Help Center

Getting Started

Trading

My Account

Mutual Funds

IPOs

Stock SIP

Gold

NPS

Government Securities

Fixed Deposits

Insurance

Loan

Smallcase

DartStock

Upstox API

NCD

US Stocks

How does order slicing work with Chart 360?

Chart 360 supports order slicing when your order size exceeds the exchange’s freeze limit.

Order slicing is a helpful feature that automatically breaks a large trade into smaller parts. This is done to follow exchange rules that limit how many contracts (lots) you can buy or sell in one go. This limit is called the ‘freeze limit’.

Instead of rejecting your order, Chart 360 will split it into smaller parts and place them one after the other. All this is done automatically for you.

In Chart 360, if you select a quantity larger than the freeze limit, the platform will automatically slice the order into multiple smaller orders, helping your trade go through smoothly.

Note - Order slicing only works with limit orders. Market orders are not allowed when slicing is active.

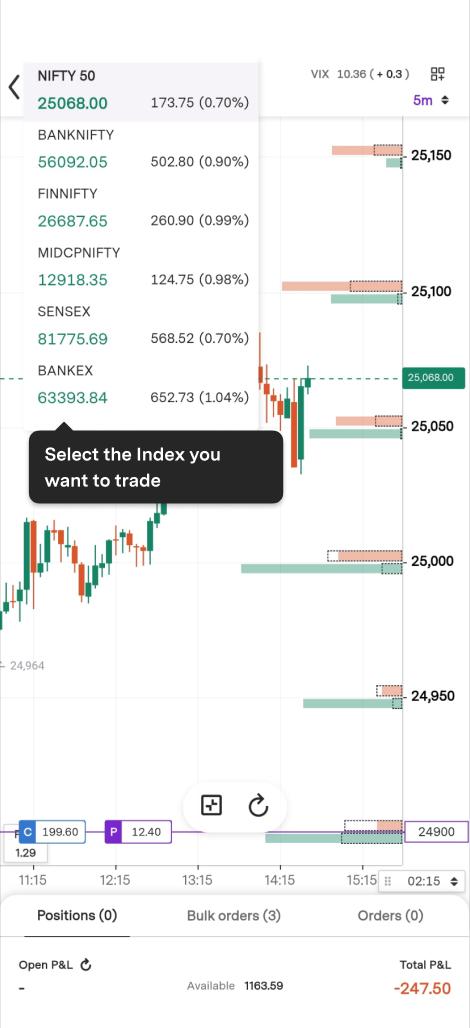

Step 1: Open Chart 360 and tap on the index you want to trade (e.g., Nifty, Bank Nifty, or Fin Nifty).

Step 2: Choose the expiry date for the option contract from the list of available options.

Step 3: Select your desired strike price by tapping on the highlighted values along the Y-axis of the chart.

Step 4: Swipe up to place a buy order or Swipe down to place a sell order.

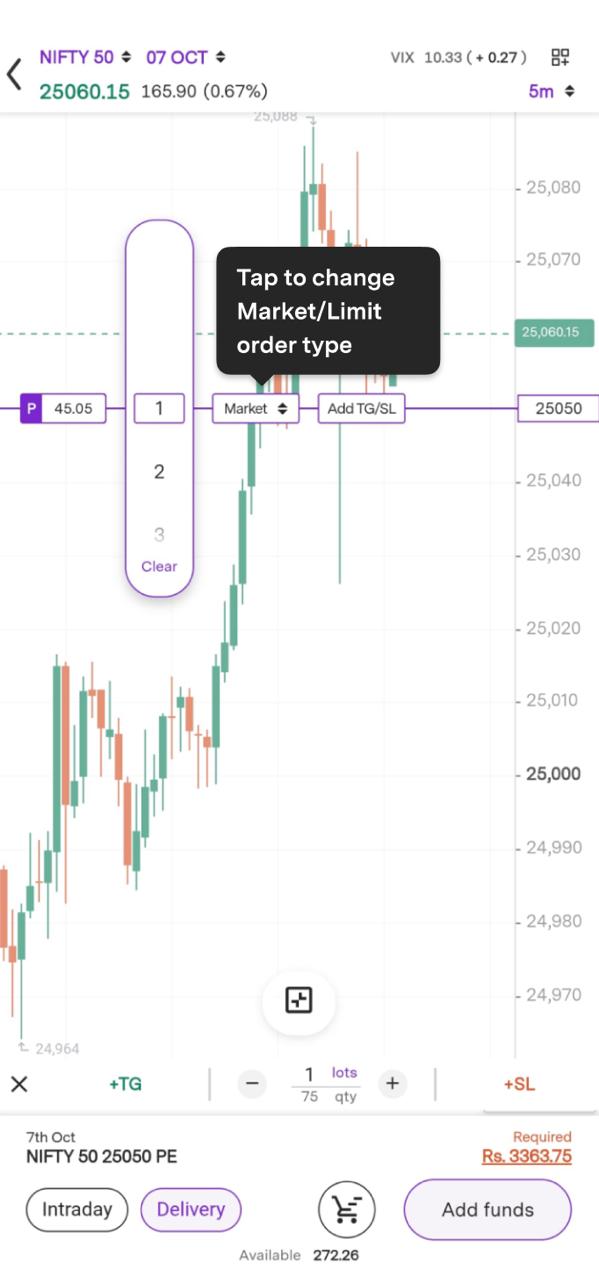

Step 5: On the order window, select a lot size that is above the freeze quantity limit. This triggers the order slicing feature.

For example: If the freeze limit is 1800 and you choose 3600 quantities, the system will automatically place two separate orders of 1800 each.

Note - Since slicing is enabled, you will only be able to place a limit order, not a market order.

Step 6: Set your limit price Drag the price line on the chart to the desired level OR Tap the keypad icon to enter a percentage-based limit price manually.

Step 7: Choose your product type Intraday (for same-day trades) Delivery (for holding beyond one day)

Step 8: Review the details and swipe to confirm your order.

Once placed, Chart 360 will handle the slicing behind the scenes and ensure your full quantity is placed in compliance with exchange rules.

Trade with Upstox

Want to open a Demat account?

Open a FREE Demat and Trading account to invest in Stocks, Mutual Funds, IPOs and more.

By signing up you agree to receive transaction updates on Whatsapp. You may also receive a call from an Upstox representative to help you with the account opening process.

Upstox Community

Upstox Community

| Topic | Replies | Views | Activity |

|---|