Market News

Analysing the Adani Group - Market recovery and growth

.png)

6 min read | Updated on June 21, 2024, 15:32 IST

SUMMARY

The Adani Group stocks experienced significant volatility following the release of the Hindenburg report. However, with concerns now dispelled, these stocks have recovered to their pre-report levels.

Stock list

How Adani Group stocks bounced back after the Hindenburg saga

With NDA 3.0 back in action and policy continuation going forward as before, the government’s push towards infrastructure remains on track keeping the infra dominant in policy making. The aggressive inorganic growth strategies through mergers and acquisitions seem to work for the group as investors applaud the group's stock prices.

Overview of Adani Group

The Adani Group, founded by Gautam Adani in 1988, is a prominent Indian multinational conglomerate headquartered in Ahmedabad, Gujarat. Initially a commodity trading business, it has diversified into various sectors, including energy, resources, logistics, agribusiness, real estate, financial services, and defence. Notably, it operates India's largest private port, Mundra Port, and has significant investments in renewable energy, aiming to become the world's largest solar power producer. The Group is known for its rapid expansion and strategic acquisitions, making it a critical player in India's infrastructure and economic development.

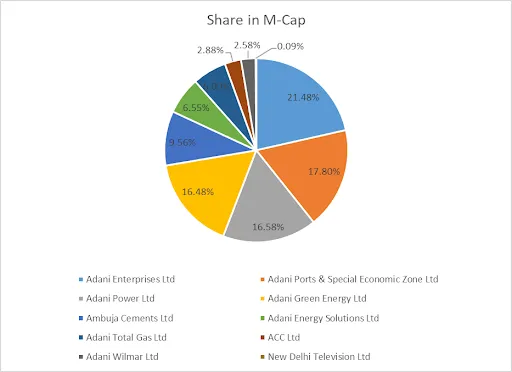

The Adani Group has over 10 listed companies with a total market cap as of June 14, 2024, at ₹17,34,999 lakh crore. Adani Enterprises is the largest valued stock of the group with a market cap of ₹3,72,666 lakh crore (21.48% of the entire group).

Top performing stocks of Adani Group

It also has a target to raise the thermal generation capacity to 21,110 MW by FY29, including 1,100 MW through an inorganic route. The YoY profits of FY24 have doubled compared to the corresponding year. The last 5 years compounded sales growth has been 16% for the company and the CAGR of stock price for the last 5 years has been 74%. The promoter has a large holding in stock at 71.75% showing faith in the future prospects.

Recently it has received all the environmental and coastal regulation zone clearances from the central government. This approval will allow the company to expand the capacity of its main port in Mundra to 514 million tonnes, involving an investment of ₹45,000 crore.

The profit of the company has grown steadily with a 50.32% YoY growth rate in consolidated net profit of FY24 from FY23. The company’s top line has increased 2.5 times from FY20 to FY24.

In April 2024, it became the first company in India to surpass 10,000 MW renewable energy capacity.

The profit of the company has shown a 29.50% YoY growth rate in FY24 against FY23.

The interesting part is that most of the growth has been inorganic, starting with the big-ticket $10.5 billion transaction to acquire Ambuja Cements and ACC. The most recent one is a complete buyout of Hyderabad-based Penna Cements for ₹10,420 crore, which comes with a capacity of 10 mtpa and another 4 mtpa that is under construction. This would total capacity of the company at 89 mtpa.

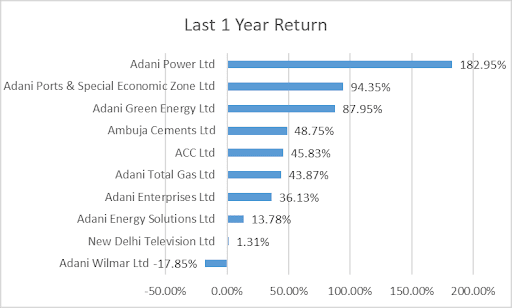

Adani Group stocks Promoter holding, last 1-year return and Market Cap as of June 14, 2024

| SCRIP | M-Cap | NSE Price on June 14,2024 | Promoter holding on 31st March 2024 | Last 1 Year Return |

|---|---|---|---|---|

| Adani Power Ltd | 2,87,728 | 746 | 71.75% | 182.95% |

| Adani Ports & Special Economic Zone Ltd | 3,08,835 | 1429.7 | 65.89% | 94.35% |

| Adani Green Energy Ltd | 2,85,918 | 1805 | 56.37% | 87.95% |

| Ambuja Cements Ltd | 1,65,916 | 673.6 | 66.74% | 48.75% |

| ACC Ltd | 49,989 | 2662 | 56.69% | 45.83% |

| Adani Total Gas Ltd | 1,04,042 | 946 | 74.80% | 43.87% |

| Adani Enterprises Ltd | 3,72,666 | 3269 | 72.61% | 36.13% |

| Adani Energy Solutions Ltd | 1,13,613 | 1018.5 | 73.22% | 13.78% |

| New Delhi Television Ltd | 1,518 | 235.45 | 69.71% | 1.31% |

| Adani Wilmar Ltd | 44,774 | 344.5 | 87.88% | -17.85% |

Below table provides FY 23 and FY 24 Consolidated Net Profit with YoY % change in Net profit and Promoter holdings

| SCRIP | FY23 NP | FY24 NP | YOY % Change in NP | YOY % change in Promoter holding |

|---|---|---|---|---|

| Adani Power Ltd | 10,727 | 20,829 | 94.17% | -3.22% |

| Adani Ports & Special Economic Zone Ltd | 5,391 | 8,104 | 50.32% | 4.86% |

| Ambuja Cements Ltd | 3,024 | 4,738 | 56.68% | 3.52% |

| ACC Ltd | 885 | 2,337 | 164.07% | 0.00% |

| Adani Enterprises Ltd | 2,422 | 3,335 | 37.70% | 3.38% |

| Adani Green Energy Ltd | 973 | 1,260 | 29.50% | -0.89% |

| Adani Total Gas Ltd | 546 | 668 | 22.34% | 0.00% |

| New Delhi Television Ltd | 53 | -21 | -139.62% | 0.00% |

| Adani Energy Solutions Ltd | 1,281 | 1,196 | -6.64% | 1.58% |

| Adani Wilmar Ltd | 582 | 148 | -74.57% | -0.06% |

The Adani Group has been a strong performer at D-street. The Group companies except NDTV engaged in the media sector, Adani Wilmar and Adani Energy Solutions all have great profitability rates on a YoY basis. ACC Ltd has reported the highest 164% YoY basis increase in consolidated profit in FY24.

The strong promoter interest in each company can be seen from the substantial holdings of promoters in each company. Adani Enterprises, Adani Port, Ambuja Cement and Adani Energy Solution have seen an increase in promoter stake from the quarter ended March 2023 to the quarter ended March 2024.

Next Story