7 Stocks In An Uptrend Right Now – Exit polls, an Election Special

Election Special

What stocks can we track during the major week that is about to unfold, the grand India election week!

The world's largest democracy has a stock market that is full of opportunity.

I speak to a lot of traders every week and a lot of them use the trend to make a big chunk of their trading decisions. The other half use an area of congestion to trade breakouts or breakdowns with. Many of these traders are part-time and trade while carrying on a day job, then it hit me; why not compile a list of stocks in trend mode and in consolidation mode. The idea is to start an insightful journey into the minds of traders, please comment and put forward your views on the charts I am about to share. Everyone’s style is different and we should all be humble and learn from each other for the selfish purpose of bettering one’s own trading.

Here is a list of 7 stocks that are in uptrends or within a consolidation pattern. This is a good shortlist for next week's election week drama that is about to unfold :)

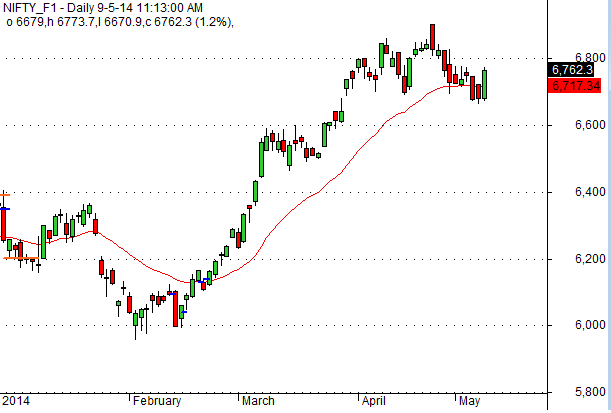

First, let’s set our eyes on Nifty, we even posted on our social networks today (9th May 2014) that Nifty is trading on major support zone when Nifty was trading at 6701, almost after a few minutes Nifty started its upward surge and hit 6780. It is likely that within uptrends major supports lead to buying. Look at the chart of Nifty below it reacted to the major support of 6690 and is now trading at 6762.

So the basic market scenario we can expect to be very similar to the benchmark Index. This is an interesting strategy to follow, allow me to elaborate. We are basically looking for stocks which are moving upwards (uptrends, higher swing lows) and are in a decline right now. This decline is also popularly referred to as “dip” within an uptrend.

The biggest problem from traders and I faced the same was where do you buy in the ‘dip’? Markets could very well continue falling and start a brand new downtrend leaving you sitting foolishly with your long positions. We all have different techniques, my technique is to buy specific reversal bars which I have found to work very well over the years, or to buy recent resistance points on lower timeframes. I will refrain from discussing the Newton method here, but rather share my stocklist for stocks to watch out for in the next week or so.

So the basic market scenario we can expect to be very similar to the benchmark Index. This is an interesting strategy to follow, allow me to elaborate. We are basically looking for stocks which are moving upwards (uptrends, higher swing lows) and are in a decline right now. This decline is also popularly referred to as “dip” within an uptrend.

The biggest problem from traders and I faced the same was where do you buy in the ‘dip’? Markets could very well continue falling and start a brand new downtrend leaving you sitting foolishly with your long positions. We all have different techniques, my technique is to buy specific reversal bars which I have found to work very well over the years, or to buy recent resistance points on lower timeframes. I will refrain from discussing the Newton method here, but rather share my stocklist for stocks to watch out for in the next week or so.

None of the stocks are recommendations, they are simply a shortlist. Do share how you will use these stocks in your trading strategy. Make sure you manage your trades well by position sizing and limiting risk to less than 0.5% of capital per trade. If you have a question, ask in the comments below.

## Stocks In Uptrends

## Stocks In Uptrends

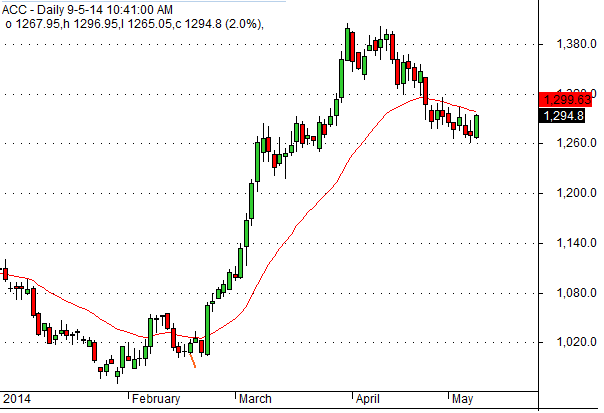

ACC – Decline within an uptrend

The Associated Cement company has put up an interesting situation (chart below). The stock is near a previous breakout point of late March 2014. It has also shown some buying interest by the way of three failed attempts to break down below the 1260 area. You will notice that as ACC approached this area it faces buying pressure, this can be seen with the formation of lower wicks.

Now with the context of the Newton Method, this stock is in an uptrend and makes for an interesting short list candidate for positional and intraday trades. The stock is currently trading at 1295.

Now with the context of the Newton Method, this stock is in an uptrend and makes for an interesting short list candidate for positional and intraday trades. The stock is currently trading at 1295.

## Apollo Tyres – Slowly steadily moving upward

## Apollo Tyres – Slowly steadily moving upward

This company is one of the few companies I refer to as ‘upward glide’ stocks. It’s only objective seems to be to follow the path of least resistance that is upward, gracefully gliding upwards giving some trough buying opportunities once every few months. One thing you must know about this stock is that it is a slow mover, it needs time.

