 200 DMAs and the options market implies a ±5.8% move.

Jewellery maker Titan is all set to announce its fourth quarter results today, with the results expected to be announced after market hours. For the fourth quarter, the company is expected to post an 11% jump in revenue to ₹11,000 crore, while the company's net profit is expected to grow by 11% to ₹800 crore.

In FY24, Titan achieved a return of 49%, significantly outperforming the NIFTY50 index, which rose by 28% over the same period.

Technical view

Titan hit a new all-time high on 30 January 2024 and since then the stock has been trading sideways, consolidating between 3,500 and 3,900. In addition, the stock recently closed below its key 50-day moving average and is currently trading between the 50 and 200 DMAs. Traders can keep a close eye on these important price levels as a close above or below these will provide further directional clues.

Options overview

The open interest data for the 30 May expiry shows a significant concentration of calls at the 3700 strike and puts at the 3400 strike. In addition, there was also a fresh accumulation of both calls and puts at the single 3600 strike.

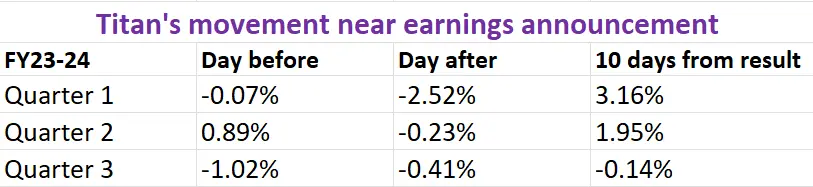

As of 2 May 2024, Titan's ATM strike price for 30 May expiry is at 3580, with both call and put options trading at ₹206. This indicates that traders are expecting a price movement of ±5.8% between now and 30 May. To better understand this expected price movement, we will review Titan's historical performance around its earnings releases over the last three quarters.

How to plan an options trade?

Given the implied move of ±5.8% from the options data, traders can initiate either a long or short volatility trade, taking into account the price movement. To trade based on volatility, a trader can take a Long or Short Straddle route.

Straddles are the options strategies that are primarily used on the basis of volatility. In simple terms, in a Long Straddle, a trader can buy an ATM call and put option of the same strike and expiry of Titan, looking for a move of more than ±5.8% on either side.

On the other hand, the Short Straddle capitalises on the fall in volatility. In a Short Straddle, a trader sells both ATM call and put option of the same strike and expiry. This strategy is deployed when the trader believes that the price of the Titan after the earnings announcement will be confined in a range of ±5.8%.

Interested to know more about straddles? Check out our UpLearn education content. If you want to see more historical earnings price data like in the table above for this stock, sign-up for our community, let us know, and we will share it!

Disclaimer

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for educational purposes. We do not recommend any particular stock, securities and strategies for trading. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.