F&O strategy: How to trade in TCS ahead of Q4 results?

Upstox

3 min read • Updated: April 11, 2024, 1:11 PM

Summary

TCS will announce its fourth quarter FY24 results on 12 April. According to options data, traders are expecting a move (up or down) of ±4.6% from the 10 April close of ₹3,980.

Tata Consultancy Services (TCS) will kick off the fourth quarter FY24 earnings season on 12 April. The results will be announced after market hours and the impact will be seen on 15 April. The focus will be on recovery in deal wins, particularly in the Banking, Financial, Services and Insurance (BFSI) segment, growth outlook for FY25 and impact due to reversal in furloughs.

On the daily chart, TCS is consolidating between the previous week's high and low and trades between its key daily moving averages (50 and 100). For directional clues, traders can watch for a rejection or close above key price points, as shown in the chart below.

Options outlook

Open interest for the 25 April expiry shows the highest call options OI at 4,000 and 4,100 strikes, which will act as immediate resistance. On the contrary the put options base is at 3,900 and 3,800 strikes. Based on the open interest data of TCS and at-the-money (ATM) straddle prices as of 10 April, the options traders are expecting a move (up or down) of ±4.6% from the closing price of ₹3,980.

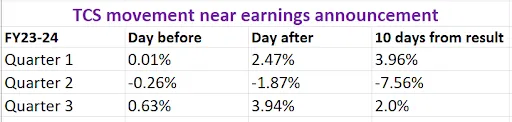

Let's look at how Tata Consultancy Services' share price has performed over the last three quarters around its earnings announcements.

How to plan a trade with options?

Considering the movement of ±4.6% implied by the options market, traders can plan a long or short volatility trade through Long or Short Straddles based on their view on volatility and price action.

In a nutshell, in a Long Straddle, a trader buys an ATM call and put options of the same strike and expiry of TCS in expectation of a move of more than ±4.5% on either side. Conversely, in a Short Straddle a trader will sell a call and put of the same strike and same expiry if he or she expects a move of less that ±4.5%.

Interested to know more about straddles? Check out our UpLearn education content. If you want to see more historical earnings price data like in the table above for this stock, sign-up for our community, let us know, and we will share it!

Disclaimer

Investments in the securities market are subject to market risk, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. To know more visit https://upstox.com/

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.