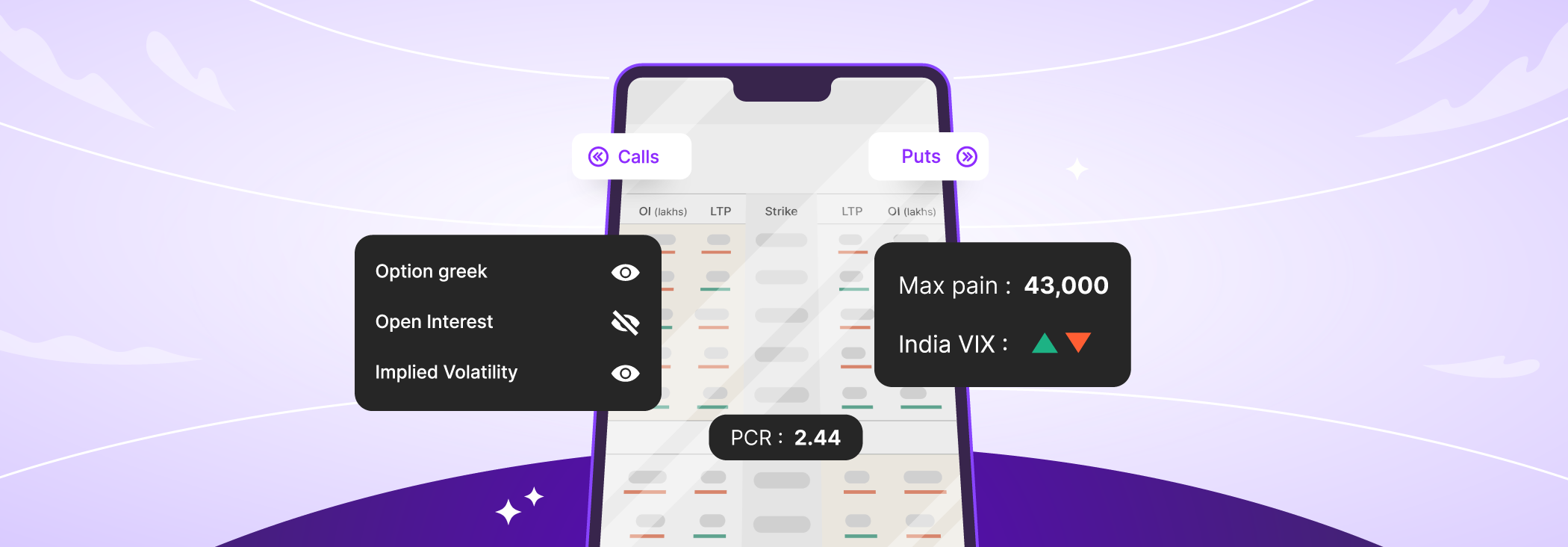

Imagine having access to all the information you need to trade options in one place. Yes, you read that right. Not just price and open interest, but you can combine the power of the four big Greeks - Delta, Theta, Gamma and Vega - on a single platform with our new option chain.

As you know, options trading is all about the intricate relationship between price movement, time decay and volatility. The option chain provides you with all this important time-sensitive data and insight, allowing you to make faster decisions without having to navigate through multiple tabs.

To better understand these intricacies, let's take a look at the four primary Greeks. ICYDK, in options, profit and loss are determined by three different sources. This means that in addition to direction (whether the stock is moving up or down), time and volatility also affect your potential profit or loss. In short, the price of an option is affected by all three, and traders use Greeks to measure and understand these factors. There are four primary Greeks that we will cover in this blog and they are Delta, Theta, Gamma and Vega.

Delta: It tells you how much is the quantum of increase or decrease you can expect in option premium when the price of the underlying stock increases or decreases. Understand the Delta from the analogy of a home loan. If the interest rate on your home loan were to increase, your EMIs would correspondingly go up. Similarly, if rates were to decrease, theoretically, your EMIs should also go down. In a nutshell, Delta is your option’s directional exposure.

Theta: The change in the option price over time is measured by the Greek Theta. It gives the trader an idea of how much the option will lose in value if held for more than one day. Think of this in terms of the expiration dates on the medicines. The expiration date on medicines tells us till how long the drug is safe for consumption to take. Similarly, in options, the Greek Theta takes the guesswork out of trading and tells you the potential losses and gains that will occur with the passage of time. It is important to note that theta decays at a faster rate closer to the expiry of the option contract and works in favour of an option seller.

Gamma: The rate of the change of the Delta with the change in the underlying is measured by the greek Gamma. In simple terms, the Gamma measures the speed by which your profit and loss is changing. Understand the gamma from the analogy of an accelerometer (the one which is next to your speedometer). Once you increase the speed of your car, the accelerometer in your car is measuring the rate of change of speed. Do note, that Gamma is highest for the contracts which are closer to the at-the-money strike.

Vega: To understand Vega, we first need to understand Implied Volatility. Implied volatility is the volatility implied by the options market. Any increase in implied volatility will lead to an increase in the option price. Conversely, any decrease in implied volatility will result in a decrease in the option price. The magnitude of the increase or decrease is Vega. Thus, Vega gives us an idea of how much the price of the option will change based on the change in implied volatility. Traders can use Vega and buy options when they expect the volatility of the underlying to increase. Conversely, option sellers can take advantage of decreasing volatility.

In conclusion, a thorough understanding of the Greeks is essential for traders to effectively manage risk and improve profitability. By combining the insights of the Greeks with the option chain, traders can now develop customised strategies and make informed decisions in the options space. So why wait? Join us today and unlock the potential of the option chain to take your options trading to new heights.