NIFTY50 and SENSEX close higher, M&M and Power Grid surge; Stock Market Highlights

Upstox

5 mins • Updated: February 15, 2024, 3:35 PM

Summary

After a subdued opening, India’s benchmark indices – NIFTY50 (+0.4%) and SENSEX (+0.3%) – moved upwards and closed higher for the third consecutive day. The market breadth was almost evenly split. Out of the NIFTY50 space, 26 stocks advanced. Mahindra & Mahindra, Power Grid and BPCL were the top gainers. On the other hand, Axis Bank, Apollo Hospitals and ITC were the top losers.

Stock Market LIVE coverage ends

Thank you, readers! That's all from Upstox.com's live market coverage on 15 February 2024. We’ll be back with our live coverage at 8:00 am on Friday.

February 15, 2024 3:35 PM

FIN NIFTY closes higher; Stock Market LIVE Updates

The NIFTY Financial Services (+0.5%) index closed higher today, with SBI and HDFC Bank being the top gainers, while Muthoot Finance Axis Bank were the top losers.

February 15, 2024 3:35 PM

BANK NIFTY closes higher; Stock Market LIVE Updates

The BANK NIFTY (+0.7%) index closed in the green. Gains in HDFC Bank, SBI and PNB supported the index.

February 15, 2024 3:34 PM

NIFTY50 and SENSEX close higher, M&M and Power Grid surge; Stock Market LIVE Updates

After a subdued opening, India’s benchmark indices – NIFTY50 (+0.4%) and SENSEX (+0.3%) – moved upwards and closed higher for the third consecutive day. The market breadth was almost evenly split. Out of the NIFTY50 space, 26 stocks advanced.

Mahindra & Mahindra, Power Grid and BPCL were the top gainers. On the other hand, Axis Bank, Apollo Hospitals and ITC were the top losers.

Gains in HDFC Bank, M&M and State Bank of India propelled the markets higher. The broader markets also made gains and outperformed the benchmark indices. NIFTY Midcap 100 and NIFTY Small Cap 100 gained more than 1% each.

February 15, 2024 3:33 PM

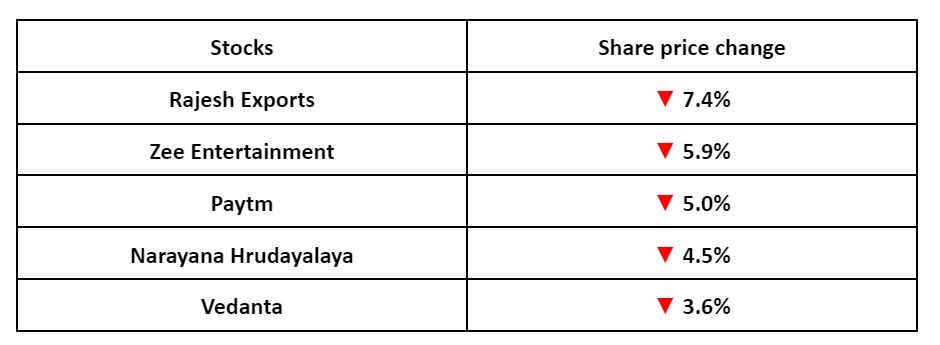

Top losers from the NSE 500 universe; Stock Market LIVE Updates

February 15, 2024 3:06 PM

BANK NIFTY OI Snapshot; Stock Market LIVE Updates

21 February expiry

- Max Call OI (resistance) : 46,000

- Max Put OI (support) : 46,000

- Max Pain: 46,000

- PCR: 1.0

February 15, 2024 2:56 PM

F&O Stock Update; Stock Market LIVE Updates

-

Long build up: M&M, NTPC, BPCL, ONGC and SBI

-

Short build up: HUL, Axis Bank, Adani Enterprises, ITC and JSW Steel

February 15, 2024 2:44 PM

-

Markets at 2:20 PM: NIFTY50 and SENSEX trade higher, M&M and Power Grid surge; Stock Market LIVE Updates

India’s benchmark indices – NIFTY50 (+0.4%) and SENSEX (+0.4%) – are trading higher amid volatility. Out of the NIFTY50 space, 32 stocks are advancing. On the sectoral front, Mahindra & Mahindra (+7.1%), Power Grid (+5.1%) and BPCL (+4.9%) are the top gainers.

February 15, 2024 2:20 PM

Aditya Birla Fashion shares decline after posting Q3 loss; Stock Market LIVE Updates

Shares of Aditya Birla Fashion, which is one of India’s leading fashion retailers – are down more than 2%.

This comes a day after the company reported a net loss of ₹108 crore in Q3FY24 compared to a net profit of ₹11 crore in Q3FY23. The management attributed this to the increase in interest costs from higher borrowing. It also pointed out that the overall market remained subdued leading to modest growth for the traditional portfolio.

Click here to read more.

February 15, 2024 1:59 PM

Power stocks surge on bright outlook; Stock Market LIVE Updates

Shares of Tata Power, Torrent Power, NHPC and Power Grid are up in the range of 2% to 6% today. This comes on the back of expectation of strong demand for power in 2024. Experts point out that the demand for power is rising in India and supply constraints are becoming complex.

Click here to read more.

February 15, 2024 1:23 PM