Cover Orders for Options

Cover Orders

- Overview

Introduction

Recently, we had enabled trading for a special order type called Cover Orders. Today, we are enabling Cover Orders for Options (sell side only) also. Cover orders is a multiple-leg order involving a regular market order and a stop-loss market order. When you place a cover order in this fashion, your margin is reduced significantly than what would normally be charged. We will go into the details below.

Cover Order Types

The following order pairs are considered valid cover orders. Cover Orders only apply when both orders are tied to the same trading symbol. Here are valid ways to construct a cover order:

-

Buy Market Order + Sell Stop Loss Market Order

-

Sell Market Order + Buy Stop Loss Market Order

Cover orders are now active for the following segments -

- Cash, Futures, Options (sell side only), Currencies. Cover orders are not allowed on MCX Commodities because it's not permitted by the exchange.

Margin Benefits

Without the cover order functionality, your margin requirements would be as follows:

Scenario: You sell 1 Nifty Option CE 6,100 at Rs. 72 and place a stop loss for the same order at Rs. 80.

Without cover orders, your margin requirement would be the requirement for 1 Nifty Option CE 6,100. The stop loss order takes up no extra margin nor does it reduce your requirement. In today's rates, it would be approximately, Rs. 23,000.

With cover orders, your margin requirement would be the price difference of the stop loss and the short position (Rs. 80

- Rs. 72 = Rs. 8) multiplied by the quantity (1 lot of Nifty = 50 shares). Hence, it would be Rs. 8 * 50 = Rs. 400. Along with this, there is a safety factor applied to this number. At Upstox, we use 1.5 as the margin safety factor. This would come to Rs. 400 * 1.5 = Rs. 600. There is also a minimum margin requirement of 2.55% of total traded value. The minimum margin requirement comes to (Rs. 6,100 + Rs. 72) * 50 * 2.55% = Rs. 7,870. So your applicable margin requirement would be the higher of Rs. 600 and Rs. 7,870. Hence, it is Rs. 7,870.

That represents a savings of over 75% when compared to traditional margin requirements. For the same amount of money, you can trade almost 3 lots of Nifty options for the price of 1, when you apply a stop loss to it.

Placing a Cover Order on NEST

Cover Orders are available on both the web trading platform and the ** desktop trading platform**.

Desktop Trading Platform

- Upstox NEST

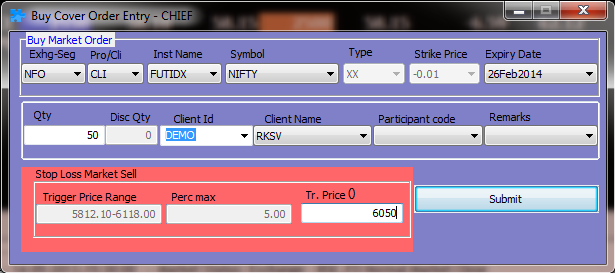

To place a buy cover order, press Shift+F1 on the main screen.

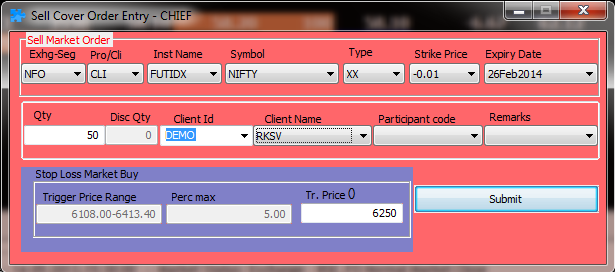

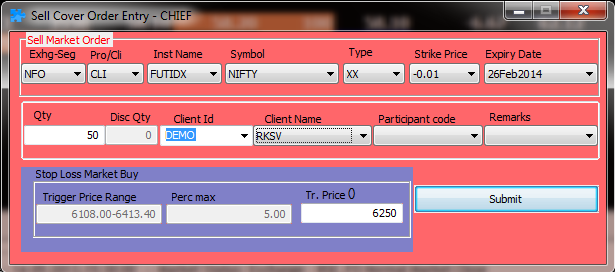

To place a sell cover order, press Shift+F2 on the main screen.

To place a sell cover order, press Shift+F2 on the main screen.

To place a sell cover order, press Shift+F2 on the main screen.

To place a sell cover order, press Shift+F2 on the main screen.

-

The bottom left portion of the window shows the range in which the trigger price can be in

-

The perc max shows the percentage value of the range

-

The trigger price is the price of the stop loss market order you want to use

Web Trading Platform

-

On the main menu, select Trade

-

Click Market WatchAt the order placement window the bottom, select your segment, ticker and select CO as the product code

[<img src="https://assets.upstox.com/content/assets/images/logos/cover-orders-for-options-3.png" alt="Upstox NEST -

Cover Order" width="988" height="132" />](https://upstox.com/app/uploads/2018/05/web_trading_platform_nest_cover_order_rksv.png)

-

A new field called Trigger Price will appear on the bottom right. This is the price of the stop loss market order