Short Call Condor Options Strategy

Written by Upstox Desk

Published on July 31, 2025 | 4 min read

The Short Call Condor is a multi-leg market neutral strategy which benefits from rise in volatility in price of underlying asset. The Short Call Condor is a combination of Bear Call spread (click here) and Bull Call spread (click here). The strategy is risk defined therefore the impact on profit and loss is limited. The strategy is suitable for underlying assets with high volatility.

The spread has four legs and therefore is structured by trading four different strikes. It entails buying ITM call at lower strike, selling ITM Call at lower middle strike, buying OTM call at higher middle strike and selling OTM call at higher strike. The Short Call Condor is similar to short butterfly spread (click here), with the only difference in selling call option strike. In Short Butterfly spread, the middle strikes are sold at same levels, wherein in Short Call Condor the sold call options are spread apart.

Like Butterfly Spread, the Short Call Condor also has two breakeven points. The spread incurs maximum loss when underlying is trading between the two middle strikes and profits from strong price movement in either direction after breaching either of the breakeven points.

Illustration:

Nifty 50 is currently trading at 18,050.

| Strategy | Index | Action | Strike | Premium |

Short Call Condor | Nifty50 | Sell Call | 17,900 (strike 1) | 220 |

Buy Call | 18,000 (strike 2) | -140 | ||

| Buy Call | 18,100 (strike 3) | -85 | ||

| Sell Call | 18,200 (strike 4) | 45 | ||

Net Premium | 40 |

The strategy is designed to generate a net credit so the premium received upfront helps in reduction of overall cost. The strategy has two breakeven points;

Lower breakeven point = (strike 1 + net premium received) = 17,900 + 40 = 17,940 Upper breakeven point = (strike 4 – net premium received) = 18,200 – 40 = 18,160

Maximum potential profit = (Net premium received * lot size) = 40 * 50 = ₹2,000

Maximum loss = (Strike 2 – strike 1 – net premium received) * lot size = (18,000 – 17,900 – 40) * 50 = 60 * 50 = ₹3,000

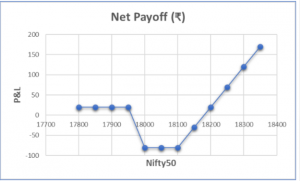

Payoff Schedule

Nifty50 @ Expiry | Net Payoff (₹) |

17800 | 40 |

17850 | 40 |

| 17900 | 40 |

17950 | -10 |

| 18000 | -60 |

18050 | -60 |

| 18100 | -60 |

| 18150 | -10 |

18200 | 40 |

18250 | 40 |

| 18300 | 40 |

Payoff chart

Impact of Greeks:

-

Delta remains close to zero when the spread is between the lowest and highest strikes. Delta is positively correlated to profit but it never expands much because of how the strategy is structured.

-

Gamma is positive and at the highest point when the spread is between the two middle strikes. Gamma declines when the spread is near the lowest or the highest strike.

-

Vega is positive and at the highest level when the spread is between two middle strikes. Higher Vega leads to price volatility and sends them trending in towards the outer strikes.

-

Theta is negative and lowest when the spread is between the two middle strikes. The time decay shall hurt the long positions that are already unprofitable at the time of taking the trade. Theta turns positive only when prices move beyond the breakeven point.

Conclusion:

- A Short Call Condor is a direction neutral but bullish on implied volatility. The strategy expects the price of the underlying asset to increase or decrease rapidly.

- It is important to deploy the spread with more time till expiry. Greater the time till expiry, higher the chance of implied volatility expanding.

- It is not necessary to hold the strikes at equal spacing. Depending on the market momentum or directional bias of the trader, the spread between short call options or between long and short call options can be altered.

- Maximum profit occurs when the prices trend rapidly and breach higher or lower break even points. The losses are incurred when price begins to consolidate between the two buy call option strikes.

About Author

Upstox Desk

Upstox Desk

Team of expert writers dedicated to providing insightful and comprehensive coverage on stock markets, economic trends, commodities, business developments, and personal finance. With a passion for delivering valuable information, the team strives to keep readers informed about the latest trends and developments in the financial world.

Read more from UpstoxUpstox is a leading Indian financial services company that offers online trading and investment services in stocks, commodities, currencies, mutual funds, and more. Founded in 2009 and headquartered in Mumbai, Upstox is backed by prominent investors including Ratan Tata, Tiger Global, and Kalaari Capital. It operates under RKSV Securities and is registered with SEBI, NSE, BSE, and other regulatory bodies, ensuring secure and compliant trading experiences.