Futures & Options Trading

F&O Trading Made Simple₹0

Commissions on Mutual Funds and IPO

₹20

Per order on Equity, F&O, Commodity and Currency

- 4.5+

App Rating

Backed by

Ratan Tata- 1 Cr+ Customers

Loved & Trusted

by Indians

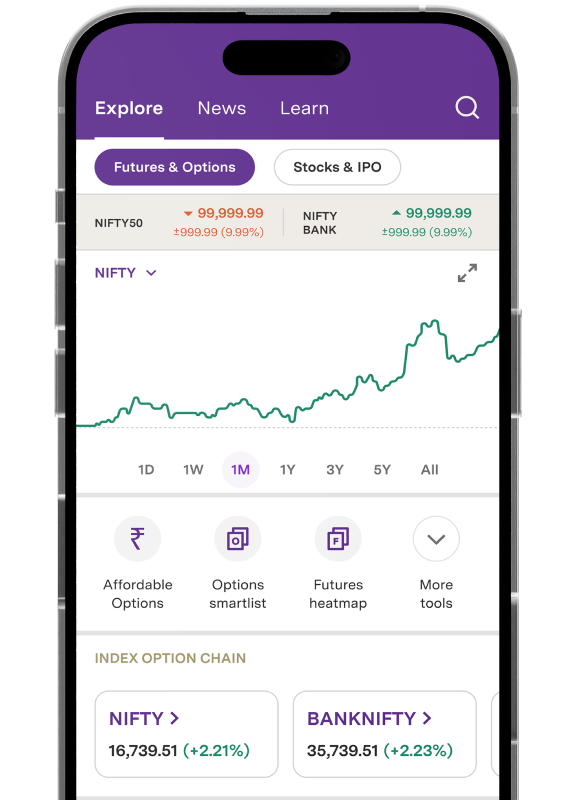

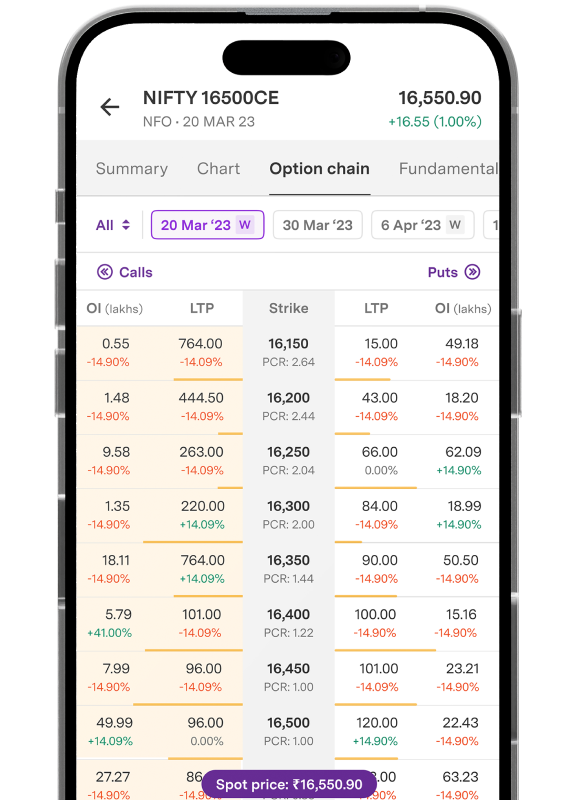

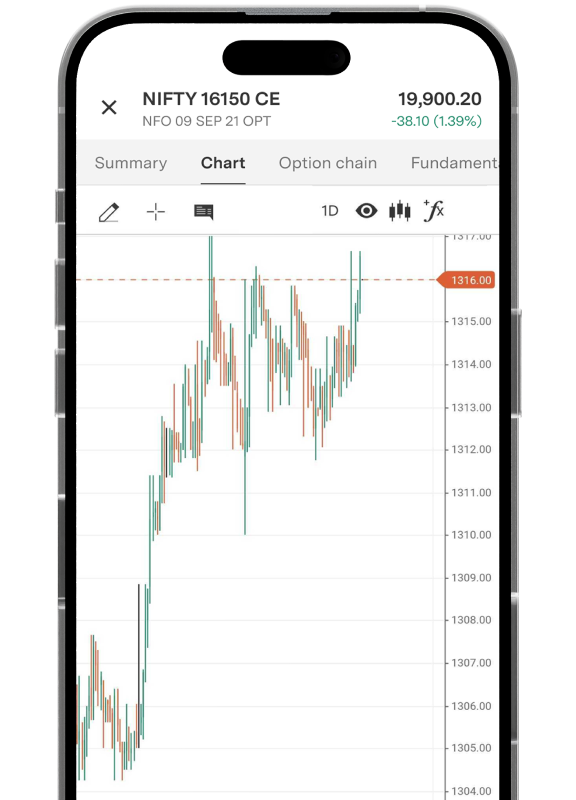

