A long call is the most commonly used options trading strategy. It is deployed when the trader holds a strong bullish view on the underlying index or a stock. In this strategy, the trader expects an up move in the stock before the expiry of the contract.

What is a call option?

A call option is a derivative contract that gives an option buyer the right to buy the stock, bond, commodity, or any other asset at a predetermined price and date. By buying a call option contract, the trader expects an upward movement in the price.

What does going long in options mean? 🖼️ Going ‘long’ in case of the call options means that you, as a trader, expect the market price of a particular underlying asset to rise. In other words, you are bullish on that specific stock or an index. The term long is used in the context of buying an options contract. Similarly, a trader holding a bearish view will go long or buy the put option contract. |

How to deploy a long call option strategy

Let’s understand the long call strategy with the help of an example of the NIFTY 50 index.

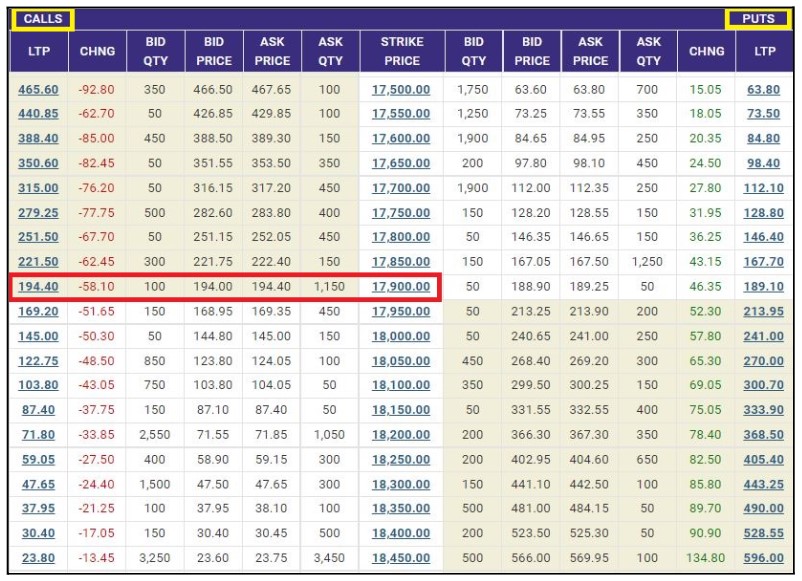

Mr. Alok, a trader, holds a bullish view on the NIFTY 50, which is currently trading at 17,885 as of September 15. He believes that the underlying will rise to the 18,100 mark (a move of 1.2%) from the current price before September 22. As per his view, he analyses the weekly contracts expiring on September 22 and buys a call option contract of 17,900 strike price at the premium of ₹194.

ITM: In-the-money👉The strikes which are below the current market price of the underlying. ATM: At-the-money 👉The strikes which are nearest or same as to the current market price of the underlying. OTM: Out of-the money 👉 The strikes which are above the current market price of the underlying. |

Breakeven point of the strategy

The breakeven point is the point where the strategy makes no profit or loss. In case of the long call strategy, one can calculate the breakeven point by adding the net premium paid to the selected strike price. For example:

Selected strike price: 17,900

Premium paid: ₹194

Breakeven point: 18,094 (17,900+194)

Selection of strike 📈

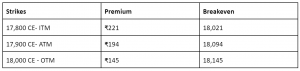

A trader can analyse and select the appropriate strikes by adjusting the net premium paid in a way that it brings the breakeven point closer to the underlying. Let’s analyse all the three ITM, ATM, and OTM strikes and understand the movement of the underlying from the selected strikes.

Nifty spot @17,885

As you can see from- the table above:

1. The ITM strike of 17,800 call option with the highest premium has the lowest breakeven point. It means that the Nifty 50 index has to move up by 0.7% (more than 136 points) from its current levels at or before expiry to cross the breakeven point.

2. The ATM strike of 17,900 call option with moderate premium has a breakeven point between the breakeven figures of ITM and OTM strikes. For the ATM strike to cross breakeven point, the Nifty 50 index has to move forward by 1.1% (more than 209 points) at or before the expiry.

3. The OTM strike of 18,000 call option with the lowest premium has the highest breakeven point. It means that if a trader selects this strike, then the Nifty 50 index has to move up by 1.4% (more than 260 points) to cross the breakeven point at or before expiry.

Based on the expectation of the movement, a trader can select the strike which keeps the breakeven point closest to the current market price of the underlying. In the example above, we have selected the ATM strike because the ITM options have higher premium and if the view goes wrong, the loss of the ITM option will be higher in comparison to the ATM strike.

Good to know

- If the Nifty 50 fails to make any move and closes at or below the strike price of 17,900- then the trader will face a loss. The trader will lose the entire premium as the option will expire worthless.

- Consider deploying a long-call strategy when the stock or an index breaks out of the consolidation zone or is expected to make a sharp move.

Maximum profit

In a long call strategy, the maximum profit a trader can make is potentially unlimited- considering that the underlying moves above the strike price before or at the contract's expiration. As you can see in the payoff graph below, once the NIFTY 50 index moves above the breakeven point, i.e. 18,094 (move of 1.1% from the 17,900 strike), the profit potential becomes unlimited.

Maximum loss

The maximum loss which a trader can incur in case of a long call strategy is the amount of premium paid. So, in case the NIFTY 50 index stays below the 17,900 call strike the strategy will make a loss. The option will expire worthless and the total loss will be ₹9,700 i.e the net premium paid (₹194* 50). It is important to note here that the lot size of a NIFTY 50 contract is 50.

Advantages of deploying a long call strategy

- The strategy is simple and easy to execute and only involves buying a single-leg option contract.

- Based on the view, once the strategy is deployed the profit for the strategy remains potentially unlimited.

- A gradual increase in implied volatility works in favour of the strategy. Meaning, if the implied volatility is expected to rise then the option price will gain the value.

- Since it is a net debit strategy, the risk of the trader remains limited. Meaning, if the price of the underlying declines and makes a sharp move against your view- the maximum loss will be capped to the net premium paid.

Disadvantages of deploying a long call

- Similar to all long option strategies, the time value (Theta) works against the long call option strategy as well. The options contract with a longer time to expiration will have higher exposure to time value. So, before initiating a long option trade always keep in mind that the long options have negative theta and short options have positive theta. This means, as time passes an option buyer will lose money due to erosion of time value and an option seller will gain money from erosion of time.

- A fall in implied volatility works against the option buyer. It means that once the implied volatility starts decreasing- the option premium starts losing the value and it starts working in favour of the option seller.

- Even though the risk in the long call strategy is limited, if the view goes wrong, the trader can lose the entire capital deployed. Hence, traders should follow strict risk-management practices and always trade the strategy with a stop loss.

We hope this strategy was simple and easy to understand. You can try spotting it on the option chain on Upstox and see if you are able to identify levels.

Want a pre-curated Long call strategy? Upstox has introduced Ready-made Option Strategies, a safer way to trade in NIFTY 50 and BANK NIFTY options. Click here to know more.