Help Center

Getting Started

Trading

My Account

Mutual Funds

IPOs

Stock SIP

Gold

NPS

Government Securities

Fixed Deposits

Insurance

Loan

Smallcase

DartStock

Upstox API

NCD

US Stocks

How to place an order using Chart 360?

Chart 360 revolutionises options trading by allowing you to place orders directly from the chart interface. Instead of switching between charts and order screens, you analyse price action and execute trades in one seamless flow.

Complete Order Placement Process

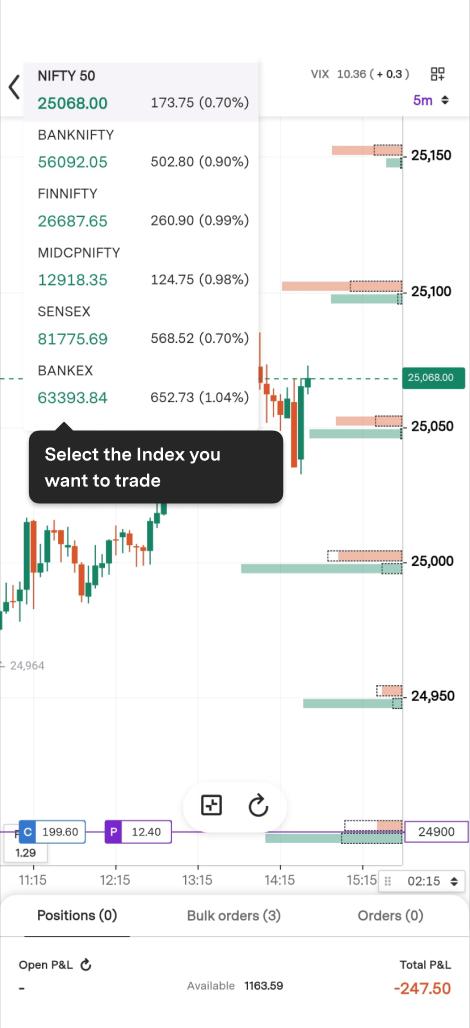

Step 1: Select the Index,

Tap on the index you want to trade from your Chart 360 dashboard. Available indices include,

- Nifty 50

- Bank Nifty

- Fin Nifty

- Midcap Nifty

- Sensex

- Bankex

The chart for your selected index will load, showing real-time price movements.

Step 2: Choose the expiry date.

From the expiry date dropdown at the top of the screen, select your desired contract expiry, it can be

- Weekly expiry OR monthly expiry OR Current/Near/Far months.

The available strike prices will update based on your expiry selection.

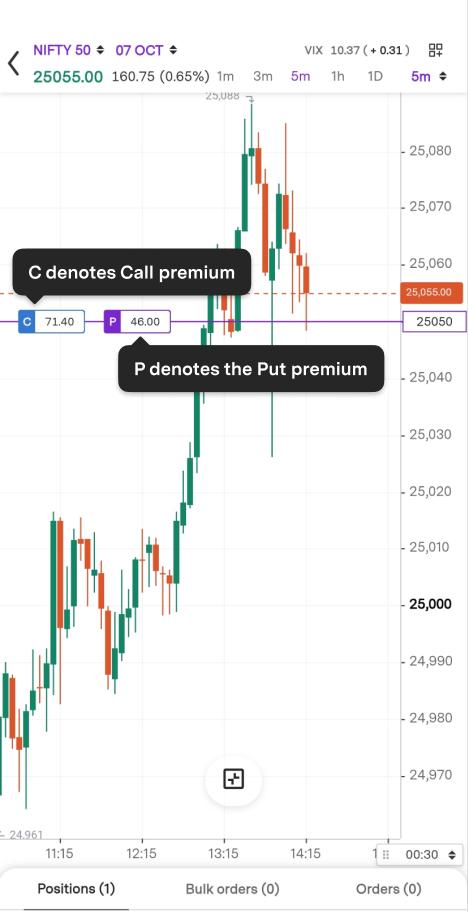

Step 3: Select the Strike Price.

On the Y-axis (right side of the chart), you will see highlighted values representing strike prices.

To select a strike,

- Tap any highlighted value on the Y-axis

- The strike price corresponding to that level is selected

- The chart updates to show that specific option contract

Step 4: Identify Option type.

Once you have selected a strike, identify whether you want,

‘C’ = Call Option OR ‘P’ = Put Option

The option type indicator appears near your selected strike on the chart.