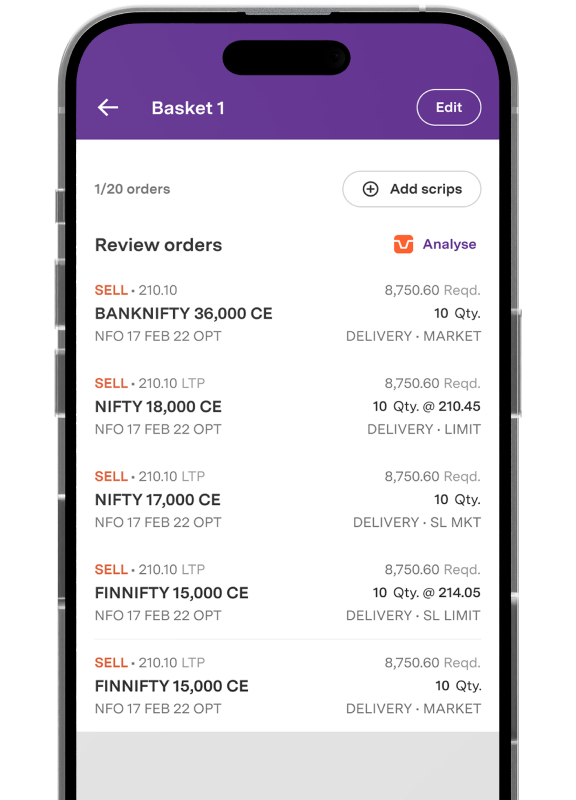

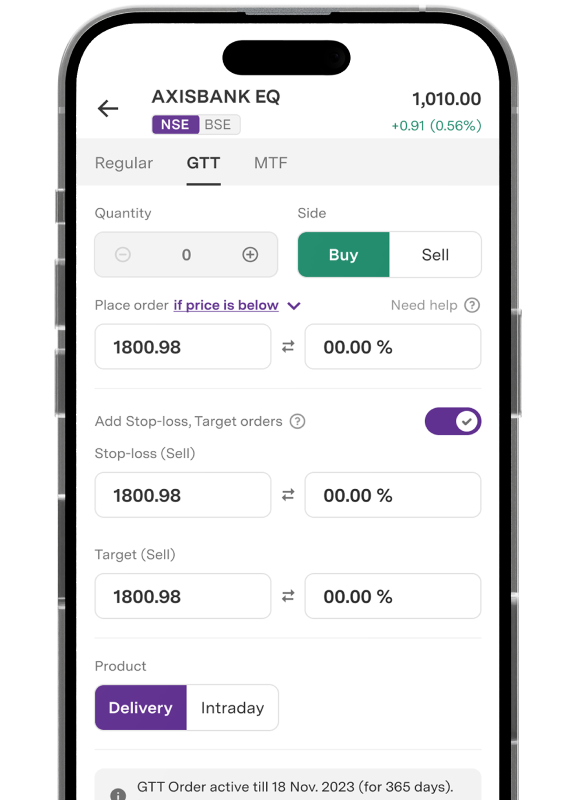

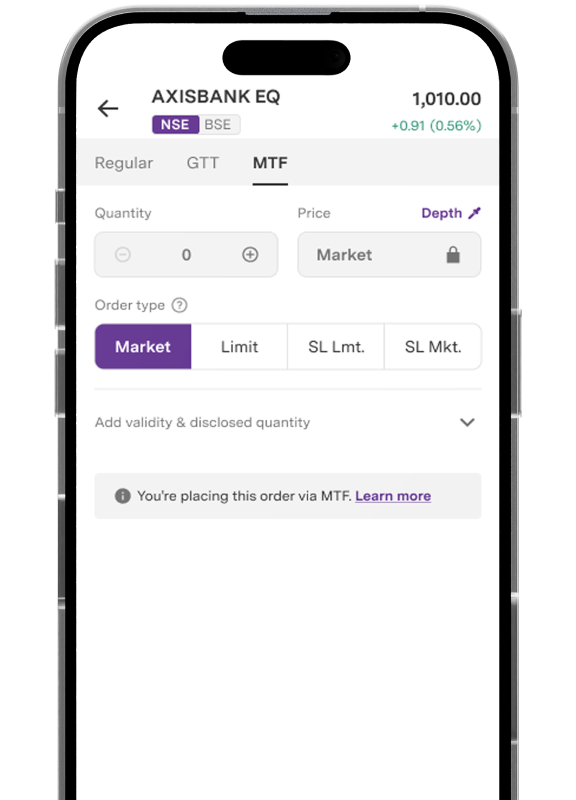

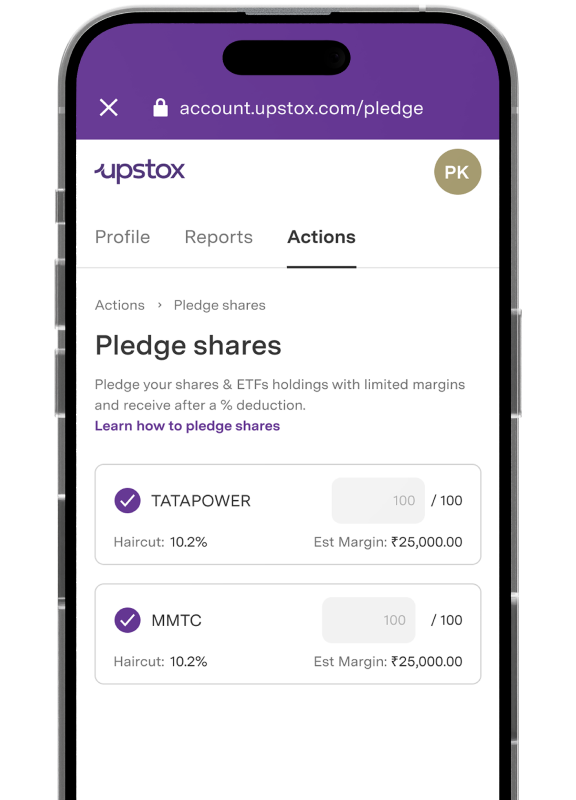

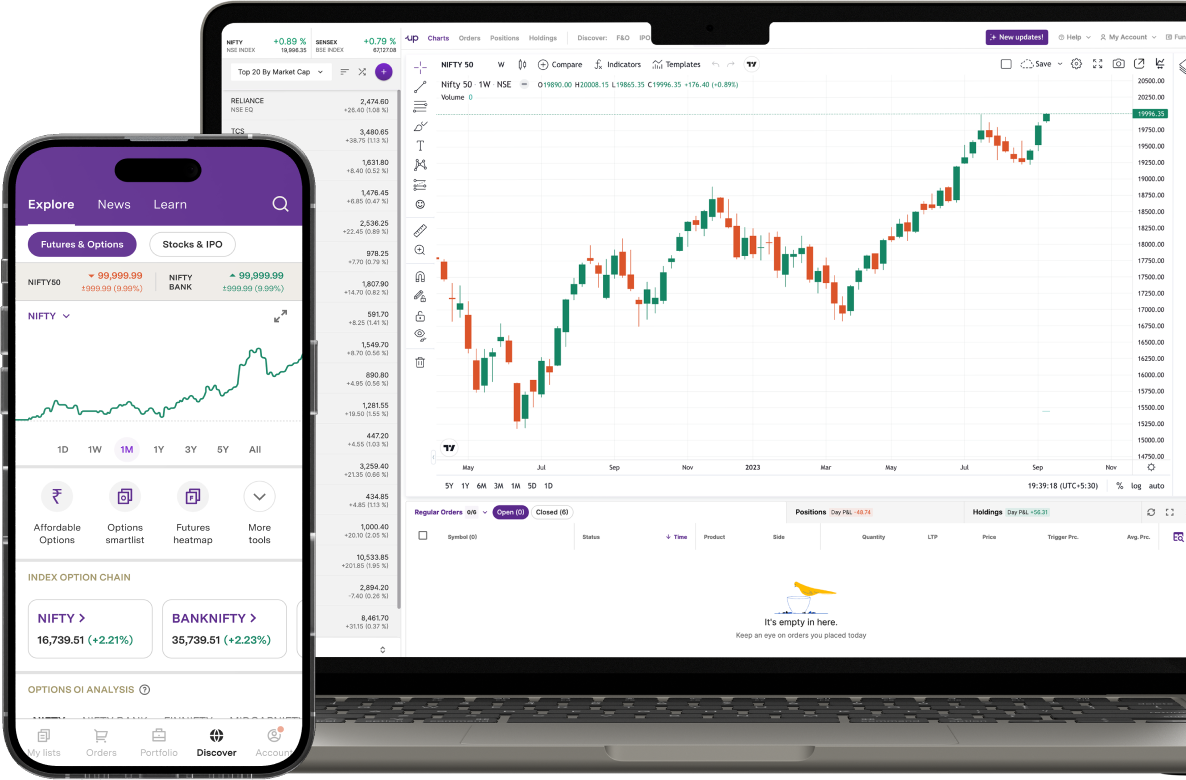

Discover. Analyse. Master F&O Trading

The only platform you'll need for all your trading needs.

Other Trading Features

OI analysis

Order Slicing

