- home/

- stocks

Invest Right, Invest Now

Open a FREE* Demat and Trading account to invest in Stocks

By signing up you agree to our Terms and Conditions

Discover Stocks Easily

5000+ stocks, find ‘the one’ easily with our smartlists

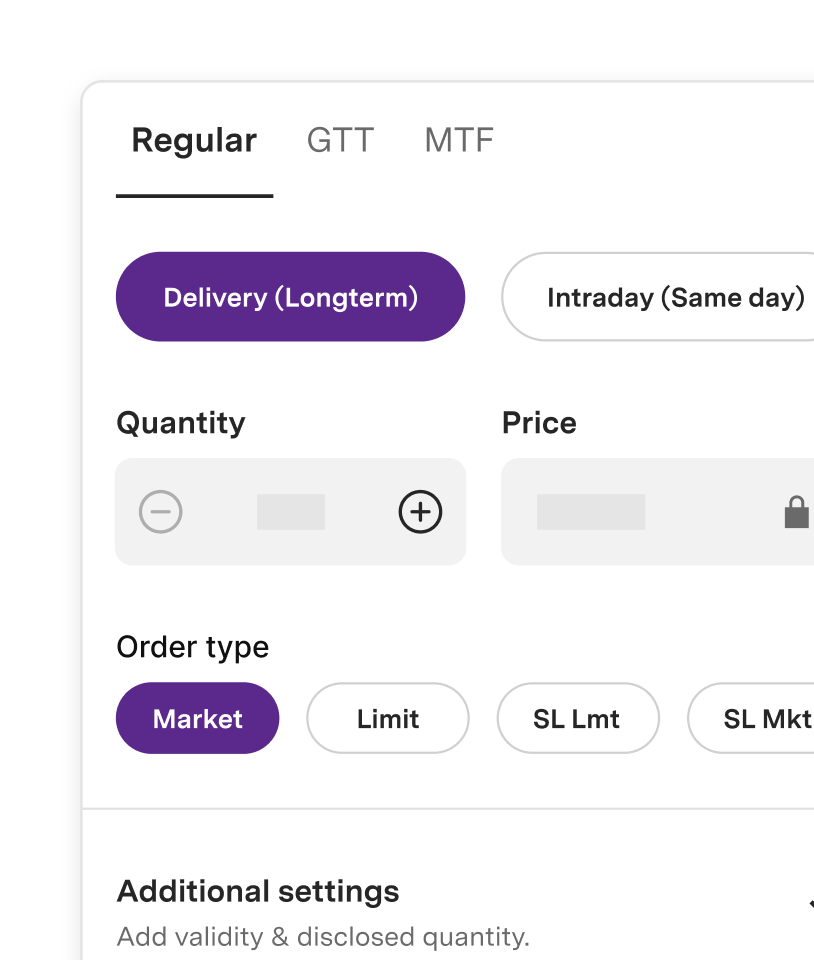

Place Quick Orders In A Few Clicks

One platform with many order types

Delivery

Intraday

Good till Triggered (GTT)

Margin Trading Facility (MTF)

