Noida Toll Bridge Stock Analysis

Noida Toll Bridge Stock Analysis*From the author:Noida Toll Bridge Company Limited (“ Noida Toll**” or the “** Company**”) operates as a road infrastructure company in India. The Company engages in the development, construction, operation, and maintenance of the Delhi Noida Toll Bridge (DND Flyway) under the build-own-operate-transfer (BOOT) basis.** For a financial report Noida Toll including its balance sheet, shareholding pattern and dividend history visit –* Noida Toll Financial Statements

**Disclaimer:The stock analysis presented below should not be taken as a buy/sell recommendation. The circumstances of the company and the economic environment may have changed since the date of this stock analysis.

What’s driving the Stock

Strong Dividend Stock

Noida Toll Bridge Company Limited (“Noida Toll Bridge” or the “Company”) has reported total sales of Rs. 107.63 Cr., EBITDA of Rs. 73.49 Cr. and Profit after Tax of Rs. Rs. 41.88 Cr. in March 2013. For nine months ended December 2013, the Company has reported total sales of Rs. 88.91 Cr., EBITDA of Rs. 64.76 and Profit after Tax of Rs. 38.62. In the same year, the Company declared a dividend of 10 % which at the current price of 21.35 (21 January 2014), translates into a dividend yield of 4.68 %. In future, once the Company becomes debt free, we believe that dividends will increase substantially or that the company will accumulate ample cash piles to invest in new ventures.

Substantial debt reduction

A major portion of the Company’s earnings have gone into debt repayment over the years. As a result, debt that stood at Rs. 358 Cr. in March 2005 has come down to Rs. 23.15 Cr. in March 2013. We expect the company to become debt-free in this financial year (i.e. FY 2013-14). This should translate into higher profits for the company in future.

Increase in Toll Revenue

There is an increasing trend in traffic/toll revenue. There has been a 15% growth in toll revenue from 77.39 Cr. in March 2012 to 88.83 Cr. in March 2013, attributable to both the increase in traffic as well as a 10% increase in tolls in November 2011. The average daily traffic on the DND has grown from 107,870 vehicles per day in FY 2010-11 to 114,721 vehicles per day in FY 2012-13, registering a 6% growth. In the long run, the traffic on the Delhi Noida Toll Bridge is expected to increase further given the trend in car sales in Delhi/Noida. The plans for improvement in the overall infrastructure in and around the NOIDA/Greater Noida region will also have a positive impact on traffic on the DND and in toll revenue.

Assured return of 20 % and/or land development rights

The Company had entered into a Concession Agreement with NOIDA in respect of the Noida Toll Bridge project to earn an assured return of 20% over the 30 years concession period commencing from 30 December 1998. The Concession Agreement provides the right to the Company to implement the project and recover the project cost, through the levy of fees/ toll revenue, with a designated rate of return i.e. 20% over the 30 years concession period commencing from 30 December 1998. As of 31 March 2013, the total amount outstanding in this regard amounts to Rs. 2,729.9 Cr.

In the event the Company has not recovered the total cost of the project and the designated return of 20% on the total project cost over the concession period of 30 years, the Concession Agreement further provides for an extension of concession period for two years at a time, till the total cost of the project together with the assured return of 20% on the total project cost is recovered by the Company.

The Concession Agreement also provides that in case of insufficient income from toll revenues to recover

- the total project cost + the designated return of 20% on the total project cost, the Company may be granted, at the discretion of NOIDA, land development rights to support any shortfall in revenues required to earn the assured returns of 20%.

Revenue from advertising expected to grow further

In addition to toll revenue, the Company generates significant advertising revenue from the bridge. Currently advertisements contribute over 14% of the Company’s total revenue. Advertisement revenue grew 9.30 % to Rs. 13.75 Cr. in March 2013, compared to Rs. 12.58 Cr. in the previous year.

The economic environment has a direct bearing on advertisement revenues. As the economy improves, the stream of advertising revenue for the company will improve with hoardings being put up along the bridge and from higher rates being charged for the existing space.

What’s Dragging the Stock

Competition from Delhi Metro

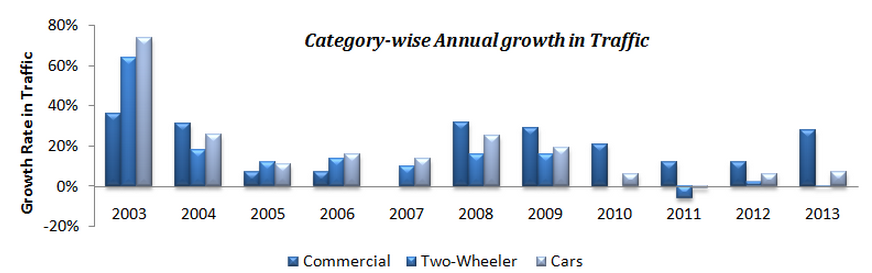

The Delhi Metro Rail Corporation (DMRC) commenced metro services in Noida from November 13, 2009. This line caters mainly to commuters travelling between Noida and central Delhi. The introduction of the Metro line, impacted DND traffic in FY 2010-11 with a drop in two wheeler use. A category-wise analysis of vehicular traffic shows that during 2010-11 two-wheeler traffic on the DND Flyway dipped by around 6%. Essentially, after the Metro line came into operation, a lot of two-wheeler based commuters have shifted to the Metro.

Changes in Government Policies

An increasing protest is being seen in different states of India against toll collection. The Noida Toll Bridge connects the State of Delhi and the State of Uttar Pradesh. There remains a possibility of nationalization of the infrastructure services provided by the Company. Nationalization of the infrastructure services provided by the Company could impact the financial health or operational performance of the Company. However, the exact impact of this cannot be determined on the basis of speculation.

Competition from other bridges

Noida Toll Bridge faces competition from two toll-free bridges that are situated nearby, Nizamuddin Bridge and Okhla Barrage which connect Delhi and Noida. Delhi Government’s consideration to extend the Barapullah Elevated Road across the Yamuna will also affect the number of commuters using DND and thereby will have an effect on toll revenues.

Rajat Sharma is the CEO at Sana Securities, an independent equity research and financial advisory firm in India. Views expressed here are of the author and Upstox Securities has not verified any facts stated above.