Option Greeks

Price Alerts

Simplified Ledger

Smartlists

After-Market-Orders

Funds breakdown

Position Analysis

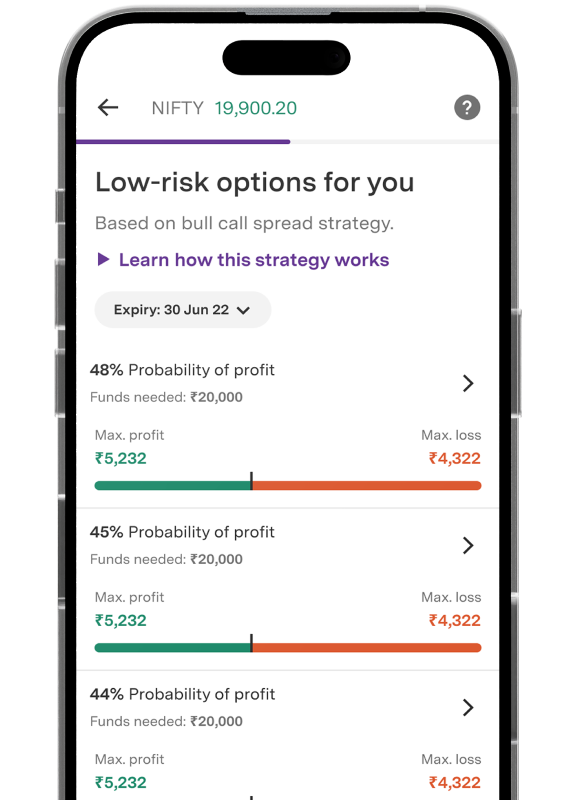

Affordable Options

Heatmap

Global Indices

FII/DII activity

Transparent pricing, no hidden charges

₹0

Account OpeningDemat + Trading

₹0

CommissionMutual Funds and IPOs

₹20

BrokerageEquity, F&O, Commodity and Currency orders

ZERO AMC is applicable for newly onboarded customers in the first year

Calculate brokerage and margin with these calculators

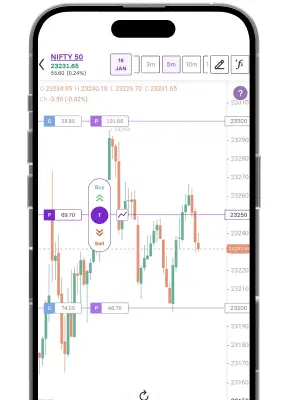

Pro Mobile App

One of India's highest-rated trading apps

Available on

Pro Mobile App

One of India's highest-rated trading apps

Available on

New to trading?