After-Market-Orders

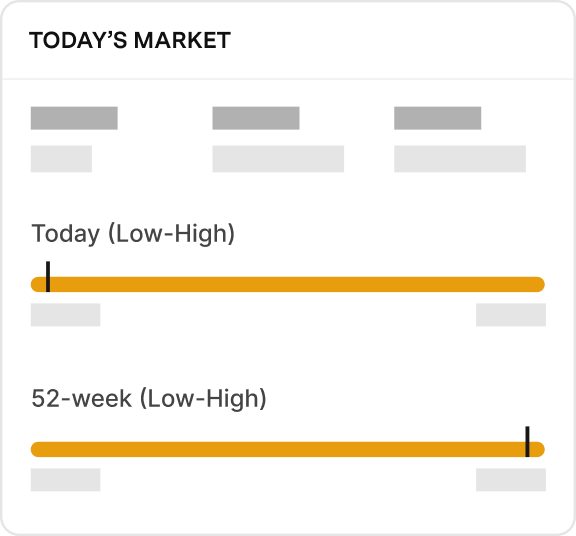

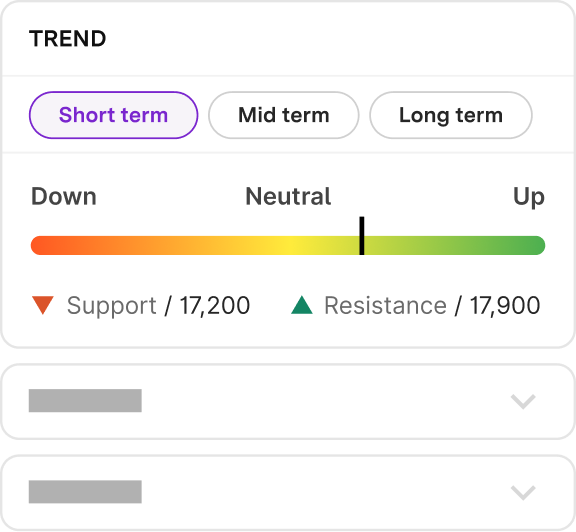

Analyse Trends Confidently

5000+ stocks, find ‘the one’ easily with our smartlists

New to Buying Stocks?

You can do everything from a single frame

Discover stocks easily

With curated stock lists such as UpTrend, Best for Beginners, Everyday Brands, etc.

