Diversification - Quick guide to asset allocation

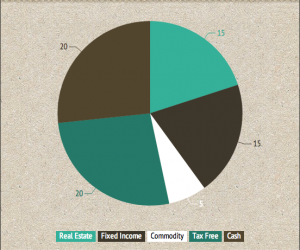

[caption id="attachment_814" align="aligncenter" width="300"] Sample chart showing diversification of assets[/caption]

Sample chart showing diversification of assets[/caption]

Sample chart showing diversification of assets[/caption]

Sample chart showing diversification of assets[/caption]Understanding Diversification

Don't put all your eggs in one basket!

Most of us have grown up with this proverb that has diversification of risk at its core.

Some of the most basic and fundamental principles of investing can often be learned through simple, real-life experiences.

Have you ever noticed that shops often sell seemingly unrelated products

- such as umbrellas and sunglasses? They may seem odd

- when would you buy both of these at the same time? Probably never. And that's the point. When it is raining, it is easier to sell umbrellas but harder to sell sunglasses. And when it's sunny, the reverse is true. By selling both, or by diversifying the product line

- the shopkeeper reduces the risk of losing money.

Let's say you have a portfolio of stocks and all of them are tech scrips. To some degree, they are all correlated. When the tech bubble blew up in March of 2000, every tech stock went down and so did the tech stocks. So if you had that portfolio, your portfolio went down big. Let's say you have a portfolio that has some tech, banking, FMCG, real estate stocks in it. When the tech bubble bursts, you get hit, but your portfolio does not "blow up." That is the power of diversification at work.

If this approach makes sense, you would already appreciate the benefits of diversification and sector allocation.

What is Diversification and Sector Allocation?

Historical market data shows us that different sectors perform differently depending on economic conditions. However, it is very difficult to predict which among the sectors will perform in the future. Diversification involves dividing your investments in a portfolio with stocks from different sectors. The process of determining which mix of sectors to hold in your portfolio is unique to each individual.

Sector allocation is the task of identifying how much of your portfolio will be invested in different sectors and helping you balance the expected returns with a level of risk that is acceptable to you. It should be based on your financial goals, the time horizon in which you wish to achieve them and your risk tolerance level.

Time Horizon

If your goals are long-term in nature, you may be comfortable investing in riskier or more volatile sectors because you can wait out slow economic cycles and the numerous ups and downs of markets. However, if your time horizon is short, you are likely to assume a lower risk.

Generally, the younger you are, the more risk you can afford to take. As you grow older, you may be more interested in preserving your capital/savings since a large decline near your retirement may need you to compromise your lifestyle or even make it impossible to retire.

Risk Tolerance

Your ability and willingness to lose some of your principal/savings in the near term in exchange for greater potential returns is called risk tolerance and is a major factor in deciding your sector allocation.

As with every investment you make, discipline and regular reviews are critical to helping you achieve your goals.

Visit the below links to learn more about diversification.