Trade Guide: Single leg option buying vs Option strategies

Trading single-leg options – calls or puts – is a common way to speculate on the future direction of an index or individual stock. When you purchase calls and puts, the upside for both of these single-leg strategies can be significant. Another benefit to trading single-leg strategies is that you have a fixed downside set at the price that you paid to purchase the option. A drawback is that the underlying security may have to move up or down a reasonable amount to offset the price to purchase the option. An alternative to higher-priced priced calls and puts is a vertical spread: a strategy that still involves purchasing a call or put combined with a short call or put.

By selling a corresponding option, while the margin blocked is higher than buying a naked option, the maximum loss that you can incur is reduced to the difference between the two premiums. In addition to this, you lower the break-even point and potentially become profitable sooner.

Let’s focus on a situation where you are bullish, or believe that the markets will go up. You can either buy a call option or as an alternative, enter into a bull call spread (vertical spread). Let’s walk through a quick example.

The Nifty is trading at 17,388 and you believe that it will continue to move upward over the next few days. You consider purchasing a call option with a strike price of 17,400. Based on the current prices, this strike with 8 days until expiration will cost you ₹184. Your break-even on this call option would be 17,584 (17400 + ₹184). So, from the current market price, the Nifty would need to rise by 1.1% before you start earning a profit.

Instead of just purchasing the 17,400 call option for ₹184, you could also sell a corresponding call option at a higher strike. If you sell the 17,600 strike, with the same 8 days until expiration, you will receive a premium of ₹95. Across the purchased call and sold call, it will cost you ₹89 for the transaction.

The break-even point for this strategy will be 17,489 (17400 + ₹89). From the current market price, the Nifty would need to rise by 0.6% to break-even. The drawback to the bull call spread is that your upside is capped. In this example, if the Nifty moves above 17,600, for the shorted strike, you don’t earn additional profit beyond the 17,600 mark. The most you can earn is the difference between the two strikes (17,600 – 17,400) less than the cost to enter the position (₹89). Therefore, your max profit is 111. This may not seem like a lot but let’s look at some historical data for perspective.

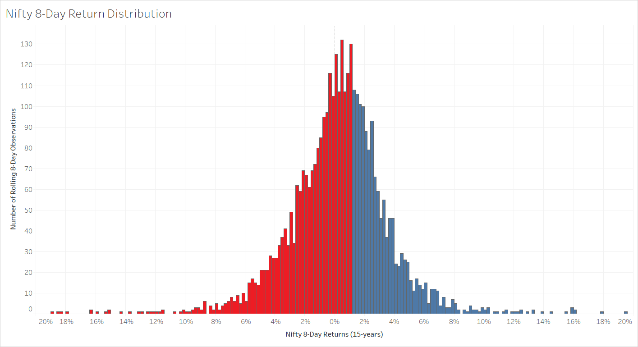

This is a chart of 8-day Nifty returns over the last 15 years. Using this data, we can see how often outcomes have happened historically. Looking at the long call trade, how often does the Nifty move more than the break-even return of 1.1% (market close-to-market close) over an 8-day period? Around 38% of the time. The blue in the chart below represents historical times when this occurred.

Now, how often does the Nifty move more than the break-even return of 0.6% for the Bull Call Spread? Around 47% of the time. Looking even further into this, how often does the Nifty move enough in order to obtain the max profit for the Bull Call Spread? The Nifty needs to move up from 17,388 to 17,600 for a gain of 1.2%. This has happened around 37% of the time in 8-days. While the simple, single-leg call option provides unlimited gains, the Bull Call Spreads offer increased likelihood of trade profitability. In some cases, like this example, the max gain of a bull call spread can be achieved with comparable market moves that would merely get a long call to break-even.

Unsure of how to get started with Bull Call Spreads (or Bear Put Spreads)? Try our new Ready-Made Option Strategies that simplify multi-leg strategies. https://upstox.com/option-strategies/