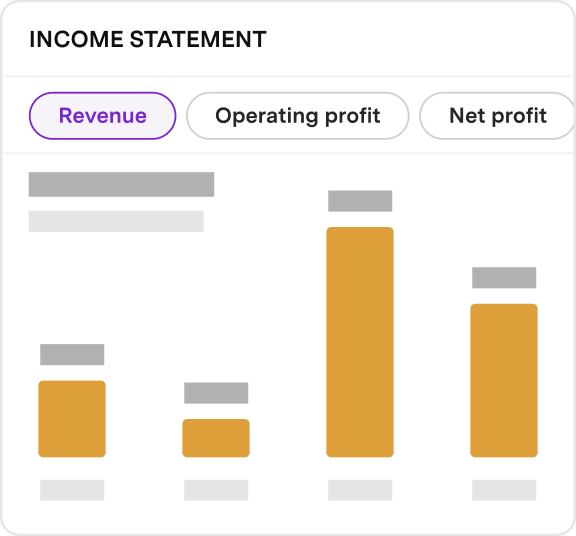

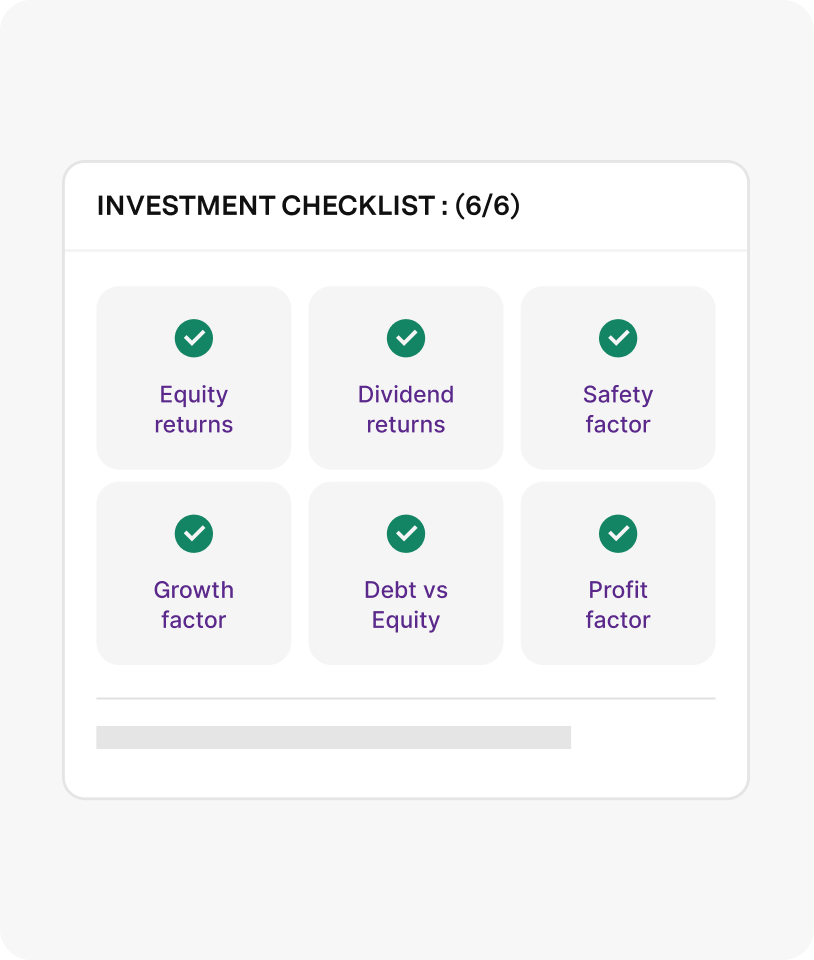

Invest in them confidently

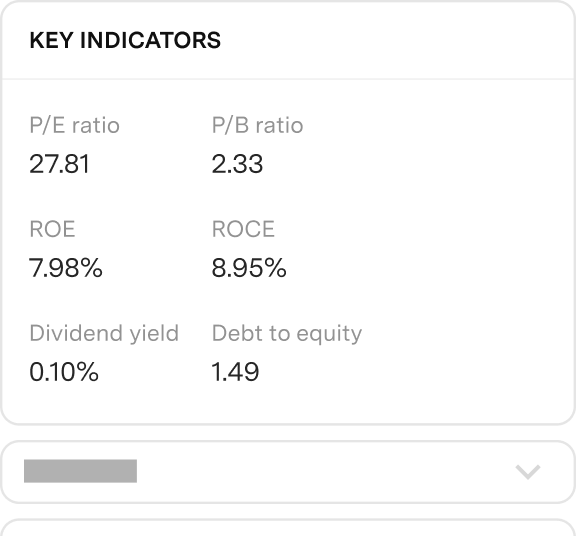

With 6-point investment checklist and analyst ratings to buy, sell or hold a stock

Stock like you shop

Simplified buying and selling experience

Discover stocks easily

With curated stock lists such as UpTrend, Best for Beginners, Everyday Brands, etc.

Invest in them confidently

With 6-point investment checklist and analyst ratings to buy, sell or hold a stock

Stock like you shop

Simplified buying and selling experience

Getting started with your investing journey?

From beginner to advanced, we cover all levels of learning

Frequently Asked Questions

Is it safe to invest in the stock market?

How can I learn about the stock market?

When it comes to the world of investing, there are tons of resources and it can get overwhelming going through

all of them. So to help you get started we’ve curated a list of the best books, videos, courses that our team

and experts swear by:

- LIST OF BOOKS

- Technical Analysis Explained by Martin Pring

- Japanese Candlestick Charting Techniques by Steve Nison (for a deeper dive into Technical Analysis)

- Options Volatility” by Sheldon Natenberg.

- Trading in the Zone by Mark Douglas

- Market Wizards by Jack Schwager (where they chat with top traders)

- When Genius Failed by Roger Lowenstein

- The Intelligent Investor by Benjamin Graham

- Common Sense on Mutual Funds by John Bogle

- Indian Mutual Funds Handbook” by Sundar Sankara

- LIST OF INVESTING VIDEO PLAYLISTS BY TEAM UPSTOX

- LIST OF ONLINE COURSES BY TEAM UPSTOX

- Options Trading – Basic Course

- Technical Analysis – Basic Course

- How to manage your Intraday trade

- Options Trading – Advanced Course

- Basics of Stock Market

- Option Indicators and Option Greeks

You can register for these here: Investor Masterclass

Hope this list gets you started on your investing journey!

What is the difference between stocks and shares?

How do stocks make you money?

Venturing into the stock market can be both exciting and rewarding. But how exactly do stocks make you money, let’s find out:

Capital Appreciation: When you buy a stock, you’re essentially buying a piece of a company. If

the company does well, its stock value may increase over time. By selling your stock at a higher price than what

you paid for, you earn a profit. This difference is your capital gain.

Dividends: Some established companies distribute a portion of their earnings back to

shareholders. These payouts, known as dividends, can provide a steady income stream. Not all companies offer

dividends, but those that do can enhance your overall returns.You can refer to the ‘High Dividend Yield’

Smartlist for such stocks.

Power of Compounding: Remember, the earlier you start, the more you let your investments enjoy the magic of compounding. As you reinvest returns, your money grows exponentially over the long run.

Do I lose money if stocks go down?

A drop in stock price doesn’t automatically translate to lost money, here’s why:

Unrealised vs. Realised Loss: When a stock dips below your purchase price on Upstox, it reflects an “unrealised” loss and will appear in red in your portfolio. It’s not until you hit that ‘Sell’ button and finalise the transaction at a lower price than your buying price, that the loss becomes “realised”.

Strategic Holding: Just because a stock’s price is in the red today doesn’t mean it won’t soar tomorrow. Keeping a long-term perspective can sometimes help in navigating the market’s ups and downs.