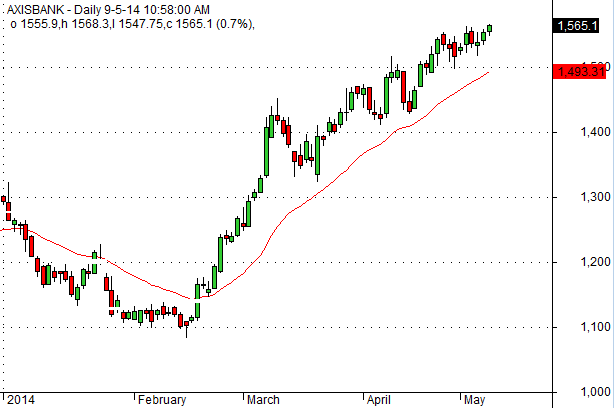

Axisbank – May hit vertical limits?

I trade Axisbank quite often (not as often as I could though), the stock remains to be in an uptrend. Although I have no positions on right now it is definitely a stock that is part of the watchlist. If the company stock price were to fall down near the moving average or even better, below it, we could wait for it to show resilience and possibly follow our own plans to buy/sell the stock. My bias would be long if the stock dips. Do share what opinion you have on this in the comments below.

One more point to add here, if the stock closes above 1571 which is the recent resistance then the stock may go into a full on bull rampage and hit ‘vertical’ moves upwards. Which-ever way we go, do share you strategy.

One more point to add here, if the stock closes above 1571 which is the recent resistance then the stock may go into a full on bull rampage and hit ‘vertical’ moves upwards. Which-ever way we go, do share you strategy.

BharatForge – Another steadily upward glide stock

How can I have an article with only one upward glide stock (Apollo tyres)? Well, I have got one more, it’s Bharat Forge. They recently bagged a 250 million Euro deal.

Hope this shortlist helps you choose stocks for next week to trade/invest in.

Hope this shortlist helps you choose stocks for next week to trade/invest in.

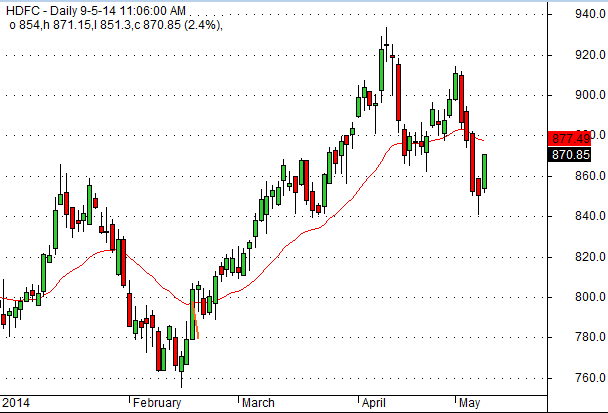

HDFC – Possible Bull Flag

HDFC is a highly traded stock, therefore any signs of reversal on a stock of this liquidity prowess should get our trader antennae up! If you notice the previous red bar (second last bar on the chart below) you will see that it was following through an existing sell off. What is interesting about this bar? It showed some last minute short covering, this can be seen by way of a tail. The lower shadow means there was buying and right at major support areas. If the next day (the latest green bar) shows an upmove we will have confirmation, not to mention the bears ‘buying’ stock back in a frenzy.

In summary, this stock is on a possible upmove from here. It will not be a swift move up because it seems to be making a bull flag. Expect a pause at 895 if it ever gets there.

Stocks In Consolidation

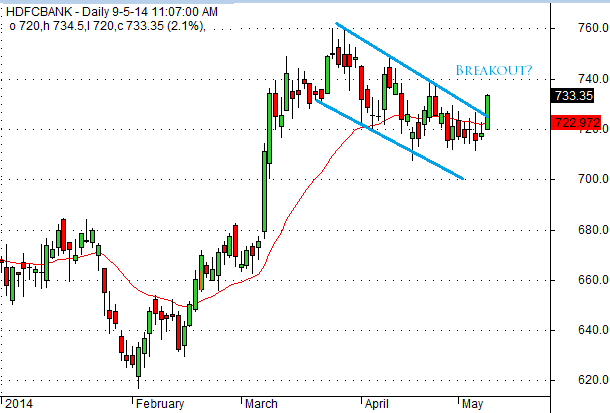

HDFCBANK – Bull Flag Breakout!

Okay now this stock is not exactly in a consolidation anymore, technically it is now in trend mode. Bull flags are a congestion pattern that allow the stock to resume the trend it was previously in. As you can see in the chart marked below, the blue lines mark the bull flag and the latest bar is the breakout provided the stock closes around here. Do you think this stock is tradable over the next few days?

Adani Enterprises – Symmetrical Triangle, political breakout on the cards?

The exit poll results which are due next week will have an impact on this stock. As a trader who relies on price charts heavily I can say that this stock is in wait and watch mode. Now I do not want to get into too much politics but the promoters of the company Gautam Adani are said to be very close to the prime ministerial candidate of the NDA Mr Narendra Modi. This closeness is interpreted by many analysts as a huge unfair advantage to the company if the NDA wins.

If the exit polls indicate a BJP win then this stock will show buying pressure, moreover if the election results show the same then there is a high probability of this stock rallying. Do remember if you decide to trade this stock to keep your position sizes small because with so much speculation, the stock can and will be extremely volatile.

If the exit polls indicate a BJP win then this stock will show buying pressure, moreover if the election results show the same then there is a high probability of this stock rallying. Do remember if you decide to trade this stock to keep your position sizes small because with so much speculation, the stock can and will be extremely volatile.

I would love to hear your thoughts on the stocks above or any other stocks that are on your shortlist radar for the rest of the day or next week.