What Did Harshad Mehta Do? The 5,000 Crore Scam

Who Is Harshad Mehta

- The 5,000 crore Rupee Scam

I’ve been in touch with the stock market for a while now, and I realize that there are only two people that pop in the minds of people who associate the market with – Rakesh Jhunjhunwalla and Harshad Mehta. Both are opposite sides of the coin in reputation, the former is a respected investor & the latter regarded as a scammer. However very few of us know exactly what Harshad Mehta did, including me –

So I dove into all the information the internet could provide me and even so a movie based on the times of Harshad Mehta called ‘Gafla’ - http://www.youtube.com/watch?v=VdoIivwA6xY (I do not own the copyrights).

I’m sure what was seen in the movie was largely based on accepted truths and drama that ensued, so take everything you read about it with a grain of salt, for who knew what exactly transpired?

Perhaps, in the long run, being the optimist SEBI’s & the RBI were able to make the securities market a safer and regulated place than it was before.

Perhaps, in the long run, being the optimist SEBI’s & the RBI were able to make the securities market a safer and regulated place than it was before.

Early Beginnings!

Harshad Mehta, born in a Gujarati family was as plain and ordinary as they come. He was a commerce graduate and soon became a stockbroker in the Bombay Stock Exchange.

What Actually Happened! The rise of the ‘Big Bull’

I believe the entire debacle was the fact that he capitalized a loophole in the banking system rather than a securities scam. Of course, securities were allegedly manipulated but the seed of the matter seemed to be the fact that Harshad Mehta was able to raise crores of rupees through a loophole in the banking system and then trade stocks using that money. Talk about owning a mint?

He used bank receipts as collateral and used that muscle to buy stocks, in one case he pushed the price from Rs 200 to Rs 9,000.

Total scam amounted to USD 850 million, that is slightly under a Billion dollars, in 2012 Rupees inflation adjusted the total scam is about 24,000 crores.

He used bank receipts as collateral and used that muscle to buy stocks, in one case he pushed the price from Rs 200 to Rs 9,000.

Total scam amounted to USD 850 million, that is slightly under a Billion dollars, in 2012 Rupees inflation adjusted the total scam is about 24,000 crores.

## How He Used The Banking System

## How He Used The Banking System

Banks lend each other money, one such transaction was called the ready-forward agreement which is basically a bank receipt which is backed by some collateral. Mehta’s firm used to broker these transactions between banks. It is said that he took one week (or more) to broker a bank receipt between one bank and another bank, in the meanwhile he asked the second bank 1 week’s time as well to find a buyer. This circulation went on with several banks and allowed him to always have collateralized backed securities from various banks which were essentially ‘in transit’. They were used as money to aggressively invest in the stock market. The ‘scam’ was essentially a regulatory failure.

Fake Bank Receipts

Bank receipts are backed by government securities so they have intrinsic value. Banks never moved the security itself, the Bank receipt acted as the security itself.

Now, what if there were banks to issue fake Bank receipts it would be like conjuring money from thin air. According to Wikipedia, Bank of Karad & Metropolitan Co-operative bank issued fake Bank Receipts to Mehta for a fee. Once he had these receipts, he simply went to other banks and got money in exchange for it – these banks assumed the bank receipts were backed by government securities. It is amazing what some fame fortune and popularity can do, banks never questioned Harshad.

When the time came to return the money to the banks he would sell the securities he bought for a profit and return the money. This worked well until stocks were rising, but what if the money could not be returned because the market fell – or worse crashed?

Now, what if there were banks to issue fake Bank receipts it would be like conjuring money from thin air. According to Wikipedia, Bank of Karad & Metropolitan Co-operative bank issued fake Bank Receipts to Mehta for a fee. Once he had these receipts, he simply went to other banks and got money in exchange for it – these banks assumed the bank receipts were backed by government securities. It is amazing what some fame fortune and popularity can do, banks never questioned Harshad.

When the time came to return the money to the banks he would sell the securities he bought for a profit and return the money. This worked well until stocks were rising, but what if the money could not be returned because the market fell – or worse crashed?

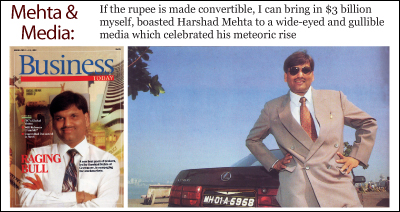

Lifestyle

Harshad Mehta was famous for pulling up in front of banks in his 40lakhs + Lexus. That, at the time it was one of the most expensive luxury vehicles around as India was opening up to the world. His day probably started by staring through his glass panes in his 11,685 sq ft Worli penthouse overlooking the sea or a morning swim in his private pool. In 2009 the flats were valued at a whopping 45 crore, In 2014 the prices would most likely be much higher.

This operation reminds me of a Ponzi scheme, many businesses are lured into such activities because of bad booking keeping norms. It also dawns upon me with examples such as Bernie Madoff, Lehman brothers (not Ponzi but over leverage example) and countless others, implodes when they become too big. I also feel banks take a tremendous amount of leverage which they cannot handle, even the fractional reserve system which is our answer to ‘liquidity’ seems to only fuel the ever increasing greed hungry machine of the banking industry. When is too much? What are the limits to our imagination and our greed?

I’ve always believed greed is good, famously said in the movie ‘Wall Street’ – Perhaps a better phrase is ‘Ambition is good, but if your business produces neither value nor assets – watch out’.