To ensure you exit a trade in profit, you can use some of these features on Upstox:

- Set a price alert

- Place a GTT Order with Stop-Loss & Profit Target

Who gets the money when I buy a stock?

Do I need a demat account to buy stocks?

How to become a stock market partner with Upstox?

To become a partner (sub-broker) with Upstox and earn brokerage commission and account opening incentives, click on this link Become Sub Broker and follow these steps;

- Sign up with your details name, email, phone number, city, and state.

- Enter PAN

- Pay a one-time registration fee

- Verify Email ID

- Open your Demat + Trading account with just a PAN and Aadhaar

- Upload the necessary documents

- Upload your photograph

- Upload your educational certificates (optional)

- Submit your IPV video

- eSign your Partner agreement

Start earning for every user you successfully refer and enjoy a share of the brokerage from each trade placed.

What do I need to buy stocks online?

How do I buy stocks online on Upstox?

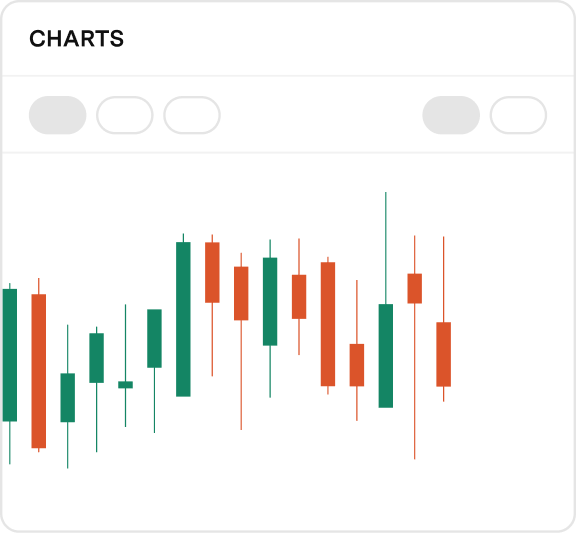

Using these powerful tools analyse trends and find trades easily:

- 100+ indicators and 80+ drawing tools on TradingView and ChartIQ charting libraries

- Option Chain with Greeks, PCR, IV data, OI Analysis, Greeks, Max Pain, India VIX

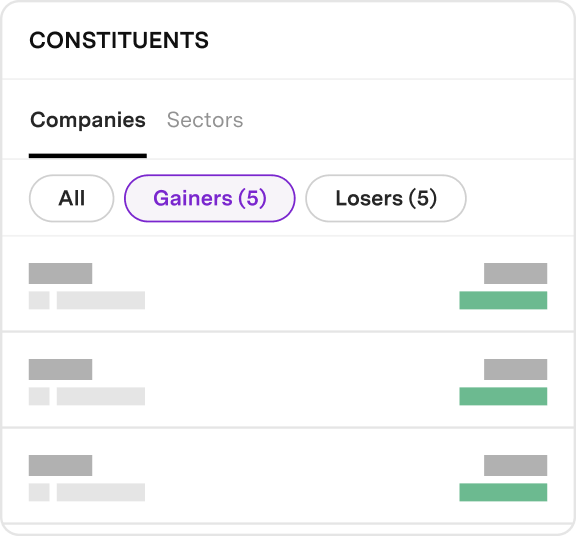

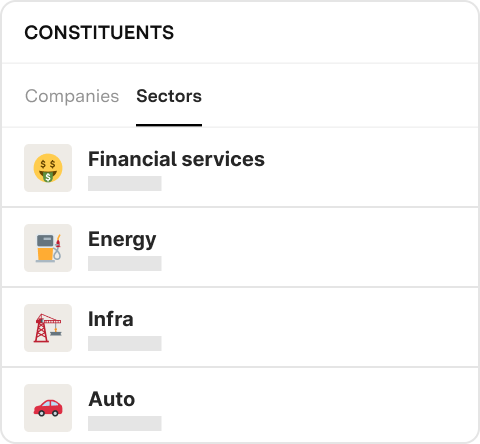

- F&O and Stock smart lists – Top Traded, Most Active, Gainers and Losers

- Readily available Fundamental Data and Trend analysis

- Pre-curated strategies for NIFTY 50 and BANK NIFTY

- Found a trade? Follow these steps to place your order

Step 1: Click on the stock you want to place an order from the watchlist.

Step 2: Click on Buy on the scrip details screen to view the order entry screen.

