EPFO interest 2024: When will EPF interest be credited in PF account for FY24?

Upstox

2 min read • Updated: April 26, 2024, 1:27 PM

Summary

EPFO interest 2024: The social security organisation has credited interest to the accounts of 28.17 crore members in financial year (FY) 2022-23. As employees eagerly await the interest credit in their PF accounts for FY24, the retirement fund organisation has dropped a major hint.

EPFO interest 2024: In February, the Employees' Provident Fund Organisation (EPFO) increased the interest rate for employees covered under the EPF by ten basis points (bps) to 8.25% for the financial year 2023-24 (FY24) from 8.15% in the preceding year.

As employees eagerly await the interest credit in their PF accounts, the retirement fund organisation has dropped a major hint.

When will EPF interest be credited for FY24?

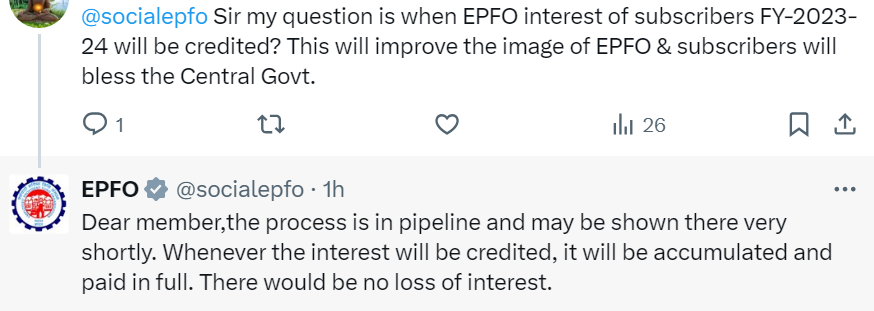

Replying to a query on X (formerly Twitter), EPFO said, "Dear member, the process is in the pipeline and may be shown there very shortly. Whenever the interest will be credited, it will be accumulated and paid in full. There would be no loss of interest".

For FY23, the social security organisation credited interest to the accounts of 28.17 crore members. "The interest for the financial year 2022-23 has been provided to 28.17 crore members accounts of EPFO as of date. If you are facing any inordinate delay, then you are requested to register your grievance on http://epfigms.gov.in," it said on X.

Also Read: EPF joint declaration: What KYC details can be changed? Steps to update form online

How to check EPF balance on the EPFO portal

- Select the 'For Employees' section on the EPFO portal

- Click on 'Member Passbook'

- Enter UAN and password

- Select your member ID and click on 'View Passbook'

Is an EPF member entitled to full interest on belated PF deposit dues by the employer?

After receiving the dues, the provident members will receive full interest for each month due, and it will not affect the interest due to EPF members on the contributions paid, EPFO said.

"The employer shall be charged penal interest under Section 7Q and penal damages under Section 14B of the Act, respectively," it added.

What is the method of credit interest to PF subscribers?

According to the EPFO, the compound interest is credited to the subscriber on a monthly running balance basis at the statutory rate declared every year. For FY24, it is 8.25%.