Market News

Election dates are out: How will the 2024 Lok Sabha election impact the stock market?

4 min read | Updated on March 18, 2024, 18:34 IST

SUMMARY

Stock market investors consistently aim to anticipate the outcomes of major events like general elections and take strategic positions in the market in advance. After the election results, investors adjust their investments based on the outcome and the extent to which their expectations are met. In the event of surprises, they reassess the situation and realign their strategies based on the new reality.

Will 2024 Lok Sabha election impact stock markets?

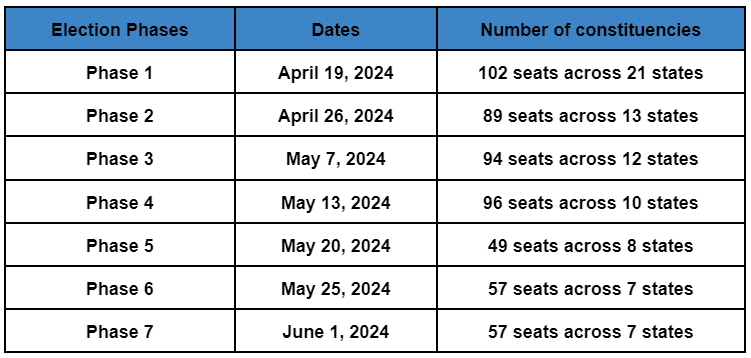

The 2024 Lok Sabha election will be held in seven phases starting from April 19. On Saturday, the Election Commission of India announced the much-awaited dates for the general election, with the first phase starting on April 19 and the last phase of the election being held on June 1. The vote counting will be done on June 4.

India will witness the world’s biggest election, with over 97 crore registered voters. To conduct this year’s Lok Sabha election, over 10 lakh polling booths will be set up, and 55 lakh electronic voting machines (EVMs) will be used.

Meanwhile, the stock market is geared up for this mega event, which could potentially impact investors sentiments.

So far in 2024, domestic stock markets are on a dream run, marching towards record highs as the broader economy continues to show signs of robust growth. The NIFTY50 has set a lifetime high of 22,526, while SENSEX set a high of 74,245 in March 2024. Both indices have given positive returns so far in this election year.

Why is the election year crucial for the stock market?

Stock market participants consistently aim to anticipate the outcomes of major events like general elections and take strategic positions in the market in advance. After the election results, investors adjust their investments based on the result and the extent to which their expectations are met. In the event of surprises, they reassess the situation and realign their strategies based on the new reality.

With that background, let’s deepdive how domestic stock markets performed in the last few general elections.

Market performance in the last four general elections?

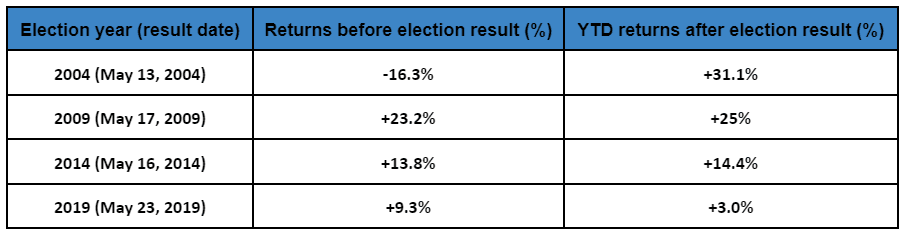

As the table below shows, the benchmark index NIFTY50 has given positive return post election results. The 2004 election was the only instance where the NIFTY50 ended negatively in the run-up to the election result.

The 2009 election year tops the chart in terms of returns given by the benchmark index. This outperformance can be attributed to recovery from the 2008 US financial crisis. After the result announcement, Indian markets experienced a boost for the remainder of the year due to substantial foreign capital inflows following the quantitative easing measures in the US.

The election year 2019 was most sluggish in terms of returns amid weak global and domestic economic growth. The US-China trade war and continuous rate hikes by the US Federal Reserve weigh on the market.

2024 Lok Sabha election to be major determinant of market and economic direction

In the run-up to this election year, markets are already trading around lifetime highs. A win for the existing government could ensure policy continuity. However, the size of the winning party in parliament is also crucial as this can influence the administration reform agenda.

The Indian economy has shown resilience in the post-pandemic era. In Q3 FY24, the economy expanded 8.4% year-on-year, the strongest growth since Q2 2022 on the back of growth in the service and manufacturing sectors.

The strong domestic growth has supported stock market growth as well. The addition of new demat accounts is at an all-time high. As of December 2023, total demat account holders crossed 13.93 crore, up 28.6% from a year ago.

Meanwhile, mutual fund total assets under management (AUM) have grown six times in ten years from ₹9.16 lakh crore to more than ₹54.5 lakh crore as of February 29, 2024.

Conclusion

Elections often lead to short-term volatility and uncertainty in the market. Nevertheless, as the election draws near, the market tends to stabilise, with the political picture becoming clearer for investors. By investing before the election, investors can position themselves to benefit from any positive market movement.

However, if the stock market plummets after the election, investors should examine long-term investing goals and avoid short-term market reactions.

About The Author

Next Story