IDFC US Equity Fund of Fund (FoF) is an open-ended scheme investing in overseas mutual funds and exchange traded funds focusing on US equities.

| Good to know

What is a fund of fund? |

Investment objective

The aggressive vaccination drive, pent-up demand and large stimulus package are expected to drive the US economy in 2021 to its highest growth levels in the last four decades. IDFC US Equity FoF aims to benefit from these strong structural opportunities in the US markets as the country’s economy rebounds from the pandemic-led slowdown.

The fund will invest in the JP Morgan US Growth scheme, which has a well-tested and proven track record. It has assets under management of $1.88 billion and has delivered market-beating returns since its inception in 2000. The fund has invested in global companies across sectors—from finance to technology to industrial.

Hence, investing in JP Morgan US Growth Fund through IDFC US Equity FoF could improve a portfolio’s diversification and returns. For instance, a portfolio with 20% exposure to the US market and 80% exposure to the Indian markets has outperformed the Nifty50 index’s returns over the last five years. Also, the US markets have low correlation to the Indian markets. This means having access to the US markets will provide stability to investors when Indian markets are going through a downturn.

Click here to invest in this NFO

Asset allocation

| Instrument | Allocation (% of total assets) | Risk profile | |

| Minimum | Maximum | ||

| Units/shares of overseas mutual fund scheme (/s)/exchange traded fund (/s) investing in US equity securities | 95 | 100 | Very high |

| Debt securities, money market instruments, and/or units of debt and liquid schemes | 0 | 5 | Low to medium |

Scheme details

| Name | IDFC US Equity FoF |

| Type | An open-ended fund of fund scheme investing in units/shares of overseas mutual fund Schemes (/s) / exchange traded fund (/s) investing in US equity securities. |

| Category | Equity-Fund of Fund |

| Expense ratio | Up to 2.25% |

| Benchmark | Russell 1000 Growth Index |

| Load structure | Entry: Nil Exit: Before 12 months: 1% After 12 months: Nil |

| Fund manager |

|

| Options | Growth and income distribution-cum-capital withdrawal plan |

| Minimum application amount (during NFO) | ₹5,000 and in multiples of ₹1 thereafter |

| Additional application amount | ₹1,000 and in multiples of ₹1 thereafter |

Click here to invest in this NFO

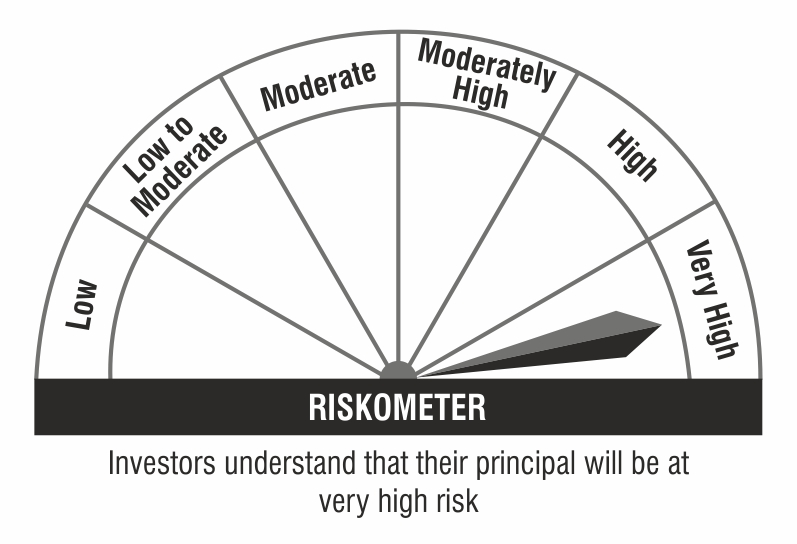

| This product is suitable for investors who are seeking*: | Riskometer |

|

|

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

Note: The above information has been sourced from the Scheme Information Document provided by IDFC Asset Management Limited. To read the entire document, click here.

Disclaimer

RKSV Securities India Private Limited (ARN/Distributor - 107930; brand name Upstox) is the distributor of the mutual fund. Please consult your investment advisor before investing.

Mutual fund investments are subject to market risks, read all scheme related documents carefully.