IPO Alert: Heranba IPO open from 23-25 February 2021

Key highlights

Price band: ₹626-627 per equity share

Lot size: 23 shares

IPO size: ₹625 crore

Cost per lot: ₹14,421

Issue opens: 23 February 2021

Issue closes: 25 February 2021

Basis of allotment date: 2 March 2021

Initiation of refunds: 3 March 2021

Credit of shares to Demat account: 4 March 2021

Expected listing date: 5 March 2021

Price band: ₹626-627 per equity share

Lot size: 23 shares

IPO size: ₹625 crore

Cost per lot: ₹14,421

Issue opens: 23 February 2021

Issue closes: 25 February 2021

Basis of allotment date: 2 March 2021

Initiation of refunds: 3 March 2021

Credit of shares to Demat account: 4 March 2021

Expected listing date: 5 March 2021

About the company

Before getting started with the IPO, let’s get two scientific terms out of the way. First, pyrethrins. These are naturally occurring insecticides derived from chrysanthemum flowers. Second, pyrethroids. These are chemicals that are similar to pyrethrins and are used to control pest insects in farms, homes, restaurants, hospitals and schools.

Before getting started with the IPO, let’s get two scientific terms out of the way. First, pyrethrins. These are naturally occurring insecticides derived from chrysanthemum flowers. Second, pyrethroids. These are chemicals that are similar to pyrethrins and are used to control pest insects in farms, homes, restaurants, hospitals and schools.

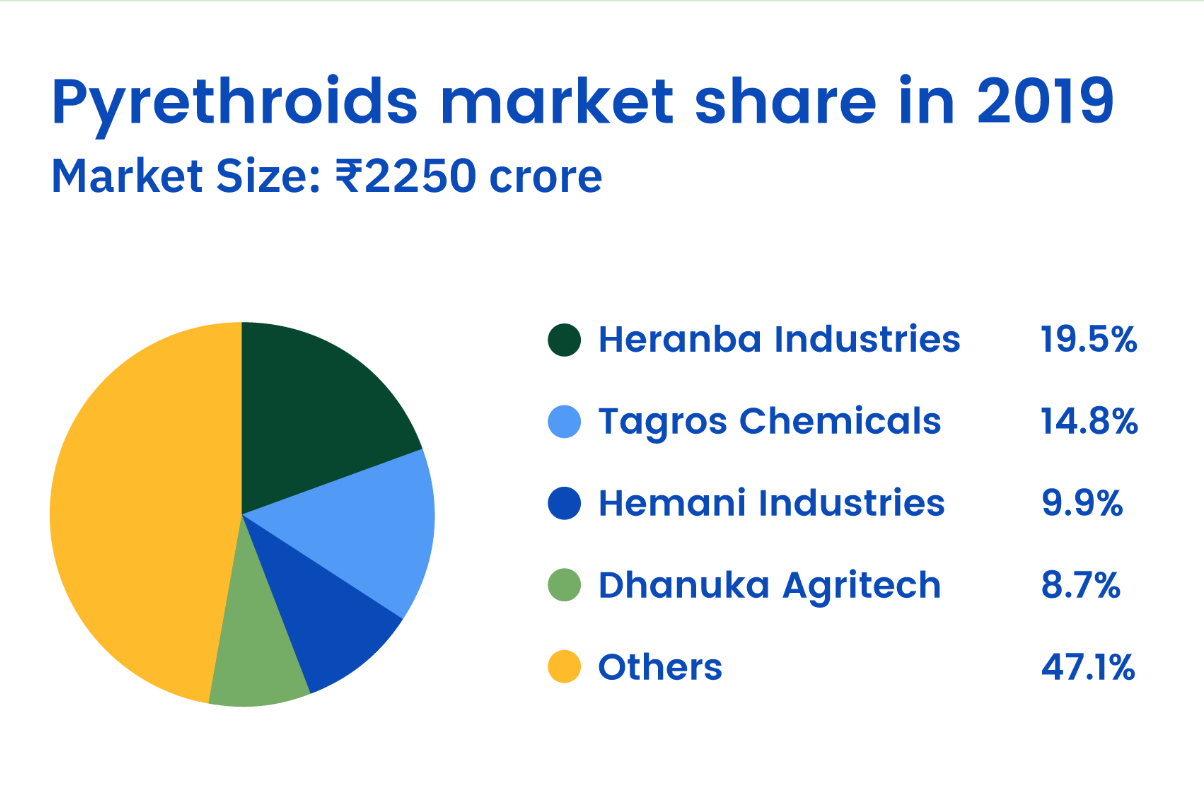

Now, 17,747 tonnes of pyrethroids was produced in India in 2019, and that volume grew at a CAGR of 7.2% during 2014-2019. For perspective, here’s a look at the market for these chemicals.

| | Market size | CAGR 2014-19 |

| --

| --

- | --

- | --

- |

| Domestic | $110 million (₹801 cr) | 7.4% |₹1,478 cr)% | 7.9% |

| Export | $203 million (

| Total | $313 million (~₹2,279 cr) | 7.7% |

That brings us to the next initial public offer of 2021: Heranba Industries. The company is a manufacturer, exporter and marketer of crop protection chemicals and is based in Vapi, Gujarat. It is one of the leading domestic producers of synthetic pyrethroids. Its product range includes insecticides, herbicides, fungicides and public health products for pest control.

The company started its manufacturing activity in 1996 with the production of chemical intermediates used to make pesticides. Today, it is present in the entire product value chain of the agrochemicals industry i.e. intermediates, technicals and formulations. The company exports its products to over 60 countries as of FY20, with over 35% of its exports going to China.

In 2019, the company was the market leader in the Indian pyrethroids market, with a market share of 19.5% of the total Indian pyrethroids production values. Second in line was Tagros Chemicals India Limited (14.8%), while Hemani Industries Limited (9.9%) was third.

The company has shown steady growth but saw a dip in FY20. Here’s a look at its financials.

| Financials | FY18 | FY19 | FY20 | H1, FY21 |

| --

| --

- | --

- | --

- | --

- | --

- |

| Revenue from operations (₹ cr) | 745 | 1,004.4 | 951.3 | 618.3 |

| Profit (₹ cr) | 46.8 | 75.4 | 97.7 | 66.3 |

About the issue

The IPO comprises a fresh issue of ₹60 crore and an offer for sale of 9,015,000 shares (₹565 crore), through which promoters Sadashiv Shetty and Raghuram Shetty are diluting their stake.

IPO allocation quota

| QIB | HNI | Retail |

| --

| --

- | --

- | --

- |

| 50% | 15% | 35% |