Margin against shares/Pledging/Collateral

What is Margin against shares (MAS)?

Clients can leverage shares in their demat accounts to obtain margin funding required to make trades. This margin can be used for taking intra-day and overnight positions. This facility is available for customers who hold shares in their demat account for long-term investments. The facility is called Margin Against Shares, (MAS) for short.

MAS (Margin against Shares) has been a huge success in the past and this has always encouraged traders to be able to place extra trades without having to add funds.

How can you avail this facility?

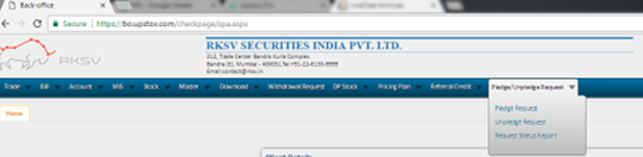

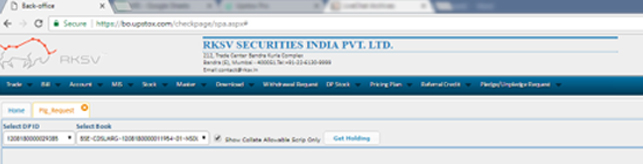

You can pledge your shares through your Back Office account. Just login with your UCC ID and password and track your shares. You can log into your Back Office and click on the option to Pledge/Unpledge requests and choose an option from the dropdown menu.

You can check your pledge request and also track your Profit and Loss.

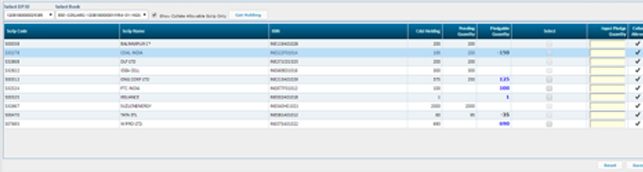

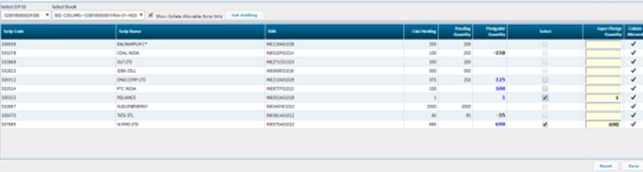

You can check your holdings and choose the ones that you want to pledge.

You can submit the shares that you want to pledge and click the SAVE option.

You can check the status of your request online.

Important points to note:

-

A 25% haircut will be applied while calculating collateral margin over holdings (10% for LIQUIDBEES). If you have questions regarding this, please ask our technical team.

-

Cash to collateral ratio will be maintained at 50:50. In layman's terms, this means that in order to trade with collateral margin, at least the equivalent amount in cash must be available in your account, failing which orders will be rejected.

-

This facility will be allowed on all instruments except Equity delivery and Options (buy side trades).

-

Rs.50/

-

per scrip will be charged toward placing a pledged or un-pledged request.

-

Click here to find the list of eligible securities which can be pledged.

-

Even if your holdings are pledged you are still entitled to enjoy corporate actions of bonus, stock splits etc.

How about we take an example to understand this?

Shyam Kumar, a customer of Upstox holds shares of three companies in his demat account:

-

Sun Pharmaceuticals Ind. Ltd

-

125 shares

-

Suzlon Energy Ltd

-

750 shares

-

Reliance Capital Ltd

-

95 shares

He wishes to pledge 100 shares of SunPharma which is trading at Rs.812.50 in order to take on a Futures position in NIFTY Futures. The value of his pledged request is:

(100*812.50) = Rs. 81,250

Once we receive his request it will be processed in the following manner.

Upstox will deduct 25% as haircut from the pledged value (25% of Rs. 81,250 = Rs.20,312.5). Therefore, the balance becomes Rs.60,938 (81,250.5

- 20312.5). This balance will become available to Shyam as collateral margin. This collateral margin will show under Collateral value in NEST (if you have any questions regarding this, please contact our customer support team at support@upstox.com).

Once margin is available, Shyam can place an order to buy two lots of NIFTY Futures which requires Rs.94,700. For this trade, as per the cash to the collateral ratio of 50:50, Rs.47,350 (50% of Rs. 94,700) will be used from free cash and the balance Rs.47,350 from collateral value. If by any chance, Shyam fails to maintain cash of Rs.47,350 in his account, then the order would be rejected.

So what are you waiting for? Shoot us an email request right away at support@upstox.com. Give yourself the power to trade without having to risk your cash. MAS is incredibly powerful. We suggest you try it out and see for yourself how you can benefit from this facility right away.

Feel free to call us at +91-6130-9999 and speaking to our customer service team if you have any question regarding this facility.

Cheers,

Upstox

Upstox