Step 3: On the order entry screen you need to enter the values in mandatory fields. i.e.

Quantity, Price, Trigger Price, etc. Check this section on how to fill the Order entry screen. Refer to “How to

Fill Order Entry” section below.

Step 4: Tap on ‘Review buy order’ or ‘Review sell order’ to view the Order Summary. If you have

disabled the order summary (in the next step), you can just swipe to place your order.

Step 5: On the order summary screen, tap on ‘Submit order’ to place your order. You can expand

the taxes and charges section to view the applicable charges. You can also select the ‘Don’t show this review

screen’ checkbox to skip the summary screen and place your orders directly from the Order entry screen from the

next time. You can also enable/disable order summary screen from the Settings menu under the Account tab.

You can read more about this here: How can I add funds to my Upstox account?

How do I open an online brokerage account with Upstox?

Step-by-step guide on opening an online Upstox Demat account

Step 1: Enter essential details – mobile number, email address, PAN and other personal details

Step 2: Verify your identity by taking a live photo.

Step 3: Verify bank account details

Step 4 (Optional): Add a nominee to your account

Step 5: eSign and done!

We will now verify your application and update you on the status within 48 hours.

Eligibility criteria to open an Upstox Demat account

- You need to be over 18 years

- You have to be a resident of India

- Your PAN should be linked to Aadhaar

How do I fund my online brokerage account?

Step 1: Login to the Upstox app using your 6-digit Pin or Biometrics.

Step 2: Click on the ‘Account’ tab.

Step 3: Click on ‘Add funds’ as per the trading account

Step 4: You can add funds in any one of the following ways:

- Net Banking

- UPI transfer

- Google Pay (GPay)

- NEFT/RTGS/IMPS

- Cheque

Read more about this here:

How can I add funds to my Upstox account?

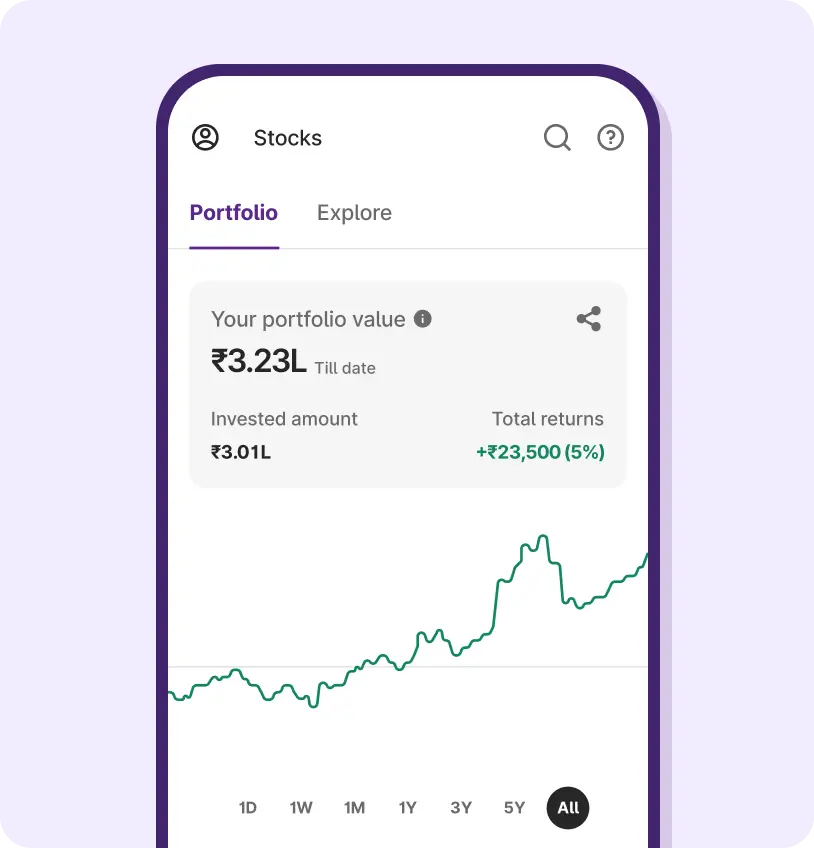

How do I keep track of my stock portfolio?

Are there any fees or taxes associated with buying stocks online?

Yes, there may be fees and taxes associated with buying stocks online, such as brokerage fees, transaction fees, and capital gains tax. It is important to research and understand these costs before making any purchases. You can read the fees and taxes on Upstox here Brokerage Charges