Truth #2 - ‘Not Investing’ is Risky

Ever wondered what could happen if you don’t invest even a rupee?

You may think that by hoarding money or keeping it in a savings account, your money is safe. That you are avoiding any risk arising from market fluctuations. But the truth is that you are losing money, every single day. Here’s how that happens!

Why ‘Not Investing’ is Risky?

If you just keep your money in a savings account or under your mattress and do not invest it, you are exposing yourself to a different kind of risk. You risk your money losing its purchasing power.

What is purchasing power?

Purchasing power is the amount of goods and services that you can buy with a given amount of money. For example, if you have ₹100 today, you can buy a kilogram of apples for ₹80 and still have ₹20 left. But if the price of apples increases to ₹120 per kilogram next year, you will need ₹120 to buy the same amount of apples. Even if you had set aside ₹100, you would have to add money i.e., ₹20 to buy the same amount of apples. This means that your purchasing power has decreased. You can only afford a lesser amount of goods with the same amount of money.

What causes purchasing power to decrease?

The rate of increase in the prices of goods and services over time, known as inflation, is the primary reason for money losing its purchasing power.

For example, if the inflation rate is 5% per year, it means that on average, the prices of goods and services increases by 5% every year. What it also means is that the value of your money is reducing by 5% every year. So ₹100 today will be worth only ₹95 next year, ₹90.25 the year after that, and so on.

Inflation is inevitable in any economy because of various factors such as demand and supply, government policies, global events, etc. Have you noticed that the price of the cutting chai (half a cup of tea) in Mumbai has doubled in the past four years? That means you're now paying double the price for the same amount of tea!

In other words, the value of your money has halved in just four years

- that's inflation in action.

Imagine the same happening to your life's savings!

This is precisely what inflation does to your investments too.

When not invested wisely, your money loses its value over time, reducing purchasing power.

How does investing help preserve purchasing power?

Investing is the process of putting your money to work for you by buying assets that generate income or appreciate in value over time. If you invest right, you can preserve the purchasing power of your money by earning returns that are higher than the inflation rate.

For example, if you invest ₹100 in an asset that gives you a 10% return per year, you will have ₹110 next year, ₹121 the year after that, and so on. This means that your purchasing power will increase because you can buy more with the same amount of money.

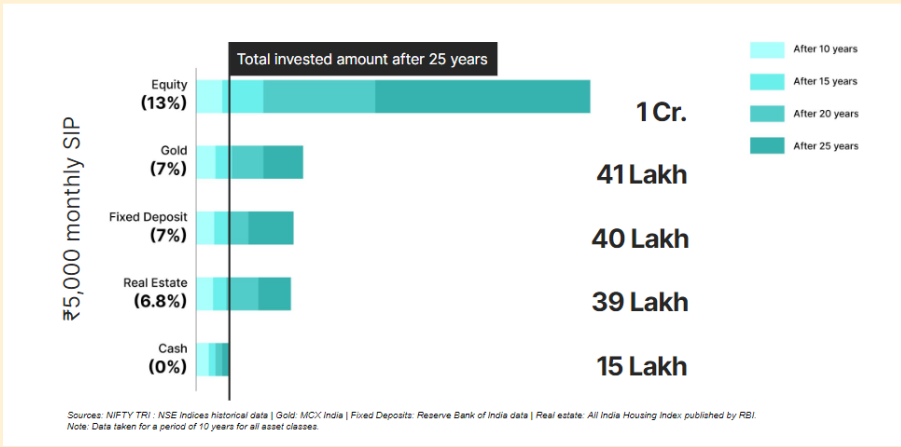

The key to successful investing is to choose assets that give higher-than-inflation returns and suit your risk profile, time horizon, and goals. Different assets have different characteristics such as volatility, liquidity, tax implications, etc. Here’s a comparison of returns given by various asset classes over a 25-year period.

As you can see in the above table, equity is the best performing asset class over a long duration. But like we saw in the First Truth of Investing, one has to be consistent with the investments and stay invested for a long time to benefit from compounding.

So, what happens if you don’t invest?

Your savings are like a car. If you park it in the garage and never use it, over time, it begins to rust, and its battery dies. Similarly, if you keep your money idle and don’t invest, it won’t grow. In fact, it loses purchasing power due to inflation

- like a car rusting in the garage.

Therefore, not investing is risky because it exposes you to the risk of losing your purchasing power and compromises your financial security.

Conclusion

The best way to overcome the risk of not investing? Start investing now. Invest regularly, and pick assets that give you returns that are higher than the inflation rate. Remember, investing is a disciplined and systematic process of creating wealth over time.