NIFTY50 and SENSEX close higher as budget uncertainty ends, gains in Reliance Industries, Infosys and TCS supported indices; Stock Market Highlights

Upstox

5 mins • Updated: February 2, 2024, 3:57 PM

Summary

India’s benchmark indices – NIFTY50 (+0.7%) and Sensex (+0.6%) – closed higher. Out of the NIFTY50 space, 38 stocks advanced. Gains in index heavyweights like Reliance Industries, Infosys and TCS propelled the markets higher.

BANK NIFTY closes lower; Stock Market LIVE Updates

The BANK NIFTY (-0.4%) index closed in the red. Fall in HDFC Bank (-1.3%), Axis Bank (+1.5%), ICICI Bank (+0.7%) and ICICI Bank (-0.1%) supported the index.

Meanwhile, NIFTY PSU index was among top gainers after the interim budget. Click here to know what led to gains in NIFTY PSU index.

February 2, 2024 3:57 PM

Markets at close: NIFTY50 and SENSEX close higher as budget uncertainty ends, gains in Reliance Industries, Infosys and TCS supported indices; Stock Market Highlights

India’s benchmark indices – NIFTY50 (+0.7%) and Sensex (+0.6%) – closed higher. Out of the NIFTY50 space, 38 stocks advanced. Gains in index heavyweights like Reliance Industries, Infosys and TCS propelled the markets higher.

February 2, 2024 3:52 PM

Market at 3:00 pm: NIFTY50 and SENSEX trade higher, BPCL and Power Grid top gainers; Stock Market LIVE Updates

India’s benchmark indices – NIFTY50 (+0.6%) and SENSEX (+0.5%) – continue to trade in green. NIFTY50 scales a fresh lifetime high of 22,126 levels. Out of the NIFTY50 space, 37 stocks are advancing. Meanwhile, BPCL, Power Grid, ONGC are the top gainers.

February 2, 2024 3:01 PM

IPOs next week: Four new issues and listing of BLS E-Services to keep primary market busy

The primary market is all set to remain in action with four new mainboard IPO, while BLS E-Services will see its shares make market debut on 6th February.

-

IPO of hotel chain operator Apeejay Surrendra Park Hotels will open for subscription between 5th to 7th February. The company plans to raise ₹920 crore through this IPO, with a price band of ₹147 to ₹155 per share and lot size of 96 shares.

-

Next up is the IPO of information and communication technology company Rashi Peripherals. ₹600 crore IPO will open on 7th February, with a price band of ₹295 to ₹311 per share and lot size of 48 shares.

-

Besides this, two financial sector companies, Capital Small Finance Bank and Jana Small Finance Bank will also open their public issue. These two IPOs will be open for subscription between 7th to 9th February.

-

Capital Small Finance Bank plans to raise ₹523.07 crore through its IPO with a price band of ₹445 to ₹468 per share and lot size of 32 shares. Jana Small Finance Bank to raise ₹570 crore. IPO price band is ₹393 to ₹414 per share, with lot size of 36 shares.

February 2, 2024 2:52 PM

-

Nifty50 hits all-time high

Feb 2 (Reuters) - India's benchmark Nifty 50 index hit an all-time high of 22,126 on Friday, helped by gains in heavyweight stocks like Maruti Suzuki (+4.4%), Axis Bank (+1.5%) and TCS (+1.0%). The government's fiscal prudence in its budget boosted market sentiment.

The NSE Nifty 50 index hit an all time high of 22,126 is currently up 1.71%, while SENSEX is up over 1100 points.

February 2, 2024 12:16 PM

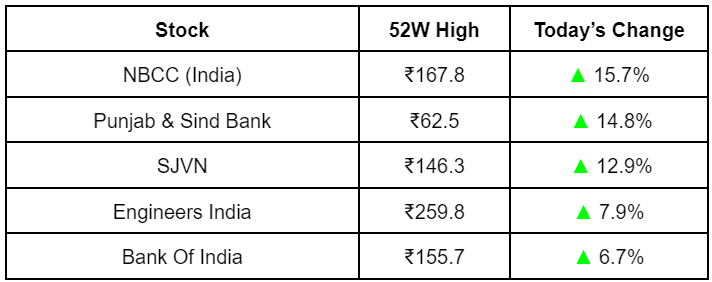

Stocks at 52-week high; Stock Market LIVE Updates

February 2, 2024 12:00 PM

BSE Sensex at 11:45 am: Winners and Losers

February 2, 2024 11:45 AM

Paytm continues to face selling pressure; Stock Market LIVE Updates

Shares of Indian digital payments firm Paytm tumble 20% today to near record lows.

This comes at a time when the Indian central bank clamped down on its payments bank. The RBI’s rap is weighing on investor sentiment despite the company's attempts to assuage fears of a hit to its business.

(Inputs from Reuters)

February 2, 2024 10:45 AM

NIFTY50 OI Snapshot; Stock Market LIVE Updates

8 February expiry

- Max Call OI (resistance) : 22,000

- Max Put OI (support) : 21,700

- Max Pain: 21,900

- PCR: 1.0

February 2, 2024 10:24 AM