UpSkill with us - we cover topics for beginners and pro traders.

FAQs

What is Futures and Options (F&O) trading in the stock market?

Futures and Options are financial derivatives whose value is derived from their underlying asset like stocks or indices. They allow investors to speculate on price changes or hedge risk. Futures obligates the holder to buy/sell the asset, while Options gives the right, but not the obligation to do so.

How does F&O trading work in India?

Trading occurs on exchanges (NSE, BSE) using standardised contracts. Instead of paying the full contract value, you deposit margin money (a percentage of value) and gain leverage. The Clearing Corporation guarantees trades. Most contracts have monthly expiry, with indices also offering weekly options.

What is the difference between Futures and Options?

Futures impose an obligation on both the parties (buyer and seller) to execute the trade and can yield unlimited profit and loss. Options give the buyer a right but no obligation, limiting their loss to the premium paid, while the possible profit remains unlimited.

Is F&O trading suitable for beginners?

No, F&O trading is not recommended for complete beginners because it is complex and possess risk. The inherent leverage can quickly multiply profits, but also losses. Asmall market move can wipe out a significant portion of capital. Beginners should initially focus on thorough education, paper trading and then start with small, low-risk positions.

What are the margin requirements for F&O trading?

F&O margin for Futures and Option Sellers is the sum of SPAN margin (10-40% of contract value based on risk) and Exposure margin (an additional 3-5%). Option Buyers only pay the full premium amount, as their maximum risk is limited to that value. Margins are marked-to-market daily and a shortfall triggers a margin call.

Can I do intraday trading in Futures and Options?

Yes, intraday trading is very popular in F&O, allowing you to square off (sell) positions the same day to avoid holding overnight. The advantage here is avoiding overnight gap risk and using F&O to profit from both rising and falling markets. Gap risk - market opening significantly different from close

What are the risks involved in F&O trading?

The primary risk is leverage which magnifies losses dramatically, at times exceeding your capital. Main risks are time decay (options lose value daily), gap risk (market opening significantly different from close) and liquidity risk (difficulty exiting positions at fair prices).

How are F&O contracts settled in India?

Index futures and options (e.g., Nifty) are cash-settled, meaning profits/losses are settled in cash. Stock futures and options are subject to physical settlement if held until expiry. Physical settlement requires the delivery or taking of actual shares. However, the vast majority of traders square off positions before expiry to avoid physical settlement.

Are Futures and Options trading legal and regulated in India?

Yes, F&O trading is end to end legal and regulated by SEBI (Securities and Exchange Board of India). Trading occurs on licensed exchanges, with clearing corporations (NSCCL, ICCL) guaranteeing all the trades. Brokers must be SEBI-registered and adhere to strict risk management norms including circuit limits (price caps) to halt trading.

How are F&O trades taxed in India?

F&O profits are treated as business income and taxed at your applicable income tax slab (5-30% plus cess). Losses can be offset against other business income and carried forward for eight years. Filing ITR-3 is mandatory (because business income) and an audit may be required if turnover or profit limit is exceeded.

Can I trade F&O on all stocks?

No, F&O contracts are available for only 180-200 select stocks that meet stringent SEBI criteria, including minimum market capitalisation and trading activity. Exchanges regularly review this list for compliance.

How can I start F&O trading on Upstox?

Ensure your Upstox account has F&O trading activated and you have sufficient funds for margin. In the app/web platform, search for the desired contract, select the expiry/strike price, enter the quantity in lots and place your order. Always use a stop-loss order to manage the inherent leverage risk.

- home/

- futures and options trading