Step 5: Initiate the trade.

Now comes Chart 360's signature gesture-based trading,

To BUY the option - Swipe UP on the chart.

To SELL the option - Swipe DOWN on the chart.

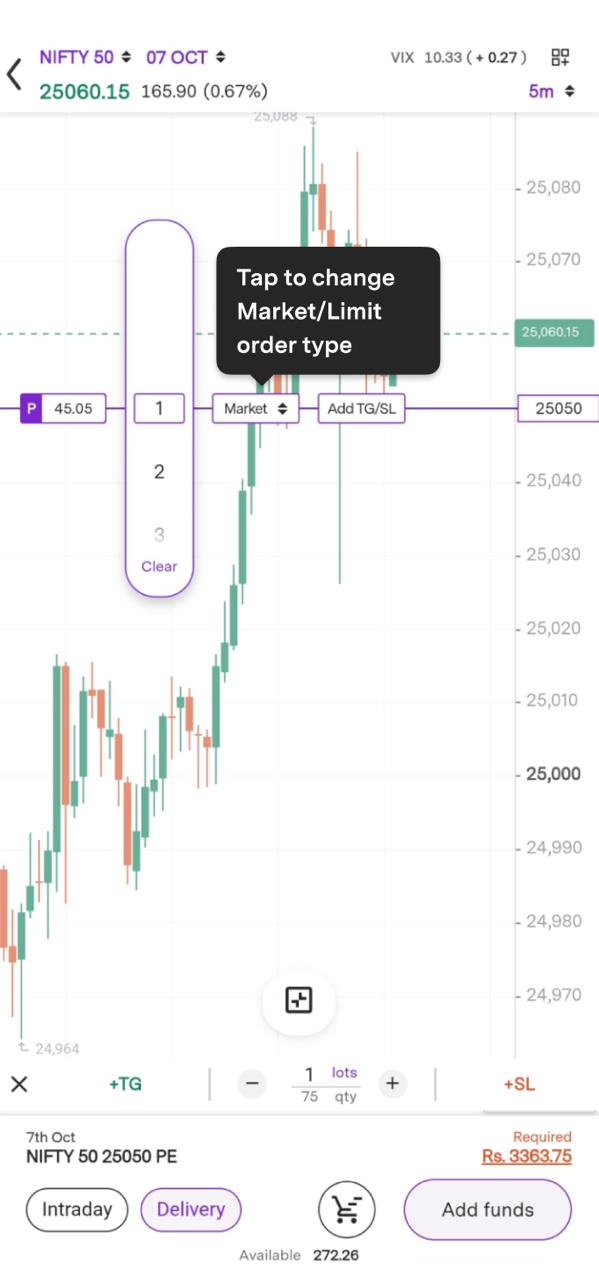

Step 6: Set the lot size.

After swiping, the order configuration panel appears.

Adjust lot size,

- Scroll UP to increase lot quantity

- Scroll DOWN to decrease lot quantity

Step 7: Choose order type,

Tap the market toggle to switch between order types,

- Market Order - Executes immediately at the best available price

- Limit Order - Executes only at your specified price or better

Toggle to your preferred order type before proceeding.

Step 8: Set Limit Price (for limit orders only),

If you selected Limit Order , you can set price limit by,

Method 1 - Drag the line

- A horizontal line appears on the chart representing your limit price.

- Drag the line up or down to visually set your desired entry/exit price.

OR

Method 2 - Manual entry

- Tap the keypad icon.

- Manually enter your limit price or specify a percentage from current market price (e.g., +2% above LTP).

Step 9: Select Order Validity.

Choose how long your order remains active,

Intraday

- Order valid only for the current trading session.

- Automatically squared off by 3:20 PM if not executed or closed manually.

OR

Delivery (Positional)

- Order carries forward beyond the current day.

- Hold position overnight or until expiry.

Note - For options, ‘Delivery’ means holding the position, not physical delivery of the underlying index.

Step 10: Confirm the Order.

Review your order details displayed on the confirmation screen and Swipe to confirm.

Trade with Upstox

Want to open a Demat account?

Open a FREE Demat and Trading account to invest in Stocks, Mutual Funds, IPOs and more.

By signing up you agree to receive transaction updates on Whatsapp. You may also receive a call from an Upstox representative to help you with the account opening process.

Upstox Community

Upstox Community

| Topic | Replies | Views | Activity |

|---|